As filed with the Securities and Exchange Commission on February 14, 2018

File No. 024-10689

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Qualification Offering Circular Amendment No. 1

to

Form 1-A

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

MUSCLE MAKER, INC

(Exact name of issuer as specified in its charter)

California

(State of other jurisdiction of incorporation or organization)

2200 Space Park Drive, Suite 310

Houston, Texas 77058

Phone: (732) 669-1200

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

Robert E. Morgan

Chief Executive Officer

Muscle Maker, Inc

2200 Space Park Drive, Suite 310

Houston, Texas 77058

Phone: (732) 669-1200

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Laura Anthony, Esq.

Craig D. Linder, Esq.

Legal& Compliance, LLC

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 561-514-0936

Fax: 561-514-0832

| 5810 | 47-2555533 | |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Post-Qualification Offering Circular Amendment No. 1

File No. 024-10689

PART II — INFORMATION REQUIRED IN OFFERING CIRCULAR

EXPLANATORY NOTE

This Post-Qualification Offering Circular Amendment No. 1 (this “Offering Circular Amendment No. 1”) amends the offering circular of Muscle Maker, Inc qualified on December 12, 2017, as further amended and supplemented from time to time (the “Offering Circular”), to update information contained in the Offering Circular. Unless otherwise defined below, capitalized terms used herein shall have the same meanings as set forth in the Offering Circular.

This Offering Circular Amendment No. 1 primarily relates to our decision to (i) reduce the offering price per share of Common Stock from $4.75 to $3.25 and reduce the number of shares of Common Stock offered from 4,200,000 to 3,076,920, for a reduction of the maximum aggregate offering amount from $19,949,995 to $9,999,990, (ii) add Cambria Capital, LLC as a lead selling agent of the Offering, and (iii) conduct another reverse stock split (a 3-for-4 reverse stock split) effective January 31, 2018, which combined each four shares of our outstanding Common Stock into three shares of Common Stock. All relevant information pertaining to the changes in the offering price and the number of shares being offered as well as the 3-for-4 reverse stock split has been updated accordingly in this Offering Circular.

All sections and information (as well as exhibits) relating to the above-mentioned amendments have been updated herein as applicable. Any investor should read this Offering in its entirety.

Preliminary Offering Circular

February 14, 2018

Subject to Completion

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Offering Circular was filed may be obtained.

MUSCLE MAKER, INC

3,076,920 Shares of Common Stock

Minimum Purchase: 140 shares of Common Stock ($455)

MUSCLE MAKER, INC, a California corporation (the “Company”), is offering up to 3,076,920 shares (“Shares”) of its common stock, no par value per share (“Common Stock”), at a fixed price of $3.25 per share of Common Stock, with an aggregate amount of $9,999,990, in a “Tier 2 Offering” under Regulation A (the “Offering”). There is no minimum number of Shares that needs to be sold in order for funds to be released to the Company and for this Offering to close. The minimum investment amount per investor is $455 (140 shares of Common Stock); however, we can waive the minimum purchase requirement on a case to case basis in our sole discretion. The subscriptions, once received, are irrevocable.

TriPoint Global Equities, LLC, a registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”), has agreed to act as our managing selling agent (the “Managing Agent”) while Cambria Capital, LLC, a registered broker-dealer and a member of FINRA, is acting as lead selling agent (the “Lead Agent” and together with the Managing Agent, the “Selling Agents”) to offer the Shares to prospective investors on a “best efforts” basis. In addition, the Selling Agents may engage one or more co- selling agents, sub selling agents or selected dealers. The Selling Agents are not purchasing the Shares, and are not required to sell any specific number or dollar amount of the Shares in the Offering. The Selling Agents and other broker dealers will receive compensation for sales of the securities offered hereby at a fixed commission rate of 7.5% of the gross proceeds of the Offering, however this commission rate will be reduced to 4% for any proceeds received from investors introduced by the Company to the Selling Agents. See “Plan of Distribution” in this Offering Circular. None of the Shares offered are being sold by present security holders of the Company.

We expect to commence the sale of the Shares as of the date on which the Offering Statement of which this Offering Circular is a part is declared qualified by the United States Securities and Exchange Commission (“SEC”). The Offering will terminate at the earlier of: (1) the date at which $9,999,990 of Shares has been sold, (2) the date which is one year after this Offering being qualified by the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”), or (3) the date on which this Offering is earlier terminated by the Company in its sole discretion (the “Termination Date”).

In addition, we have engaged WhoYouKnow LLC, a California limited liability company, d/b/a CrowdfundX (“Offering Campaign Consultant”), to assist us in the planning, public relations and promotion of this Offering, utilizing the BANQ Online Platform.

No public market currently exists for our shares of Common Stock. We intend to list our common stock on the NYSE American (“NYSE American”) under the symbol “MMB” after we register our common stock under the Securities Exchange Act of 1934, as amended (“Exchange Act”), following the termination of this offering. There is no assurance that our common stock will be registered under the Exchange Act or, if registered under the Exchange Act, that our listing application will be approved by the NYSE American. If not approved by the NYSE American, we intend to apply for quotation of our common stock on the OTCQX Marketplace under the symbol “MMB” after the termination of this offering.

We are an “emerging growth company,” as such term is defined in Section 2(a)(19) of the Securities Act of 1933, as amended, and we will be subject to reduced public reporting requirements. See “Emerging Growth Company Status.”

| Price to Public | Underwriting

Discounts and Commissions(1) (2) |

Proceeds,

Before Expenses, to Company(3) |

||||||||||

| Per Share | $ | 3.25 | $ | 0.24 | $ | 3.01 | ||||||

| Total (4) | $ | 9,999,990 | $ | 750,000 | $ | 9,249,990 | ||||||

(1) This table depicts broker-dealer commissions of 7.5% of the gross offering proceeds. Please refer to the section entitled “Plan of Distribution” beginning on page 50 of this Offering Circular for additional information regarding total underwriter compensation. We agreed to pay the Managing Agent a due diligence fee of $15,000 all of which was paid on signing the engagement letter with the Managing Agent. We have agreed to reimburse certain additional expenses to our Selling Agents. Please refer to the section entitled “Plan of Distribution” in this Offering Circular for additional information regarding total Selling Agents compensation

(2) In addition to the broker-dealer discounts and commissions included in the above table, our Selling Agents will have the right to acquire warrants to purchase shares of our common stock equal to 5% of the aggregate shares sold in this offering (“Selling Agent Warrants”). The Selling Agent Warrants have an exercise price of $4.0625 per share.

(3) Does not include estimated offering expenses including, without limitation, legal, accounting, auditing, escrow agent, transfer agent, other professional, printing, advertising, travel, marketing, blue-sky compliance and other expenses of this Offering. We estimate the total expenses of this Offering, excluding the Selling Agents’ commissions and expenses, will be approximately $518,000.

(4) Assumes that the maximum aggregate offering amount of $9,999,990 is received by us.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

An investment in the Shares is subject to certain risks and should be made only by persons or entities able to bear the risk of and to withstand the total loss of their investment. Prospective investors should carefully consider and review the RISK FACTORS beginning on page 21.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION, OR THE COMMISSION, DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This Offering Circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

|

|

The date of this Offering Circular is __________, 2018.

TABLE OF CONTENTS

We have not, and the Selling Agents have not, authorized anyone to provide any information other than that contained or incorporated by reference in this Offering Circular prepared by us or to which we have referred you. Neither we nor the Selling Agents take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Offering Circular is an offer to sell only the Common Stock offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current only as of its date, regardless of the time of delivery of this Offering Circular or any sale of Common Stock.

For investors outside the United States: We have not done anything that would permit this Offering or possession or distribution of this Offering Circular in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this Offering and the distribution of this Offering Circular.

MARKET AND INDUSTRY DATA AND FORECASTS

Certain market and industry data included in this Offering Circular is derived from information provided by third-party market research firms, or third-party financial or analytics firms, that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications and third-party forecasts in conjunction with our assumptions about our markets. We have not independently verified such third-party information. The market data used in this Offering Circular involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in this Offering Circular. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

Certain data are also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding the industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this Offering Circular. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

In this Offering Circular, unless the context otherwise requires:

| ● | “we,” “us,” “our,” the “company” or “Muscle Maker,” refers collectively to Muscle Maker, Inc, a California corporation, incorporated in December 2014, the issuer of the common stock in this offering, and its subsidiaries; | |

| ● | “American Restaurant Holdings” refers to American Restaurant Holdings, Inc., a private equity restaurant group, which has invested over $5 million in growth capital into Muscle Maker to date and anticipates continuing to invest in Muscle Maker providing growth capital as necessary to continue the operations and expansion of Muscle Maker Grills regardless of the capital raised through this offering under Regulation A; | |

| ● | “Common Stock” refers to common stock, no par value per share, of Muscle Maker, Inc | |

| ● | “CTI” refers to Custom Technology, Inc., a New Jersey corporation, formed in July 2015, which is Muscle Maker Corp.’s direct, 70%-owned subsidiary; | |

| ● | “MMF Members” refers to Robert E. Morgan, Membership, LLC and P. John, LLC, who previously owned collectively 26% of Muscle Maker Brands, which in turn converted into MMBC, and then MMBC merged into Muscle Maker; | |

| ● | “Muscle Maker Brands” refers to Muscle Maker Brands, LLC, a California limited liability company, formed in December 2014, which was Muscle Maker’s previous direct, 74% owned subsidiary, prior to Muscle Maker Brands converting into MMBC and then MMBC merging into Muscle Maker; | |

| ● | “MMBC” refers to Muscle Maker Brands Conversion, Inc., a California corporation, which Muscle Maker Brands converted into from a limited liability company on June 8, 2017 and then merged in to Muscle Maker on September 15, 2017; | |

| ● | ”Muscle Maker Corp.” refers to Muscle Maker Corp., LLC, a Nevada limited liability company, which was formed on July 18, 2017, which is Muscle Maker’s direct, wholly owned subsidiary, that operates the corporate restaurant operations of Muscle Maker; | |

| ● | “Muscle Maker Development” refers to Muscle Maker Development, LLC, a Nevada limited liability company, which was formed on July 18, 2017, which is Muscle Maker’s direct, wholly owned subsidiary, that operates the franchising restaurant operations of Muscle Maker; |

| 1 |

| ● | “Muscle Maker Franchising” refers to Muscle Maker Franchising, LLC, a New Jersey limited liability company; | |

| ● | “Muscle Maker Grill” refers to the name under which our corporate and franchised restaurants do business; | |

| ● | “NYSE American” refers to The NYSE American; | |

| ● | “Offered Shares” or “Shares” refers to the 3,076,920 shares of common stock, no par value per share, of Muscle Maker, Inc which are being offered in this offering under Regulation A; | |

| ● | “OTCQX” refers to the OTCQX Marketplace by the OTC Markets Group; | |

| ● | “our restaurant system” or “our system” refers to both company-operated and franchised restaurants, and the number of restaurants presented in our restaurant system, unless otherwise indicated, is as of December 31, 2016; | |

| ● | “our restaurants,” or results or statistics attributable to one or more restaurants without expressly identifying them as company-operated, franchised or both, refers to our company-operated restaurants only; | |

| ● | when referring to “system-wide” financial metrics, we are referring to such financial metrics at the restaurant-level for company-operated restaurants plus those reported to us by our franchisees; | |

| ● | “average check” refers to company restaurant revenues from company-operated restaurants divided by company-operated restaurant transactions; | |

| ● | “dayparts” refers to five dayparts consisting of lunch as 10:00 a.m. to 2:00 p.m., snack as 2:00 p.m. to 5:00 p.m., dinner as 5:00 p.m. to 8:00 p.m., and after dinner as 8:00 p.m. to close; and | |

| ● | “aided brand awareness” refers to when a survey respondent indicates recognition of a specific brand from a list of possible names presented by those conducting the survey instead of indicating recognition of a specific brand without being offered a list of potential responses. |

We use a twelve-month fiscal year ending on December 31st of each calendar year. Fiscal 2015 and fiscal 2016 ended on December 31, 2015 and December 31, 2016, respectively.

In a twelve-month fiscal year, each quarter includes three-months of operations; the first, second, third and fourth quarters end on March 31st, June 30th, September 30th, and December 31st, respectively.

Comparable restaurant sales growth reflects the change in year-over-year sales for the comparable restaurant base (as applicable, system-wide, franchised or company-operated restaurants). A new restaurant enters our comparable restaurant base on the first full day of the month after being open for 15 months using a mid-month convention.

System-wide comparable restaurant sales include restaurant sales at all comparable company-operated restaurants and at all comparable franchised restaurants, as reported by franchisees. While we do not record franchised restaurant sales as revenues, our royalty revenues are calculated based on a percentage of franchised restaurant sales.

We measure system-wide, franchised and company-operated average unit volumes, or AUVs, on a fiscal year basis. Annual AUVs are calculated using the following methodology: first, we determine the restaurants that have been open for a full 15-month period; and second, we calculate the revenues for these restaurants and divide by the number of restaurants in that base to arrive at our AUV calculation.

| 2 |

The restaurant industry is divided into two segments: full service and limited service. Full service is comprised of the casual dining, mid-scale and fine dining sub-segments. Limited service, or LSR, is comprised of the quick-service restaurant, or QSR, and fast-casual sub-segments. “QSRs” are defined by Technomic as traditional “fast-food” restaurants with average check sizes of $3.00-$8.00. “Fast-casual” is defined by Technomic as a limited or self-service format with average check sizes of $8.00-$12.00 that offers food prepared to order within a generally more upscale and developed establishment. Our restaurants combine elements of both QSRs and fast-casual restaurants. Our restaurants’ convenient locations and format and average check are attributes that we share with QSRs (rather than with the fast-casual segment generally), while the quality of our food, the freshness of our ingredients and our traditional cooking methods are attributes that we generally share with fast-casual restaurants.

Certain monetary amounts, percentages and other figures included in this Offering Circular have been subject to rounding adjustments. Percentage amounts included in this Offering Circular have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this Offering Circular may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements. Certain other amounts that appear in this Offering Circular may not sum due to rounding.

Our board of directors and shareholders approved (i) a 1-for-7 reverse split of our common stock, which was effected on September 20, 2017 (the “1-for-7 Reverse Split”) and (ii) a 3-for-4 reverse split of our common stock, which was effected on January 31, 2018 (the “3-for-4 Reverse Split”; and together with the 1-for-7 Reverse Split, the “Reverse Splits”). The 1-for-7 Reverse Split combined each seven shares of our outstanding common stock into one share of common stock, the 3-for-4 Reverse Split combined each four shares of our outstanding common stock into three shares of common stock and the Reverse Splits correspondingly adjusted the exercise prices of our common stock purchase warrants and options and conversion price of our convertible debt. No fractional shares were issued in connection with the Reverse Splits, and any fractional shares resulting from the Reverse Splits were rounded down to the nearest whole share. Unless otherwise provided herein, all references to common stock, common stock purchase warrants, restricted stock, share data, per share data and related information have been retroactively adjusted, where applicable, in this Offering Circular to reflect the Reverse Splits of our common stock (and the corresponding adjustment of the exercise prices of our common stock purchase warrants) as if it had occurred at the beginning of the earliest period presented.

Unless otherwise indicated, all references to “dollars” and “$” in this Offering Circular are to, and amounts are presented in, U.S. dollars.

Unless otherwise indicated or the context otherwise requires, financial and operating data in this offering circular reflect the consolidated business and operations of Muscle Maker and its subsidiaries.

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products and the formulations for such products. This Offering Circular may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this Offering Circular is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this Offering Circular are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. Our ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could have a material adverse effect on our forward-looking statements and upon our business, results of operations, financial condition, funds derived from operations, cash available for dividends, cash flows, liquidity and prospects include, but are not limited to, the factors referenced in this Offering Circular, including those set forth below.

| 3 |

When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this Offering Circular. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this Offering Circular. The matters summarized below and elsewhere in this Offering Circular could cause our actual results and performance to differ materially from those set forth or anticipated in forward-looking statements. Accordingly, we cannot guarantee future results or performance. Furthermore, except as required by law, we are under no duty to, and we do not intend to, update any of our forward-looking statements after the date of this Offering Circular, whether as a result of new information, future events or otherwise.

This summary of the Offering Circular highlights material information concerning our business and this offering. This summary does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire Offering Circular, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” Unless otherwise provided herein, all historical information in this Offering Circular has been adjusted to reflect the 1-for-7 reverse stock split of our common stock that was effective September 20, 2017 and the 3-for-4 reverse stock split of our common stock that was effective January 31, 2018.

In this Offering Circular, unless the context indicates otherwise, “Muscle Maker,” the “Company,” “we,” “our,” “ours” or “us” refer to Muscle Maker, Inc, a California corporation, and its subsidiaries.

Our Company

The Muscle Maker Grill is a high-growth, fast casual restaurant concept that specializes in preparing healthy-inspired, high-quality, fresh, made-to-order lean, protein-based meals featuring chicken, seafood, pasta, burgers, wraps and flat breads. In addition, we feature freshly prepared entrée salads and an appealing selection of sides, protein shakes and fruit smoothies. We operate in the approximately $34.5 billion fast casual restaurant segment, which we believe has created significant recent disruption in the restaurant industry and is rapidly gaining market share from adjacent restaurant segments, resulting in significant growth opportunities for restaurant concepts such as Muscle Maker Grill.

We believe our restaurant concept delivers a highly differentiated customer experience by combining the quality and hospitality that customers commonly associate with our full service and fast casual restaurant competitors with the convenience and value customers generally expect from traditional fast food restaurants. The following core values form the foundation of our brand:

| ● | Quality. Commitment to provide the highest quality, healthy-inspired food for a wonderful experience. | |

| ● | Empowerment and Respect. We seek to empower our employees to take initiative and give their best while respecting themselves and others to maintain an environment for team work and growth. | |

| ● | Service. Provide world class service to achieve excellence each passing day. | |

| ● | Value. Our combination of high-quality, healthy-inspired food, empowerment of our employees, world class service, all delivered at a low price, strengthens the value proposition for our customers. |

In striving for these goals, we aspire to connect with our target market and create a great brand with a strong and loyal customer base.

As of November 1, 2017, Muscle Maker and its subsidiaries and franchisees operated 53 Muscle Maker Grill restaurants located in 14 states, 12 of which are owned and operated by Muscle Maker, and 41 are franchise restaurants.

| 4 |

As of June 30, 2017, Muscle Maker and its subsidiaries and franchisees operated 51 Muscle Maker Grill restaurants located in 10 states, 11 of which are owned and operated by Muscle Maker, and 40 are franchise restaurants. Our restaurants generated company-operated restaurant revenue of $2,735,222 and $2,658,015 for the year ended December 31, 2016 and the six months ended June 30, 2017, respectively. For the six months ended June 30, 2017 and the year ended December 31, 2016, total company revenues were $3,890,822 and $4,953,205, respectively. For the six months ended June 30, 2017 and the fiscal year ended December 31, 2016, we reported net losses of $6,929,514 and $4,219,687, respectively, and negative cash flow from operating activities of $1,648,186 and $2,110,702, respectively. As of June 30, 2017, we had an aggregate accumulated deficit of $9,016,729. We anticipate that we will continue to report losses and negative cash flow. As a result of the net loss and cash flow deficit for the year ended December 31, 2016 and other factors, our independent auditors issued an audit opinion with respect to our financial statements for the year ended December 31, 2016 that indicated that there is a substantial doubt about our ability to continue as a going concern.

We are the owner of the trade name and service mark Muscle Maker Grill® and other trademarks and intellectual property we use in connection with the operation of Muscle Maker Grill® restaurants. We license the right to use the Muscle Maker Grill® trademarks and intellectual property to our wholly-owned subsidiaries, Muscle Maker Development and Muscle Maker Corp., and to further sublicense them to our franchisees for use in connection with Muscle Maker Grill® restaurants.

Seasonal factors and the timing of holidays cause our revenue to fluctuate from quarter to quarter. Our revenue per restaurant is typically lower in the fourth quarter due to reduced December traffic and higher traffic in the first, second, and third quarters.

Our healthy-inspired menu, value proposition, and culture have helped us to deliver strong and consistent revenue growth, as illustrated by the following:

| ● | our company-owned annual average unit volumes, or AUVs, are approximately $712,000 in fiscal year 2016; and | |

| ● | from the year ended December 31, 2015 to the year ended December 31, 2016, we increased our total revenue by 59% from $3,106,779 to $4,953,205. |

Our Industry

We operate within the LSR segment of the U.S. restaurant industry, which includes QSR and fast-casual restaurants. According to Technomic, 2015 sales for the total LSR category increased 5.2% from 2014 to $255 billion. We offer fast-casual quality food combined with quick-service speed, convenience and value across multiple dayparts. According to Technomic, sales for the total QSR segment grew 4.1% from 2014 to $212 billion in 2015, and are projected to grow to $254 billion by 2019, representing a compounded annual growth rate, or CAGR, of 4.6%. Total sales in the fast-casual segment grew 11.3% from 2014 to $43 billion in 2015, and are projected to grow to $64 billion by 2019, representing a CAGR of 10.2%. We believe our differentiated, high-quality menu delivers great value all day, every day, positions us to compete successfully against both QSR and fast-casual concepts, providing us with a large addressable market.

We expect that the trend towards healthier eating will attract and increase consumer demand for fresh and hand-prepared dishes, leading to a positive impact on our sales.

Our Strengths

Compelling Speed Using Cook to Order Preparation: Our guests can expect to enjoy their meals in eight minutes or less. While this service time may be slightly higher than the QSR segment, it fits well within the range of the fast casual segment. Our meals are prepared from a cook to order method using only the freshest, all natural ingredients.

Daypart Mix and Revenue Streams: Standard operating hours for a Muscle Maker Grill are from 10:30 AM to 8:30 PM, Monday through Friday, 11:00 AM to 6 PM, Saturday, and closed on Sunday. While our daypart mix is typical to the QSR fast casual segment which is 5% pre-lunch, 45% lunch, 35% dinner and 15% late evening. We have multiple revenue streams that allow for greater efficiencies and operations and ultimately higher profitability. A typical QSR fast casual brand has two to three revenue streams: dine-in, take-out and delivery. Muscle Maker Grill executes on eight different revenue streams; including: dine-in, take-out, delivery, catering, meal plans, retail and grab and go kiosks and food trucks.

| 5 |

Attractive Price Point and Perceived Value: Muscle Maker Grill offers meals with ‘power sides’ beginning at $8.99, using only the highest quality ingredients such as grass-fed beef, all natural chicken, whole wheat pastas, brown rice and a power blend of kale, romaine and spinach. Our cook to order method, speed of service, hospitality and the experience of our exhibition style kitchen creates a great value perception for our customers. Meal Plan meals begin at $8 a meal making them not only convenient but affordable too. Muscle Maker Grill also offers a boxed lunch program for schools and other organizations starting at $10 a box. These lunches include a wrap, salad or entrée, and a side and a drink. We not only reward our guests with a great value and guest experience, we reward them for their loyalty as well. Frequent Muscle Maker Grill guests can take advantage of its loyalty program, Muscle Maker Grill Rewards, where points are awarded for every dollar spent towards free or discounted menu items. Cards are not required to participate as members can provide their phone number or use the mobile app, Muscle Maker Grill Rewards, to receive notifications announcing new menu items, special events and more. The program is enjoyed by thousands or guests!

Muscle Maker Grill Business Facts:

| ● | Largest protein based QSR fast casual in the united states. | |

| ● | Established in 1995 in Colonia, NJ. | |

| ● | Muscle Maker Grill operates 53 restaurants, 41 franchised and 12 company as of November 1, 2017 with system-wide sales exceeding $24 million in 2016. | |

| ● | Ranked in the future 50 list of the fastest growing small chains in America and achieved a spot on Fastcasual.com’s top 100 Movers and Shakers in 2016 and expecting a top five ranking in 2017. | |

| ● | National footprint in 14 states as of November 1, 2017 and soon to be 18 states by the end of 2017. | |

| ● | Multiple International expansion opportunities including: Kuwait, Dubai and India. | |

| ● | Currently a preferred vendor for the US military with restaurants opportunities in GA, KY, MA, NY, NC, SC, VA, TX and WA. |

Restaurant Level Profitability and Unit Economics: We believe our brand position in a segment with limited competition, strong value perception and multiple revenue streams provides a great opportunity for continued corporate and franchise growth. Our low cost of entry and real estate strategy allows for greater operating efficiencies and higher profitability. See below for corporate store economics. We primarily operate in urban and suburban markets using in line locations and targeting second generation restaurants. Typical capital investment ranges from $180,000 to $225,000 for buildout and equipment. Annual revenues of $800,000 may anticipate achieving a 10% operating profit. Other company revenue sources include a franchise fee of $35,000 per unit on a sliding scale for multi-unit development. Franchisees currently pay 5% off gross sales in royalties and 3% of gross sales for marketing and advertising.

Leveraging Non-Traditional Revenue Streams:

Delivery: A significant differentiator is that Muscle Maker Grill offers delivery at every location nation-wide. Delivery is an option through our mobile app, online ordering platform making it easy and convenient for our guests. Delivery percentages range from 10% up to 56% of sales. We strongly believe this segment will continue to grow as our core demographic has demonstrated the need for online ordering and delivery versus dine-in and take-out.

Catering: Our diverse menus items are also offered through our catering program making it easy and affordable to feed a group. We can feed a group ranging from 10 or 5,000. Muscle Maker Grill has secured large catering contracts with multi-national corporations, universities as well as professional and college athletic programs. Our boxed lunch program, which includes a wrap, salad, or entrée, a side and a drink for a set price is widely popular within schools and other organizations.

| 6 |

Meal Plans: To make healthy eating even easier, Muscle Maker Grill’s signature nutritionally-focused menu items are available through its new Meal Plan program, allowing pre-orders of meals that taste great via phone, online or in-store, available for pick up or delivered right to their door. Available as five, 10, 15 or 20 meals, guests can choose from 28 Muscle Maker Grill menu items, including the Hollywood Salad, Turkey Meatball Wrap, Arizona and many more.

Retail: All Muscle Maker Grill locations participate in our retail merchandising and supplement program. This is a unique revenue stream specific to the Muscle Maker Grill brand and is atypical in the QSR fast casual segment. Guests can purchase our propriety protein in bulk, supplements, boosters, protein and meal replacement bars and cookies. This program gives our guests the opportunity to manage their healthy lifestyle beyond the four walls of our restaurants.

Grab and Go Kiosks: Muscle Maker Grill offers grab and go kiosks both in the restaurants and non-traditional locations. The kiosks are comprised of 10 to 12 core meal plan menu items. We have positioned the kiosks so that guests can grab a meal on the run. These meals are convenient to guests that chose not to dine in or want additional meals for themselves or family members.

Food Trucks: Food trucks have become a more main stream point of destination for restaurant goers and we strongly believe the growth trend in the segment will continue. Muscle Maker Grill wants to make our healthy options available to all consumers and will continue to develop and grow this revenue stream. Muscle Maker Grill currently has one food truck in operation in Dallas, TX and three to five in the pipeline for US military bases such as Hans comb Airforce Base, Quantico Marine Base and West Point Military Academy.

Strategy

We plan to pursue the following strategies to continue to grow our revenues and profits.

Expand Our System-Wide Restaurant Base. We believe we are in the early stages of our growth story with 53 current locations in 14 states, as of November 1, 2017. For the year ended December 31, 2014, we opened 12 new franchised restaurants and no new company-operated restaurants. For the year ended December 31, 2015, we opened one new company-operated and seven new franchised restaurants. For the year ended December 31, 2016, we opened six new company-operated and four new franchised restaurants. We anticipate that between November 2017 and April 2018, we will open 5 to 10 new company-operated and 9 new franchised restaurants, including military bases, across Arizona, California, Florida, Georgia, Illinois, Louisiana, Kansas, Massachusetts, Nebraska, New Jersey, New York, Nevada, North Carolina, Pennsylvania, Texas, Washington and Internationally. Over the long term, we plan to grow the number Muscle Maker Grill restaurants by 30% to 50% annually. There is no guarantee that we will be able to increase the number of our restaurants. We may be unsuccessful in expanding within our existing or into new markets for a variety of reasons described herein under “Risk Factors” above, including competition for customers, sites, franchisees, employees, licenses and financing.

Drive Comparable Restaurant Sales. We plan to continue delivering comparable restaurant sales growth through the following strategies:

| ● | Menu Strategy and Evolution. We will continue to adapt our menu to create entrees that complement our health-inspired offerings and that reinforce our differentiated fast casual positioning. We believe we have opportunities for menu innovation as we look to provide customers more choices through customization and limited time alternative proteins. Our marketing and operations teams collaborate to ensure that the items developed in our test kitchen can be executed to our high standards in our restaurants with the speed and value that our customers have come to expect. To provide added variety, from time to time we introduce limited time offerings such as our fish tacos and shish-k-bobs. Some of these items have been permanently added to the menu. | |

| ● | Attract New Customers Through Expanded Brand Awareness: We expect to attract new customers as Muscle Maker Grill becomes more widely known due to new restaurant openings and marketing efforts focused on broadening the reach and appeal of our brand. We expect consumers will become more familiar with Muscle Maker Grill as we continue to penetrate our markets, which we believe will benefit our existing restaurant base. Our marketing strategy centers on our “Great Food with Your Health in Mind” campaign, which highlights the desirability of healthy-inspired food and made-from-scratch quality of our food. We also utilize social media community engagement and public relations to increase the reach of our brand. Additionally, our system will benefit from increased contributions to our marketing and various advertising funds as we continue to grow our restaurant base. |

| 7 |

| ● | Increase Existing Customer Frequency: We are striving to increase customer frequency by providing a service experience and environment that “compliments” the quality of our food and models our culture. We expect to accomplish this by enhancing customer engagement, while also improving throughput, order execution and quality. Additionally, we have recently implemented a customer experience measurement system, which provides us with real-time feedback and customers’ insights to enhance our service experience. We believe that always striving for excellent customer service will create an experience and environment that will support increased existing customer visits. | |

| ● | Continue to Grow Dayparts: We expect to drive growth across these dayparts through optimized labor and management allocation, enhanced menu offerings, innovative merchandising and marketing campaigns, which have successfully driven growth in our dayparts. We plan to continue introducing and marketing limited time offers to increase occasions across our dayparts as well as to educate customers on our lunch and dinner offerings. |

Continue to Enhance Profitability. We focus on expanding our profitability while also investing in personnel and infrastructure to support our future growth. We will seek to further enhance margins over the long-term by maintaining fiscal discipline and leveraging fixed costs. We constantly focus on restaurant-level operations, including cost controls, while ensuring that we do not sacrifice the quality and service for which we are known. Additionally, as our restaurant base grows, we believe we will be able to leverage support costs as general and administrative expenses grow at a slower rate than our revenues.

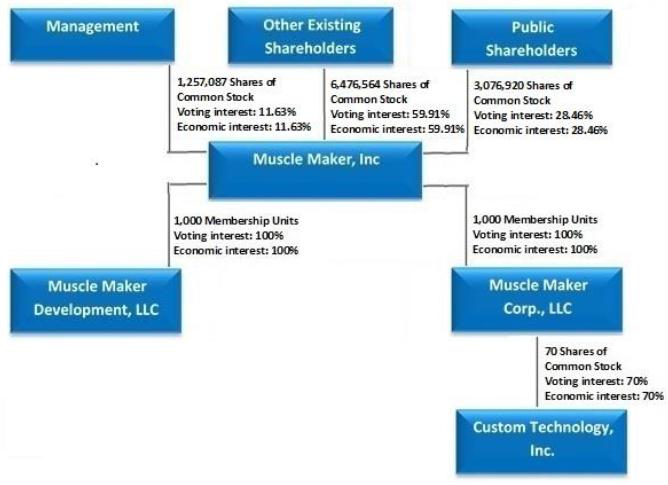

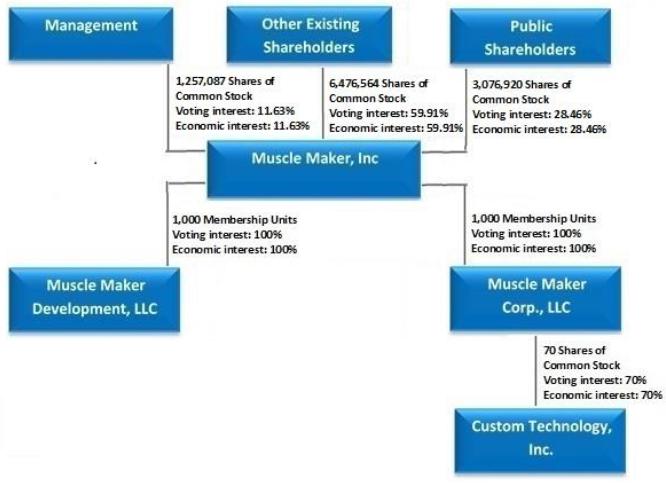

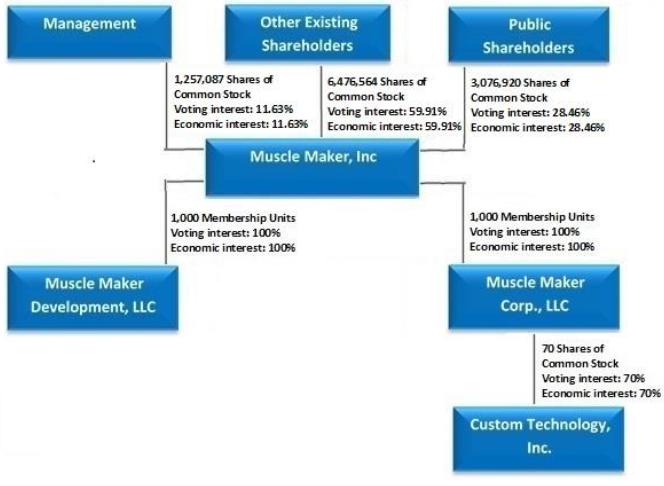

Overview of Corporate Structure

Muscle Maker serves as a holding company of the following subsidiaries:

| (i) | Muscle Maker Development, LLC (“Muscle Maker Development”), a directly wholly owned subsidiary, which was formed in Nevada on July 18, 2017 for the purposes of running our existing franchise operations and continuing to franchise the Muscle Maker Grill name and business system to qualified franchisees; and | |

| (ii) | Muscle Maker Corp., LLC (“Muscle Maker Corp.”), a directly wholly owned subsidiary, which was formed in Nevada on July 18, 2017 for the purposes of developing new corporate stores and operating our new and existing corporate stores. Muscle Maker Corp. has a direct 70% ownership interest in Custom Technology, Inc. (“CTI”), which was formed in New Jersey on July 29, 2015, and is a technology and point of sale (“POS”) systems dealer and technology consultant. |

We plan to expand our Muscle Maker Grill brand through the (i) development and opening of additional company owned Muscle Maker Grill restaurants and (ii) franchising of additional Muscle Maker Grill restaurants. Muscle Maker together with Muscle Maker Development, Muscle Maker Corp., and CTI are referred to herein collectively as the “Company”.

Corporate History

Formation of Muscle Maker

Muscle Maker, Inc. (“Muscle Maker”), was incorporated by American Restaurant Holdings (“American Restaurant Holdings”) in California on December 8, 2014. On December 22, 2014, Muscle Maker issued 10,713 shares of its common stock, no par value per share, to the Chief Executive Officer of American Restaurant Holdings as founder shares for cash proceeds of $10.

Acquisition of 74% of Muscle Maker Brands

Muscle Maker Brands, LLC (“Muscle Maker Brands”) was formed on December 22, 2014 in the state of California for the purpose of acquiring and operating company owned Muscle Maker Grill restaurants, as well as franchising the Muscle Maker Grill name and business system to qualified franchisees. Muscle Maker Franchising, LLC (“Muscle Maker Franchising”) was founded in 1995 in order to develop a brand of healthy-option fast food restaurants.

| 8 |

On January 23, 2015, Muscle Maker, Muscle Maker Brands and Muscle Maker Franchising entered into a Unit Purchase Agreement whereby Muscle Maker Brands purchased substantially all of the assets and liabilities of Muscle Maker Franchising, Muscle Maker acquired 7,400 membership units of Muscle Maker Brands (representing 74% of the membership units of Muscle Maker Brands), and certain members of Muscle Maker Franchising (“MMF Members”) acquired 2,600 membership units of Muscle Maker Brands (representing 26% of the membership units of Muscle Maker Brands). (the “MMG Acquisition”). The aggregate purchase consideration for Muscle Maker’s membership interest in Muscle Maker Brands was $4,244,000 and consisted of $3,570,000 in cash, $604,000 of promissory notes (consisting of a $400,000 promissory note (“MM Note”) from Muscle Maker and a $204,000 promissory note (“MMB Note”) from Muscle Maker Brands) and 53,571 shares of common stock of Muscle Maker valued at $1.31 per share or $70,000 issued. On January 23, 2015, in exchange for the issuance by Muscle Maker to American Restaurant Holdings of 4,339,285 shares of common stock of Muscle Maker, American Restaurant Holdings provided cash of $3,645,000 and an obligation to repay an aggregate of $604,000 of principal due under MM Note and MMB Note issued to Muscle Maker Franchising in order to facilitate the Muscle Maker Brands acquisition. Pursuant to the terms of the Unit Purchase Agreement, the MMF Members shall convert their non-controlling interest in Muscle Maker Brands into an aggregate of 1,550,964 shares of common stock of Muscle Maker prior to Muscle Maker going public.

On January 24, 2015, Muscle Maker granted 21,428 shares of its common stock valued at $1.31 per share to its Director of Brand Development, in connection with an employment agreement with the Director of Brand Development.

On January 24, 2015, the Company issued 45,918 shares of its common stock to the Director of Brand Development in exchange for cash proceeds of $1.31 per share, or $60,000.

On July 23, 2015 and August 28, 2015, the Company issued 80,356 and 53,571 of its common stock, and 3-year warrants for the purchase of 40,178 and 26,785 shares of common stock respectively, for aggregate cash proceeds of $750,000. The warrants are exercisable at $7.00 per share.

Springfield Acquisition

On May 4, 2015, Muscle Maker Brands acquired a business in Springfield, New Jersey, as a corporate store (the “Springfield Acquisition”). The purchase price of the store was $30,060, of which $8,670 related to equipment purchased and the remaining $21,390 was accounted for as goodwill.

CTI Acquisition

On August 1, 2015, the Company acquired 70% of the shares of Custom Technology, Inc. (“CTI”), a technology and point of sale (“POS”) systems dealer and technology consultant, in exchange for $70,000 in cash (the “CTI Acquisition”). CTI was formed in New Jersey on July 29, 2015 and entered into an asset purchase agreement on August 1, 2015 pursuant to which CTI purchased POS computer systems, cash registers, camera systems and related inventory and supplies from its predecessor entity.

Repayment of Promissory Notes regarding MMG Acquisition

The MMB Note was completely repaid on March 9, 2015. On July 21, 2015, January 23, 2016 and July 23, 2016, installments of $100,000, $150,000 and $150,000 were repaid on the balance of the MM Note. As of July 23, 2016, there is no balance outstanding related to MM Note.

Advances and Exchange of Advances for Convertible Notes

On December 31, 2015, Muscle Maker issued a promissory note in the amount of $1,082,620 (the “2015 ARH Note”) to American Restaurant Holdings. The 2015 ARH Note had no stated interest rate and was convertible into 231,990 shares of the Company’s common stock at $4.67 per share.

| 9 |

During the period from July 1, 2016 through December 31, 2016, American Restaurant Holdings provided $1,364,842 of advances to Muscle Maker. These advances, combined with the $1,257,000 payable to American Restaurant Holdings as June 30, 2016 were exchanged for a convertible note in the amount of $2,621,842 (the “2016 ARH Note”). The 2016 ARH Note had no stated interest rate or maturity date and was convertible into shares of common stock of Muscle Maker at a conversion price of $3.73 per share at a time to be determined by the American Restaurant Holdings.

More Advances and Exchange of Advances for Convertible Notes and Conversion of Convertible Notes to Shares of Common Stock

During the period from December 31, 2016 through February 15, 2017, American Restaurant Holdings provided $980,949 of advances to the Company. The payable due to American Restaurant Holdings as a result of these advances was exchanged for a convertible promissory note in the amount of $980,949 (the “First 2017 ARH Note”). The First 2017 ARH Note has no stated interest rate or maturity date and is convertible into shares of common stock of Muscle Maker at a conversion price of $3.73 per share at a time to be determined by the lender.

On March 14, 2017, American Restaurant Holdings elected to convert: (a) the 2015 ARH Note in the principal amount of $1,082,620 into 231,990 shares of common stock of Muscle Maker at a conversion price of $4.67 per share; (b) the 2016 ARH Note in the principal amount of $2,621,842 into 702,279 shares of common stock of Muscle Maker at a conversion price of $3.73 per share; and (c) the First 2017 ARH Note in the principal amount of $980,949 into 262,753 shares of common stock of Muscle Maker at a conversion price of $3.73 per share.

Second and Third 2017 Advances and Exchange of Advances for Convertible Notes

During the period from February 16, 2017 through March 15, 2017, American Restaurant Holdings provided $338,834 of advances to the Company. The payable due to American Restaurant Holdings as a result of these advances was exchanged for a convertible promissory note in the amount of $338,834 (the “Second 2017 ARH Note”). The Second 2017 ARH Note has no stated interest rate or maturity date and is convertible into shares of common stock of Muscle Maker at a conversion price of $4.67 per share at a time to be determined by the lender.

During the period from March 16, 2017 through July 18, 2017, American Restaurant Holdings provided $336,932 of advances to the Company. The payable due to American Restaurant Holdings as a result of these advances was exchanged for a convertible promissory note in the amount of $336,932 (the “Third 2017 ARH Note”). The Third 2017 ARH Note has no stated interest rate or maturity date and is convertible into shares of common stock of Muscle Maker at a conversion price of $7.47 per share at a time to be determined by the lender.

Unrelated Party Loans for Convertible Notes

During the period from March 17, 2017 to August 15, 2017, Muscle Maker issued convertible notes, as amended and extended on or about January 29, 2018, maturing upon the earlier of the closing of the Offering or six months following the date of the extension of the convertible notes, convertible into common stock at a price per share of $1.625 (50% of initial public offering price), and, if not converted, a stated interest rate of 10% per six months, will become due and payable along with the principal amount, to the following unrelated parties:

(a) JM Assets LP for a loan of $500,000;

(b) Midland IRA Inc FBO Randall Avery for a loan of $100,000;

(c) Tom Buckley for a loan of $25,000;

(d) John Mohan for a loan of $100,000;

(e) Kevin Mohan for a loan of $50,000;

(f) Attary LLC for a loan of $75,000;

(g) Sean Harrison for a loan of $50,000;

(h) Robert Mohan for a loan of $50,000;

(i) Jerry Neugebauer for a loan of $100,000; and

(j) Shawn Holmes for a loan of $100,000.

Spin-Off of Muscle Maker by American Restaurant Holdings

On March 23, 2017, American Restaurant Holdings authorized and facilitated the distribution of 5,536,308 shares of common stock of Muscle Maker held by American Restaurants, LLC, the wholly owned subsidiary of American Restaurant Holdings, to the shareholders of American Restaurant Holdings (the “Spin-Off”). As a result of the Spin-Off on March 23, 2017, American Restaurant Holdings is no longer a majority owner of Muscle Maker.

Related Party Loan for Convertible Note

During the period from May 1, 2017 to August 15, 2017, Muscle Maker issued convertible notes, as amended and extended on or about January 29, 2018, maturing upon the upon the earlier of the closing of the Offering or six months following the date of the extension of the convertible notes, convertible into common stock at a price per share of $1.625 (50% of initial public offering price), and, if not converted, a stated interest rate of 10% per six months, will become due and payable along with the principal amount, to the following related parties:

(a) John Feeney for a loan of $50,000;

(b) Membership, LLC for a loan of $100,000; and

(c) A.B. Southall for a loan of $100,000.

| 10 |

Issuances of Warrants

The Company issued the following warrants to purchase an aggregate of 605,150 shares of common stock of Muscle Maker: (a) a 3-year warrant to Dean Miles to purchase 66,963 shares of common stock of Muscle Maker at an exercise price of $7.00 per share, in connection with two private placements to Mr. Miles in 2015; (b) a 3-year warrant to American Restaurant Holdings to purchase of 245,797 shares of common stock of Muscle Maker at an exercise price of $9.33 per share, in connection with the exchange of advances for the 2016 ARH Note in 2016; (c) a 3-year warrant to American Restaurant Holdings to purchase of 91,963 shares of common stock of Muscle Maker at an exercise price of $9.33 per share, in connection with the exchange of advances for the First 2017 ARH Note in 2017; (d) a 3-year warrant to American Restaurant Holdings to purchase of 15,793 shares of common stock of Muscle Maker at an exercise price of $9.33 per share, in connection with the exchange of advances for the Second 2017 ARH Note in 2017; (e) a 3-year warrant to American Restaurant Holdings to purchase of 15,793 shares of common stock of Muscle Maker at an exercise price of $9.33 per share, in connection with the exchange of advances for the Third 2017 ARH Note in 2017; (f) a 3-year warrant to Prashant Shah to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share; (g) a 3-year warrant to JM Assets LP to purchase of 26,785 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by JM Assets LP to Muscle Maker in 2017; (h) a 3-year warrant to Midland IRA Inc FBO Randall Avery to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Midland IRA Inc FBO Randall Avery to Muscle Maker in 2017; (i) a 3-year warrant to John Feeney to purchase of 2,678 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by John Feeney to Muscle Maker in 2017; (j) a 3-year warrant to Tom Buckley to purchase of 1,338 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Tom Buckley to Muscle Maker in 2017; (k) a 3-year warrant to John Mohan to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by John Mohan to Muscle Maker in 2017; (l) a 3-year warrant to Kevin Mohan to purchase of 2,678 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Kevin Mohan to Muscle Maker in 2017; (m) a 3-year warrant to Dan Pettit to purchase of 8,035 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Dan Pettit to Muscle Maker in 2017; (n) a 3-year warrant to Attary LLC to purchase of 4,017 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Attary LLC to Muscle Maker in 2017; (o) a 3-year warrant to John Marques to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Membership, LLC to Muscle Maker in 2017; (p) a 3-year warrant to Sean Harrison to purchase of 2,678 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Sean Harrison to Muscle Maker in 2017; (q) a 3-year warrant to Robert Mohan to purchase of 2,678 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Robert Mohan to Muscle Maker in 2017; (r) a 3-year warrant to Spartan Capital Securities, LLC to purchase of 1,713 shares of common stock of Muscle Maker at an exercise price of $9.33 per share; (s) a 3-year warrant to Jerry Neugebauer to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan Jerry Neugebauer to Muscle Maker in 2017; (t) a 3-year warrant to A.B. Southall to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by A.B. Southall to Muscle Maker in 2017; (u) a 3-year warrant to Shawn Holmes to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share in connection with the loan by Shawn Holmes to Muscle Maker in 2017; and (v) a 3 year-warrant to Catalytic Capital LLC to purchase 78,733 share of common stock of Muscle Maker at an exercise price of $1.625 per share in connection with the loan by Catalytic Capital LLC to Muscle Maker in 2018. As of the date of this Offering Statement, there are unexercised warrants outstanding to purchase an aggregate of 599,788 shares of common stock of Muscle Maker.

| 11 |

Grant of Shares of Restricted Common Stock to Employees and Consultants

In May 2017, Muscle Maker granted 119,721 shares of its common stock to its employees and consultants at a value of $9.33 per share. Such share grants are subject to graduated vesting in equal installments of 20% on each of the following dates: (i) the date of grant, (ii) January 1, 2018, (iii) January 1, 2019, (iv) January 1, 2020, and (v) January 1, 2021. In the event of resignation or termination for any reason (except for a “change of control”) of an employee or consultant that receives such shares, the remaining non-vested shares of such employee or consultant prior to such resignation or termination will be forfeited.

Recent Developments

Reorganization

Conversion of Muscle Maker Brands

On June 8, 2017, Muscle Maker Brands converted from a limited liability company into a California corporation named Muscle Maker Brands Conversion, Inc. (“MMBC”).

Formation of Muscle Maker Development to Operate Franchising and Assignment of Franchise Agreements

On July 18, 2017, Muscle Maker formed Muscle Maker Development, LLC (“Muscle Maker Development”) in the state of Nevada for the purpose of running our existing franchise operations and continuing to franchise the Muscle Maker Grill name and business system to qualified franchisees. Muscle Maker Development issued 1,000 membership units to its sole member and manager, Muscle Maker. On August 25, 2017, MMBC assigned all the existing franchise agreements to Muscle Maker Development pursuant to the terms of that certain Assignment and Assumption Agreement, dated August 25, 2017, between MMBC and Muscle Maker Development.

Formation of Muscle Maker Corp. to Develop and Operate Corporate Stores

On July 18, 2017, Muscle Maker formed Muscle Maker Corp., LLC (“Muscle Maker Corp.”) in the state of Nevada for the purpose of developing new corporate stores and operating new and existing corporate stores of Muscle Maker. Muscle Maker Corp. issued 1,000 membership units to its sole member and manager, Muscle Maker.

Issuance of Shares of Muscle Maker to CrowdfundX for Marketing Services in Connection with Offering

On July 20, 2017, Muscle Maker entered into that certain Master Services Agreement, effective as of July 20, 2017, with WhoYouKnow LLC, California limited liability company d/b/a CrowdfundX (“CrowdfundX”), whereby CrowdfundX is providing management services to Muscle Maker in connection with the Offering. Pursuant to the terms of the agreement, Muscle Maker issued 52,307 shares of common stock at a value of $3.25 per share (or, an aggregate value of $170,000) to CrowdfundX. In addition, Muscle Maker agreed to pay a cash fee to CrowdfundX in the amount of $145,000, which was paid in installments of $40,000 within five business days after the Effective Date, $40,000 on August 21, 2017, and $65,000 on September 21, 2017.

| 12 |

Shares Purchased by Daniel Pettit

On July 21, 2017, Muscle Maker issued 6,696 shares of common stock of Muscle Maker to Daniel Pettit, as trustee of the Daniel E. Pettit Revocable Trust at a purchase price of $7.47 per share providing $50,000 of proceeds to Muscle Maker.

Appointment of Computershare as Transfer Agent

On July 24, 2017, Muscle Maker entered into an agreement with Computershare Inc., and its wholly-owned subsidiary Computershare Trust Company, N.A. (together with Computershare, Inc., “Computershare”), whereby Computershare agreed to act as the transfer agent of Muscle Maker.

Exercise of Warrants by Prashant Shah

On July 25, 2017, Prashant Shah exercised his 3-year warrant to purchase of 5,356 shares of common stock of Muscle Maker at an exercise price of $9.33 per share providing $50,000 of proceeds to Muscle Maker.

Options Granted to Franchisees

On July 27, 2017, Muscle Maker granted stand-alone (non-Plan based) non-qualified stock options to purchase an aggregate of 33,750 shares of its common stock to its franchisees. The options are fully vested, have an exercise price of $9.33 per share and expire 3 years after the date of grant.

Amendment of Bylaws Permitting Electronic Voting of Shareholders

Our board of directors approved on August 11, 2017 an amendment to our Bylaws permitting electronic notice by the Board of Directors to shareholders seeking shareholder approval on corporate matters and for shareholders to electronically vote directly on corporate matters rather than to require the provision of proxies at a shareholder meeting.

Shared-Service Agreement between Muscle Maker and Muscle Maker Development

On August 25, 2017, Muscle Maker and Muscle Maker Development entered into a Shared-Service Agreement as to the payment of compensation and expenses of employees and consultants which are shared by both Muscle Maker and Muscle Maker Development.

Shares Purchased by CCNC-MMG, LLC

On August 25, 2017, Muscle Maker issued 40,178 shares of common stock of Muscle Maker to CCNC-MMG, LLC at a purchase price of $7.47 per share providing $300,000 of proceeds to Muscle Maker.

Shares Purchased by Alex Danze

On September 1, 2017, Muscle Maker issued 6,696 shares of common stock of Muscle Maker to Alex Danze at a purchase price of $7.47 per share providing $50,000 of proceeds to Muscle Maker.

| 13 |

Merger and Reorganization

Merger of Muscle Maker Brands Conversion, Inc. with Muscle Maker

On September 15, 2017 (“Effective Merger Date”), pursuant to an Agreement of Merger, MMBC was merged (“Merger”) into Muscle Maker, with Muscle Maker as the surviving corporation, in a tax-free reorganization. Pursuant to the Merger, each share of common stock of MMBC, no par value per share (the “MMBC Common Stock”), other than shares owned by Muscle Maker, was converted into 596.5251 shares of common stock of Muscle Maker, with any fractional shares resulting to any shareholder of MMBC being rounded to the next nearest whole share (the “Merger Consideration”) for a total consideration of 1,550,964 shares of common stock of Muscle Maker to the MMF Members. On the Effective Merger Date, by virtue of the Merger, each share of MMBC Common Stock issued and held immediately prior to the Effective Time by Muscle Maker was automatically cancelled and retired and ceased to exist, and no consideration was delivered in exchange for the cancellation and retirement of the MMBC Common Stock held by Muscle Maker. As a result of the Merger, Muscle Maker owned 70% of the shares of CTI.

Assignment of Corporate Stores and shares of CTI to Muscle Maker Corp.

On September 15, 2017, Muscle Maker assigned all the existing corporate stores and its 70% ownership interest in CTI to Muscle Maker Corp. pursuant to the terms of that certain Agreement of Conveyance, Transfer and Assigning of Assets and Assumptions of Liabilities, dated September 15, 2017, between Muscle Maker Corp and Muscle Maker.

Conversion of Second 2017 ARH Note to Shares of Common Stock

On September 19, 2017, American Restaurant Holdings elected to convert the Second 2017 ARH Note in the principal amount of $338,834 into 72,606 shares of common stock of Muscle Maker at a conversion price of $4.67 per share.

Conversion of Third 2017 ARH Note to Shares of Common Stock

On September 19, 2017, American Restaurant Holdings elected to convert the Third 2017 ARH Note in the principal amount of $336,932 into 45,124 shares of common stock of Muscle Maker at a conversion price of $7.47 per share.

Employment Agreements

Muscle Maker entered into an Employment Agreement with each of (i) Robert Morgan, as Chief Executive Officer, (ii) Grady Metoyer, as Chief Financial Officer and (iii) Rodney Silva, as Chief Culture Officer, effective as of the date Muscle Maker successfully receives at least $5,000,000 in gross proceeds from an SEC qualified offering under this Offering Statement under Regulation A+ under the Securities Act of 1933, as amended. See “Executive Compensation – Employment Agreements”.

Payment of Lease Payment Obligations

On September 15, 2017, American Restaurant Holdings entered into an Assumption Agreement with Muscle Maker and Muscle Maker Corp, whereby Muscle Maker and Muscle Maker Corp. agree to make all required payments under the Muscle Maker Grill corporate restaurant leases which American Restaurant Holdings entered into on behalf of Muscle Maker, Inc, Muscle Maker Corp., LLC, Muscle Maker Brands, LLC and Muscle Maker Brands Conversion, Inc.

1-for-7 Reverse Stock Split

Our board of directors and shareholders approved on September 18, 2017 and September 20, 2017, respectively, a 1-for-7 reverse split of our common stock, which was effected on September 20, 2017. The reverse split combined each seven shares of our outstanding common stock into one share of common stock and correspondingly adjusted the exercise prices of our common stock purchase warrants and options and conversion price of our convertible debt. No fractional shares were issued in connection with the reverse split, and any fractional shares resulting from the reverse split were rounded down to the nearest whole share. All references to common stock, common stock purchase warrants, restricted stock, share data, per share data and related information have been retroactively adjusted, where applicable, in this Offering Circular to reflect the reverse split of our common stock (and the corresponding adjustment of the exercise prices of our common stock purchase warrants) as if it had occurred at the beginning of the earliest period presented. As a result of the reverse stock split, the number of shares of common stock issued and outstanding decreased from 71,591,120 shares as of September 20, 2017, to approximately 10,184,445 shares. In connection with the reverse stock split, we filed Certificate of Amendment to our Articles of Incorporation to effect the reverse stock split with the Secretary of State of California on September 20, 2017.

| 14 |

Adoption of Muscle Maker, Inc 2017 Stock Option and Stock Issuance Plan

Our board of directors and shareholders adopted and approved on July 27, 2017 and September 21, 2017, respectively, the Muscle Maker, Inc 2017 Stock Option and Stock Issuance Plan, effective September 21, 2017, under which stock options and restricted stock may be granted to officers, directors, employees and consultants. Under the Plan, 1,071,428 shares (10,000,000 pre-reverse split shares) of Common Stock, no par value per share, are reserved for issuance.

Grant of Shares of Restricted Common Stock to Directors under Plan

On September 21, 2017, Muscle Maker granted 5,356 shares (post-reverse stock split) of common stock under its Muscle Maker 2017 Stock Option and Stock Issuance Plan to each of its six directors of Muscle Maker (32,142 shares of common stock in the aggregate) at a value of $9.33 per share. Such share grants are subject to graduated vesting in the following installments on each of the following dates: (i) 66.666% as of the date of grant and (ii) 8.333% as of (a) October 1, 2017, (b) November 1, 2017, (c) December 1, 2017, and (d) January 1, 2018.

Additional Unrelated Party Loans for Convertible Notes

During the period from October 3, 2017 to January 4, 2018, Muscle Maker issued convertible notes, as amended and extended on or about January 29, 2018, which are automatically convertible into common stock at a price per share of $1.625 (50% of initial public offering price) upon the earlier of the closing of this Offering or maturity date of the notes, which are six months following the date of extension of the convertible notes, and bear no interest to the following unrelated parties:

(a) Anthony Ferrara for a loan of $129,000;

(b) Michael D. Reysack for a loan of $50,000;

(c) Allen E. Style, Jr. for a loan of $100,000;

(d) Todd Petersen for a loan of $25,000;

(e) IRA Resources, Inc. for a loan of $90,000;

(f) Saca Ventures, LLC for a loan of $100,000;

(g) John Samsel, Jr. for a loan of $61,500;

(h) Stephanie Bosh for a loan of $2,500;

(i) Stephanie Love for a loan of $3,000;

(j) Jay Jamshasb for a loan of $21,000;

(k) Boldin Rice for a loan of $20,000;

(l) Ronald F. Bratek for a loan of $10,000;

(m) Jesse Roe, IV for a loan of $10,000;

(n) Paul B. Switzer for a loan of $10,000;

(o) Paul W. Switzer for a loan of $15,000;

(p) Douglas Bunkers for a loan of $10,000;

(q) Ronald Mauch for a loan of $10,000;

(r) Arvind Shrestha for a loan of $10,000;

(s) Robert Ingenthron for a loan of $14,800;

(t) Steve Bierman for a loan of $25,000; and

(u) Richard A. Carieri for a loan of $100,000.

Unrelated Party Loans for Notes (Non-Convertible)

During the period from November 17, 2017 to January 4, 2018, Muscle Maker issued notes, as amended and extended on or about January 29, 2018, with a stated interest rate of 10% over the original 60-day term and become due and payable along with the principal amount upon the earlier of the closing of the Offering or six months following the date of the extension of the notes, to the following unrelated parties:

(a) Kevin Mohan for a loan of $100,000;

(b) David Frawley for a loan of $150,000;

(c) Shawn Holmes for a loan of $50,000; and

(c) Robert Mohan for a loan of $25,000.

Related Party Loans for Notes (Non-Convertible)

During the period from November 17, 2017 to December 8, 2017, Muscle Maker issued notes, as amended and extended on or about January 29, 2018, with a stated interest rate of 10% over the original 60-day term and become due and payable along with the principal amount upon the earlier of the closing of the Offering or six months following the date of the extension of the notes, to the following related parties:

(a) John Feeney for a loan of $25,000;

(b) Robert Morgan for a loan of $35,000 and a one-time reimbursement of $1,750;

(c) Rod Silva for a loan of $25,000 and a one-time reimbursement of $1,250;

(d) Paul L Menchik for a loan of $50,000; and

(e) A.B. Southall for a loan of $100,000.

| 15 |

Related Party Loan for Convertible Note

On January 24, 2018, Muscle Maker issued a $100,000 convertible note to John Marques, as amended and extended on or about January 29, 2018, with a stated interest rate of 10% per the original 60-day-term, convertible at the option of the holder into common stock at a price per share of $1.625 (50% of initial public offering price), and, if not converted, will become due and payable along with the principal amount upon the earlier of the closing of the Offering or six months following the date of the extension of the note.

Unrelated Party Loan for Non-Convertible Note

On January 24, 2018, Muscle Maker entered into a promissory note with Catalytic Capital LLC, an unrelated third party, in the principal amount of $511,765 with a maturity date of March 30, 2018. The note was issued with a 15% original issue discount of which Muscle Maker received cash proceeds of $435,000. In connection with the promissory note, Muscle Maker issued a three-year warrant for the purchase of an aggregate of 78,733 shares of the Muscle Maker’s common stock with an exercise price per share of $1.625 (50% of initial public offering price), which constitutes 50% warrant coverage ($511,764.71/$3.25 = 157,466 shares x 50% = 78,333 shares). The warrant contains a cashless exercise provision and piggyback registration rights as to the common stock underlying the warrants subsequent to the filing and effectiveness of the Form 8-A with the SEC following the closing of this Offering. If any Event of Default (as defined in the note), the principal amount of the note is to be increased by 30% of the original principal amount (which is $153,529, increasing the total principal amount from $511,765 to $665,294) and another three-year warrant for the purchase of an additional 78,333 shares of Muscle Maker’s common stock with an exercise price per share of $1.625 (50% of initial public offering price), which together with the original warrant would constitute 100% warrant coverage ($511,764.71/$3.25 = 157,466 shares).

Unrelated Party Loan for Convertible Note

On January 25, 2018, Muscle Maker issued a $50,000 convertible note to Mary J. Floyd, as amended and extended on or about January 29, 2018, with a stated interest rate of 10% per the original 60-day-term, convertible at the option of the holder into common stock at a price per share of $1.625 (50% of initial public offering price), and, if not converted, will become due and payable along with the principal amount upon the earlier of the closing of the Offering or six months following the date of the extension of the note.

Resignation of Chief Financial Officer

On January 17, 2018, Grady Metoyer resigned as our Chief Financial Officer, effective immediately. There was no disagreement between Muscle Maker and Mr. Metoyer on any matter that caused his resignation.

Appointment of Vice President of Finance and Employment Agreement