As filed with the Securities and Exchange Commission on November 9, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Vantiv, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

7389 (Primary Standard Industrial Classification Code Number) |

26-4532998 (I.R.S. Employer Identification Number) |

8500 Governor's Hill Drive

Symmes Township, Ohio 45249

(513) 900-5250

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Nelson F. Greene, Esq.

Chief Legal Officer and Secretary

8500 Governor's Hill Drive

Symmes Township, Ohio 45249

(513) 900-5250

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

| Copies to: | ||

Alexander D. Lynch, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 (Phone) (212) 310-8007 (Fax) |

Richard J. Sandler, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 (Phone) (212) 701-5224 (Fax) |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

| Class A common stock, $0.01 par value per share | $100,000,000 | $11,460 | ||

- (1)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(o) promulgated under the Securities Act.

- (2)

- Includes shares of Class A common stock that may be issuable upon exercise of an option to purchase additional shares granted to the underwriters.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to Completion, dated November 9, 2011

Shares

![]()

Class A Common Stock

This is an initial public offering of shares of Class A common stock of Vantiv, Inc. Vantiv, Inc. is selling shares of Class A common stock and the selling stockholders named in this prospectus are selling a total of shares of Class A common stock. Vantiv, Inc. will not receive any proceeds from the sale of Class A shares to be offered by the selling stockholders.

Prior to this offering, there has been no public market for the Class A common stock. It is currently estimated that the initial public offering price per share of our Class A common stock will be between $ and $ . After pricing the offering, we expect the Class A common stock will be listed on the New York Stock Exchange or NASDAQ Global Market under the symbol " ".

Investing in our Class A common stock involves a high degree of risk. See "Risk Factors" beginning on page 17.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Initial public offering price |

$ | $ | |||||

Underwriting discounts and commissions |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

Proceeds, before expenses, to the selling stockholders |

$ | $ | |||||

We have granted the underwriters an option, for a period of 30 days from the date of this prospectus, to purchase up to additional shares of our Class A common stock to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Vantiv, Inc.'s Class A common stock to investors on or about , 2012.

| J.P. Morgan | Morgan Stanley | Credit Suisse |

| Goldman, Sachs & Co. | Deutsche Bank Securities |

| Citigroup | UBS Investment Bank | Jefferies |

| Raymond James | William Blair & Company | Wells Fargo Securities |

, 2012

Neither we, the selling stockholders, nor the underwriters (or any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, the selling stockholders nor the underwriters (or any of our or their respective affiliates) take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, the selling stockholders are not and the underwriters (or any of our or their respective affiliates) are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is only accurate as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

"VANTIV", "NPC", "NATIONAL PROCESSING COMPANY" and "JEANIE" and their respective logos are our trademarks. Solely for convenience, we refer to our trademarks in this prospectus without the ™ and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners. As indicated in this prospectus, we have included market data and industry forecasts that were obtained from industry publications and other sources.

Until , 2012 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ii

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider. Therefore, you should also read the more detailed information set out in this prospectus, including the risk factors, the financial statements and related notes thereto, and the other documents to which this prospectus refers before making an investment decision. Unless otherwise stated in this prospectus, or as the context otherwise requires, references to "Vantiv," "we," "us" or "our company" refer to Vantiv, Inc. and its subsidiaries.

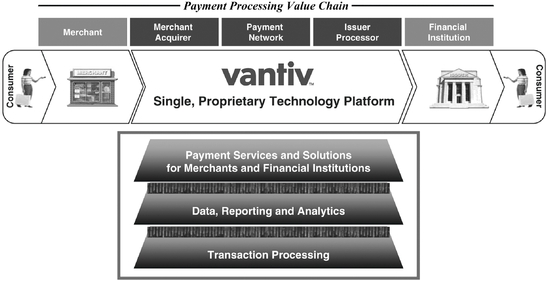

Vantiv is a leading, integrated payment processor differentiated by a single, proprietary technology platform. We are the third largest merchant acquirer and the largest PIN debit acquirer by transaction volume in the United States. We efficiently provide a suite of comprehensive services to merchants and financial institutions of all sizes. Our technology platform offers our clients a single point of service that is easy to connect to and use in order to access a broad range of payment services and solutions. Our integrated business and single platform also enable us to innovate, develop and deploy new services and provide us with significant economies of scale. Our varied and broad distribution provides us with a large and diverse client base and channel partner relationships. We believe this combination of attributes provides us with competitive advantages and has enabled us to generate strong growth and profitability.

Our single, proprietary technology platform is differentiated from our competitors' multiple platform architectures. Because of our single point of service and ability to collect, manage and analyze data across the payment processing value chain, we can identify and develop new services more efficiently. Once developed, we can more cost-effectively deploy new solutions to our clients through our single platform. Our single scalable platform also enables us to efficiently manage, update and maintain our technology, increase capacity and speed and realize significant operating leverage.

We offer a broad suite of payment processing services that enable our clients to meet their payment processing needs through a single provider. We enable merchants of all sizes to accept and process credit, debit and prepaid payments and provide them supporting services, such as information solutions, interchange management and fraud management, as well as vertical-specific solutions in sectors such as grocery, pharmacy, retail, petroleum and restaurants, including, quick service restaurants, or QSRs. We also provide mission critical payment services to financial institutions, such as card issuer processing, payment network processing, fraud protection, card production, prepaid program management, ATM driving and network gateway and switching services that utilize our proprietary Jeanie PIN debit payment network.

We provide small and mid-sized clients with the comprehensive solutions that we have developed to meet the extensive requirements of our large merchant and financial institution clients. We then tailor these solutions to the unique needs of our small and mid-sized clients. In addition, we take a consultative approach to providing services that help our clients enhance their payments-related services. We are also well positioned to provide payment solutions for high growth markets, such as prepaid, ecommerce and mobile payment offerings, because we process payment transactions across the entire payment processing value chain on a single platform.

We distribute our services through direct and indirect distribution channels using a unified sales approach that enables us to efficiently and effectively target merchants and financial institutions of all sizes. Our direct channel includes a national sales force that targets financial institutions and national merchants, regional and mid-market sales teams that sell solutions to merchants and third-party reseller clients and a telesales operation that targets small and mid-sized merchants. Our indirect channel to merchants includes relationships with a broad range of independent sales organizations, or ISOs, merchant banks, value-added resellers and trade associations that target merchants, including difficult

1

to reach small and mid-sized merchants. Our indirect channel to financial institutions includes relationships with third-party resellers and core processors.

We have a broad and diversified merchant and financial institution client base. Our merchant client base has low client concentration and is heavily weighted in non-discretionary everyday spend categories, such as grocery and pharmacy, and includes large national retailers, including nine of the top 25 national retailers by revenue in 2010, and over 200,000 small and mid-sized merchant locations. Our financial institution client base is also well diversified and includes over 1,300 financial institutions.

We generate revenues based primarily on transaction fees paid by merchants or financial institutions. Our revenue increased from $884.9 million for the year ended December 31, 2008 to $1.2 billion for the year ended December 31, 2010. Our revenue, less network fees and other costs, which we refer to as net revenue, increased from $451.4 million for the year ended December 31, 2008 to $566.1 million for the year ended December 31, 2010. Our net income decreased from $152.6 million for the year ended December 31, 2008 to $54.9 million for the year ended December 31, 2010. Our adjusted EBITDA increased from $278.7 million for the year ended December 31, 2008 to $400.5 million for the year ended December 31, 2010.

Our History and Separation from Fifth Third Bank

We have a 40 year history of providing payment processing services. We operated as a business unit of Fifth Third Bank until June 2009 when certain funds managed by Advent International Corporation acquired a majority interest in Fifth Third Bank's payment processing business unit with the goal of creating a separate stand-alone company. Since the separation, we established our own organization, headquarters, brand and growth strategy. As a stand-alone company, we have made substantial investments to enhance our single, proprietary technology platform, recruit additional executives with significant payment processing and operating experience, expand our sales force, reorganize our business to better align it with our market opportunities and broaden our geographic footprint beyond the markets traditionally served by Fifth Third Bank and its affiliates. In addition, we made three strategic acquisitions in 2010. We acquired NPC Group, Inc., or NPC, to substantially enhance our access to small to mid-sized merchants, certain assets of Town North Bank, N.A., or TNB, to broaden our market position with credit unions, and certain assets of Springbok Services Inc., or Springbok, to expand our prepaid processing capabilities.

Industry Background

Electronic payments is a large and growing market, and according to The Nilson Report, personal consumption expenditures in the United States using cards and other electronic payments reached $4.48 trillion in 2009 and are projected to reach $7.23 trillion in 2015, representing a compound annual growth rate of approximately 8% during that period. This growth will be driven by favorable secular trends, such as the shift from cash and checks towards card-based and other electronic payments due to their greater convenience, security, enhanced services and rewards and loyalty features.

Payment processors help merchants and financial institutions develop and offer electronic payment solutions to their customers, facilitate the routing and processing of electronic payment transactions and manage a range of supporting security, value-added and back office services. In addition, many large

2

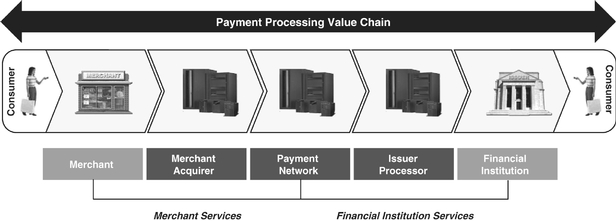

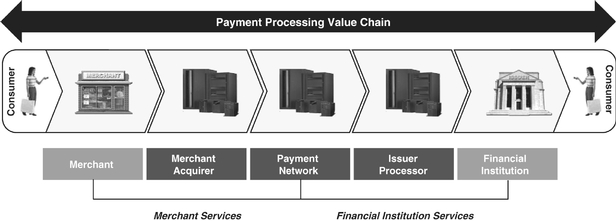

banks manage and process their card accounts in-house. This is collectively referred to as the payment processing value chain and is illustrated below:

Many payment processors specialize in providing services in discrete areas of the payment processing value chain, such as merchant acquiring, payment network or issuer processing services. A limited number of payment processors have capabilities or offer services in multiple parts of the payment processing value chain. Many processors that provide solutions targeting more than one part of the payment processing value chain utilize multiple, disparate technology platforms requiring their clients to access payment processing services through multiple points of contact.

The payment processing industry will continue to adopt new technologies, develop new products and services, evolve new business models and experience new market entrants and changes in the regulatory environment. In the near-term, we believe merchants and financial institutions will seek services that help them enhance their own offerings to consumers, provide additional information solution services to help them run their businesses more efficiently and develop new products and services that provide tangible, incremental revenue streams. Over the medium to longer-term, we believe that emerging, alternative payment technologies, such as mobile payments, electronic wallets, mobile marketing offers and incentives and rewards services, will be adopted by merchants and other businesses and represent an attractive growth opportunity for the industry.

Our Competitive Strengths

Single, Proprietary Technology Platform

We have a single, proprietary technology platform that provides our clients with differentiated payment processing solutions and provides us with significant strategic and operational benefits. Our clients access our processing solutions through a single point of access and service, which is easy to use and enables our clients to acquire additional services as their business needs evolve. Our platform also allows us to collect, manage and analyze data that we can then package into information solutions for our clients. It also provides insight into market trends and opportunities as they emerge, which enhances our ability to innovate and develop new value-added services. Our single platform allows us to more easily deploy new solutions that span the payment processing value chain, such as prepaid, ecommerce and mobile, which are high growth market opportunities. Since we operate one scalable technology platform, we are able to efficiently manage, update and maintain our technology and increase capacity and speed, which provide significant operating leverage.

Integrated Business

We operate as a single integrated business using a unified sales and product development approach. Our integrated business and established client relationships across the payment processing

3

value chain enhance our ability to cross-sell our services, develop new payment processing services and deliver substantial value to our clients. By operating as a single business, we believe we can manage our business more efficiently resulting in increased profitability. Our integrated business differentiates us from payment processors that are focused on discrete areas of the payment processing value chain or that operate multiple payment processing businesses.

Comprehensive Suite of Services

We offer a broad suite of payment processing services that enable our merchant and financial institution clients to address their payment processing needs through a single provider. Our solutions include traditional processing services as well as a range of innovative value-added services. We provide small and mid-sized clients with the comprehensive solutions originally developed for our large clients that we have adapted to meet the specific needs of our small and mid-sized clients. We have developed industry specific solutions with features and functionality to meet the specific requirements of various industry verticals, market segments and client types.

Diverse Distribution Channels

We sell our services to merchants, financial institutions and third-party reseller clients of all types and sizes through diverse distribution channels, which has resulted in low client concentration. Our direct channel includes a national sales force that targets financial institutions and national retailers, regional and mid-market sales teams that sell solutions to merchants and third-party reseller clients and a telesales operation that targets small and mid-sized merchants. Our indirect channel includes relationships with a broad range of ISOs, merchant banks, value-added resellers and trade associations that target merchants, including difficult to reach small and mid-sized merchants, as well as arrangements with core processors that sell our solutions to small and mid-sized financial institutions.

Strong Execution Capabilities

Our management team has significant experience in the payment processing industry and has demonstrated strong execution capabilities. Since we created a stand-alone company in 2009, we have invested substantial resources to enhance our technology platform, deepened our management organization, expanded our sales force, completed three acquisitions, introduced several new services, launched the Vantiv brand and built out and moved into our new corporate headquarters. We executed all of these projects while delivering substantial revenue growth and strong profitability.

Our Strategy

Increase Small to Mid-Sized Client Base

We are focused on increasing our small to mid-sized client base to capitalize on the growth and margin opportunities provided by smaller merchants and financial institutions, which outsource all or a significant portion of their payment processing requirements and are generally more profitable on a per transaction basis. We plan to continue to identify and reach these small to mid-sized merchants and financial institutions through our direct sales force, ISOs, partnership and referral arrangements and third-party resellers and core processors.

Develop New Services

We seek to develop additional payment processing services that address evolving client demands and provide additional cross-selling opportunities by leveraging our single technology platform, industry knowledge and client relationships across the payment processing value chain. For example, we intend to expand our prepaid card services and customized fraud management services and introduce data-rich

4

information solutions to provide our merchant and financial institution clients with new opportunities to generate incremental revenue or lower their costs.

Expand Into High Growth Segments and Verticals

We believe there is a substantial opportunity for us to expand further into high growth payment segments, such as prepaid, ecommerce, mobile and information solutions, and attractive industry verticals, such as business-to-business, healthcare, government and education. We intend to further develop our technology capabilities to handle specific processing requirements for these segments and verticals, add new services that address their needs and broaden our distribution channels to reach these potential clients.

Broaden and Deepen Our Distribution Channels

We intend to broaden and deepen our direct and indirect distribution channels to reach potential clients and sell new services to our existing clients. We plan to grow our direct sales force, including telesales, add new referral partners, such as merchant banks, and grow our indirect channels through new ISOs, partnership and referral arrangements, third-party resellers and core processors. We will also continue to develop additional support services for our distribution channels, provide sales and product incentives and increase our business development resources dedicated to growing and promoting our distribution channels.

Enter New Geographic Markets

When we operated as a business unit of Fifth Third Bank we had a strong market position with large national merchants, and we focused on serving small to mid-sized merchants in Fifth Third Bank's core market in the Midwestern United States. We are expanding our direct and indirect distribution channels and leveraging our technology platform to target additional regions. In the future, we will also look to augment our U.S. business by selectively expanding into international markets through strategic partnerships or acquisitions that enhance our distribution channels, client base and service capabilities.

Pursue Acquisitions

We have recently completed three acquisitions, and we intend to continue to seek acquisitions that provide attractive opportunities to increase our small to mid-sized client base, enhance our service offerings, target high growth payment segments and verticals, enter into new geographic markets and enhance and deepen our distribution channels. We also will consider acquisitions of discrete merchant portfolios that we believe would enhance our scale and client base and strengthen our market position in the payment processing industry.

Risks Affecting Our Business

Investing in our Class A common stock involves substantial risk. Before participating in this offering, you should carefully consider all of the information in this prospectus, including risks discussed in "Risk Factors" beginning on page 17. Some of our most significant risks are:

- •

- If we cannot keep pace with rapid developments and change in our industry and provide new services to our clients, the use

of our services could decline, reducing our revenues.

- •

- The payment processing industry is highly competitive, and we compete with certain firms that are larger and that have greater financial resources. Such competition could adversely affect the transaction and other fees we receive from merchants and financial institutions.

5

- •

- Unauthorized disclosure of data, whether through cybersecurity breaches, computer viruses or otherwise, could expose us to

liability, protracted and costly litigation and damage our reputation.

- •

- Our systems and our third party providers' systems may fail due to factors beyond our control, which could interrupt our

service, cause us to lose business and increase our costs.

- •

- Any acquisitions, partnerships or joint ventures that we make could disrupt our business and harm our financial condition.

- •

- If we fail to comply with the applicable requirements of the Visa, MasterCard or other payment networks, those payment

networks could seek to fine us, suspend us or terminate our registrations through our financial institution sponsors.

- •

- We rely on financial institution sponsors, which have substantial discretion with respect to certain elements of our

business practices, and financial institution clearing service providers, in order to process electronic payment transactions. If these sponsorships or clearing services are terminated and we are

unable to secure new bank sponsors or financial institutions, we will not be able to conduct our business.

- •

- If Fifth Third Bank fails or is acquired by a third party, it could place certain of our material contracts at risk,

decrease our revenue, and would transfer the ultimate voting power of a significant amount of our common stock to a third party.

- •

- We are subject to extensive government regulation, and any new laws and regulations, industry standards or revisions made

to existing laws, regulations, or industry standards affecting the electronic payments industry and other industries in which we operate may have an unfavorable impact on our business, financial

condition and results of operations.

- •

- Because we are deemed to be controlled by Fifth Third Bank and Fifth Third Bancorp for purposes of federal and state

banking laws, we are subject to supervision and examination by federal and state banking regulators, and our activities are limited to those permissible for Fifth Third Bank and Fifth Third Bancorp.

We may therefore be restricted from engaging in new activities or businesses, whether organically or by acquisition. We are also subject to supervision and examination by the new federal Consumer

Financial Protection Bureau.

- •

- We may not be able to successfully manage our intellectual property and may be subject to infringement claims.

- •

- We have a limited operating history as a stand-alone company upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any newly stand-alone company encounters. Furthermore, we maintain many relationships with our former parent entity, Fifth Third Bank.

Organizational Structure

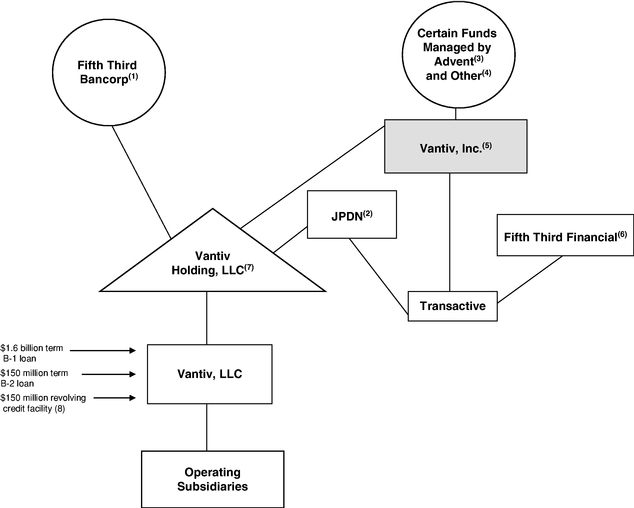

Prior to the completion of this offering, we will effect the reorganization transactions described in "Organizational Structure." We are a holding company, and our principal assets are equity interests in Vantiv Holding, LLC, or Vantiv Holding, and Transactive Ecommerce Solutions Inc., or Transactive. As the majority unitholder of Vantiv Holding and the majority stockholder of Transactive, we will operate and control the business and affairs of Vantiv Holding and Transactive. Our control will be subject to the terms of a stockholders' agreement, or the Vantiv, Inc. Stockholders' Agreement, and the Amended and Restated Vantiv Holding Limited Liability Company Agreement, each of which includes supermajority voting or consent requirements for specified matters. See "Description of Capital Stock—Vantiv Holding" and "Certain Relationships and Related Party Transactions—Reorganization and Offering Transactions—Vantiv, Inc. Stockholders' Agreement." Through Vantiv Holding, Transactive

6

and their respective operating subsidiaries, we will continue to conduct the business conducted by the operating entities included in our historical financial statements. We will conduct all of our domestic operations through Vantiv Holding and its subsidiaries. The units of Vantiv Holding held by the Fifth Third Bank or its affiliates and the shares of Transactive held by Fifth Third Financial Corporation, or Fifth Third Financial, are treated as a non-controlling interest in our financial statements. The diagram below depicts our organizational structure immediately following this offering:

Principal Stockholders

Our principal equity holders are (i) funds managed by Advent International Corporation, which we refer to as Advent, which hold our Class A common stock and (ii) Fifth Third Bank and its subsidiary, FTPS Partners, LLC, which we refer to, together with their affiliates, as the Fifth Third investors, which after the reorganization transactions will hold our Class B common stock as well as Class B units of Vantiv Holding. References in this prospectus to our "existing investors" are to Advent, the Fifth Third investors and JPDN Enterprises, LLC, an affiliate of Charles D. Drucker, our chief executive officer, or JPDN.

Advent

Since 1984, Advent has raised $26 billion in private equity capital and completed over 270 transactions valued at more than $60 billion in 35 countries. Advent's current portfolio is comprised of investments in 54 companies across five sectors—Retail, Consumer & Leisure; Financial and Business Services; Industrial; Technology, Media & Telecoms; and Healthcare. The Advent team includes more than 170 investment professionals in 18 offices around the world.

7

Fifth Third Bancorp and Fifth Third Bank

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. Fifth Third Bank is an Ohio banking corporation and a wholly-owned indirect subsidiary of Fifth Third Bancorp. As of September 30, 2011, Fifth Third Bancorp had $115 billion in assets and operated 15 affiliates with 1,314 full-service Banking Centers, including 103 Bank Mart locations open seven days a week inside select grocery stores and 2,437 ATMs in 12 states throughout the Midwestern and Southern regions of the United States. Fifth Third Bancorp operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Investment Advisors. Fifth Third Bancorp's common stock is traded on the NASDAQ National Global Select Market under the symbol "FITB."

Additional Information

We are a Delaware corporation. We were incorporated as Advent-Kong Blocker Corp. on March 25, 2009 and changed our name to Vantiv, Inc. on November 8, 2011. Our principal executive offices are located at 8500 Governor's Hill Drive, Symmes Township, Cincinnati, Ohio 45249. Our telephone number at our principal executive offices is (513) 900-5250. Our corporate website is www.vantiv.com. The information that appears on our website is not part of, and is not incorporated into, this prospectus.

8

Common stock offered by us |

shares of Class A common stock. | |

Common stock offered by the selling stockholders |

shares of Class A common stock. |

|

Total offering |

shares of Class A common stock. |

|

Class A common stock to be outstanding after this offering |

shares of Class A common stock ( shares if the underwriters' option to purchase additional shares is exercised in full). |

|

Class B common stock to be outstanding after this offering |

shares of Class B common stock. The Fifth Third investors will receive one share of our Class B common stock for each Class B unit of Vantiv Holding that they hold upon the consummation of the reorganization transactions, this offering and the repurchase of the Class B units by Vantiv Holding with the proceeds from the offering at a purchase price equal to the public offering price less the underwriting discounts and commissions, as described in "Use of Proceeds." The Class B common stock has no economic rights, but will provide the Fifth Third investors with the voting rights in Vantiv, Inc. as described below. |

|

Option to purchase additional |

The underwriters have an option to purchase a maximum of additional shares of Class A common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

|

Conflicts of interest |

We expect to use more than 5% of the net proceeds from the sale of the Class A common stock to repay indebtedness under our senior secured credit facilities (see "Description of Certain Indebtedness") owed by us to certain affiliates of the underwriters. Accordingly, the offering is being made in compliance with the requirements of Rule 5121 of the Financial Industry Regulatory Authority's Conduct Rules. This rule provides generally that if more than 5% of the net proceeds from the sale of securities, not including underwriting compensation, is paid to the underwriters or their affiliates, the initial public offering price of the Class A common stock may not be higher than that recommended by a "qualified independent underwriter" meeting certain standards. Deutsche Bank Securities Inc. is assuming the responsibilities of acting as the qualified independent underwriter in conducting due diligence. See "Underwriting—Conflicts of Interest." |

9

Use of proceeds |

We estimate that the net proceeds to us from our sale of shares of Class A common stock in this offering will be approximately $ million, after deducting underwriting discounts and commissions and estimated expenses payable by us in connection with this offering. This assumes a public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus. We intend to contribute $ of the net proceeds to Vantiv Holding and $ of the net proceeds to Transactive. Vantiv Holding intends to use a portion of net proceeds to repay $ principal amount of our senior secured credit facilities. Vantiv Holding also intends to use $ of such net proceeds to redeem Class B units from the Fifth Third investors at a purchase price equal to the public offering price less underwriting discounts and commissions. Transactive intends to use $ of such net proceeds to redeem shares of its Class B common stock from Fifth Third Financial at a purchase price equal to the public offering price less underwriting discounts and commissions. We will not receive any proceeds from the sale of shares of Class A common stock by the selling stockholders. See "Use of Proceeds." |

|

Dividend policy |

We do not anticipate paying any dividends on our common stock in the foreseeable future. See "Dividend Policy." |

|

Voting rights |

Each share of Class A stock will entitle the holder to one vote in all matters. |

|

|

The shares of our Class B common stock will entitle the holders of the Class B common stock collectively to hold up to 19.9% of the aggregate voting power of our outstanding common stock determined on a formulaic basis. To the extent that the Fifth Third investors hold more than 19.9% of the aggregate voting power of our outstanding common stock as a result of the ownership of both Class A and Class B common stock, the Fifth Third investors' voting power will be limited to 19.9%, other than in connection with a stockholder vote to approve a merger or other change of control of Vantiv, Inc., in which event the Fifth Third investors will have the right to that number of votes equal to the number of shares of Class A common stock they would own if they had converted all of their Class B units of Vantiv Holding. In addition (and except in connection with such change of control), to the extent that the Fifth Third investors otherwise hold Class A common stock and Class B common stock entitled to less than 19.9% of the voting power of the outstanding common stock, then the Fifth Third investors will be entitled only to such lesser voting power. |

10

|

Holders of our Class A and Class B common stock will vote together as a single class on all matters presented to our stockholders for their vote or approval, except that holders of our Class B stock, voting as a separate class, will be entitled to elect a number of our directors equal to the percentage of the voting power of all of our outstanding common stock represented by the holders of our Class B common stock but not exceeding 19.9% of the board of directors, except as otherwise required by applicable law. |

|

|

Immediately following this offering, our public stockholders will have % of the voting power in Vantiv, Inc., or % if the underwriters exercise in full their option to purchase additional shares. See "Description of Capital Stock." |

|

Risk factors |

Investing in our Class A common stock involves a high degree of risk. See "Risk Factors" beginning on page 17 of this prospectus for a discussion of factors you should carefully consider before investing in our Class A common stock. |

|

Proposed NYSE or Nasdaq symbol |

" ." |

Unless otherwise indicated, the number of shares of our Class A common stock to be outstanding after this offering:

- •

- includes shares of unrestricted Class A common stock

and shares of restricted

Class A common stock issuable upon the conversion or exercise of phantom equity units outstanding under the Vantiv Holding Management Phantom Equity Plan;

- •

- excludes an aggregate of additional shares of Class A common stock that will

initially be available

for future awards pursuant to our 2012 Vantiv, Inc. Equity Incentive Plan;

- •

- excludes shares of Class A common stock issuable upon

exercise of a warrant currently held by Fifth

Third Bank or any conversion of Class B units of Vantiv Holding issuable upon exercise of such warrant;

- •

- excludes shares of Class A common stock issuable upon

the exchange of Class B units of

Vantiv Holding for Class A common stock;

- •

- gives effect to a for 1 stock split of our Class A common stock prior to the consummation

of this

offering;

- •

- gives effect to our amended and restated certificate of incorporation, which will be in effect prior to the consummation

of this offering; and

- •

- assumes no exercise of the underwriters' option to purchase up to additional shares of our Class A common stock from us.

Unless otherwise indicated, this prospectus assumes an initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus.

11

SUMMARY HISTORICAL FINANCIAL AND OTHER DATA

The period prior to and including June 30, 2009, the date of the separation transaction, is referred to in the following table as "Predecessor," and all periods after such date are referred to in the following table as "Successor." Prior to the separation transaction, we operated as a business unit of Fifth Third Bank. As a result, the financial data for the predecessor period included in this prospectus does not necessarily reflect what our financial position or results of operations would have been had we operated as a separate, stand-alone entity during those periods. The financial statements for all successor periods are not comparable to those of the predecessor periods.

The following table sets forth our summary historical financial and other data for the periods and as of the dates indicated. We derived the statement of income data for the six months ended June 30, 2011 and 2010 and the balance sheet data as of June 30, 2011 from our unaudited financial statements included elsewhere in this prospectus. We derived the statement of income data for the year ended December 31, 2010, the non-GAAP combined year ended December 31, 2009 and the year ended December 31, 2008 from our audited financial statements for such periods included elsewhere in this prospectus. Results for the year ended December 31, 2009 are presented on a non-GAAP combined basis containing the predecessor period of January 1 to June 30, 2009 combined with the successor period of July 1 to December 31, 2009 to enable a comparison with 2008 and 2010 on a full year basis. There were no other adjustments made to these non-GAAP combined results. The non-GAAP combined results do not purport to reflect the results that would have been obtained had the separation transaction occurred on January 1, 2009.

We have prepared the unaudited financial information set forth below on the same basis as our audited financial statements and have included all adjustments, consisting of only normal recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for such periods. The results for any interim period are not necessarily indicative of the results that may be expected for a full year.

The summary unaudited pro forma as adjusted balance sheet data as of June 30, 2011 has been prepared to give pro forma effect to (i) the reorganization transactions described in "Organizational Structure" and (ii) the sale of our Class A common stock in this offering and the application of the net proceeds from this offering as described in "Use of Proceeds."

Our historical results are not necessarily indicative of future operating results. You should read the information set forth below in conjunction with "Selected Historical Financial Data," "Unaudited Pro Forma Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and the related notes thereto included elsewhere in this prospectus.

12

| |

Successor | Non-GAAP Combined Year Ended December 31, 2009(1) |

Predecessor | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Six Months Ended June 30, 2011 |

Six Months Ended June 30, 2010 |

Year Ended December 31, 2010 |

Year Ended December 31, 2008 |

|||||||||||||

| |

(in thousands, except share data) |

||||||||||||||||

Statement of income data: |

|||||||||||||||||

Revenue |

$ | 774,010 | $ | 511,235 | $ | 1,162,132 | $ | 950,726 | $ | 884,918 | |||||||

Network fees and other costs |

367,910 | 265,345 | 595,995 | 476,605 | 433,496 | ||||||||||||

Net revenue |

406,100 | 245,890 | 566,137 | 474,121 | 451,422 | ||||||||||||

Sales and marketing |

115,789 | 36,822 | 98,418 | 70,047 | 71,247 | ||||||||||||

Other operating costs |

72,720 | 54,509 | 124,383 | 48,275 | — | ||||||||||||

General and administrative |

49,607 | 26,005 | 58,091 | 46,526 | 8,747 | ||||||||||||

Depreciation and amortization |

75,701 | 50,825 | 110,964 | 52,241 | 2,250 | ||||||||||||

Allocated expenses |

— | — | — | 52,980 | 114,892 | ||||||||||||

Income from operations |

92,283 | 77,729 | 174,281 | 204,052 | 254,286 | ||||||||||||

Interest expense—net |

(59,573 | ) | (57,691 | ) | (116,020 | ) | (68,657 | ) | — | ||||||||

Non-operating expenses |

(13,799 | ) | (3,000 | ) | (4,300 | ) | (9,227 | ) | (5,635 | ) | |||||||

Income before applicable income taxes |

18,911 | 17,038 | 53,961 | 126,168 | 248,651 | ||||||||||||

Income tax expense (benefit) |

2,551 | 3,269 | (956 | ) | 36,700 | 96,049 | |||||||||||

Net income |

16,360 | 13,769 | 54,917 | $ | 89,468 | $ | 152,602 | ||||||||||

Less: net income attributable to non-controlling interests |

(7,481 | ) | (9,173 | ) | (32,924 | ) | |||||||||||

Net income attributable to Vantiv, Inc. |

$ | 8,879 | $ | 4,596 | $ | 21,993 | |||||||||||

Pro forma net income per share(2): |

|||||||||||||||||

Basic |

|||||||||||||||||

Diluted |

|||||||||||||||||

Pro forma weighted average shares outstanding(2): |

|||||||||||||||||

Basic |

|||||||||||||||||

Diluted |

|||||||||||||||||

Other data: |

|||||||||||||||||

Adjusted EBITDA(3) |

$ | 197,007 | $ | 188,283 | $ | 400,503 | $ | 298,399 | $ | 278,668 | |||||||

Transactions (in millions): |

|||||||||||||||||

Merchant Services |

4,522 | 3,876 | 8,206 | 7,250 | 6,493 | ||||||||||||

Financial Institution Services |

1,702 | 1,436 | 3,060 | 2,628 | 2,369 | ||||||||||||

| |

As of June 30, 2011 | ||||

|---|---|---|---|---|---|

| |

Actual | Pro Forma As Adjusted(4) |

|||

Balance sheet data: |

|||||

Cash and cash equivalents |

$ | 255,831 | |||

Total assets |

3,335,882 | ||||

Total long-term liabilities |

1,759,452 | ||||

Non-controlling interests |

599,213 | ||||

Total equity |

1,201,772 | ||||

- (1)

- Results for the year ended December 31, 2009 are presented on a non-GAAP combined basis containing the predecessor period in 2009 combined with the successor period in 2009 to enable a comparison with 2008 and 2010 on a full year basis. There were no other adjustments made to these non-GAAP combined results. The non-GAAP combined results do not purport to reflect the results that would have been obtained had the separation transaction occurred on January 1, 2009. For more detail on the non-GAAP combined results for 2009, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations."

13

- (2)

- Pro

forma information gives effect to the reorganization transactions as more fully described in "Organizational Structure."

- (3)

- Adjusted

EBITDA is calculated as net income before interest expense—net, income tax (benefit) expense and depreciation and amortization adjusted

for:

- •

- transition costs related to our separation transaction from Fifth Third Bank;

- •

- debt refinancing costs;

- •

- share-based compensation expense;

- •

- acquisition and integration costs incurred in connection with our acquisitions;

- •

- changes in the fair value of the put rights Vantiv, Inc. received in connection with the separation transaction;

- •

- transaction costs incurred in connection with the separation transaction; and

- •

- NPC's EBITDA for the six months ended June 30, 2010 and the period January 1, 2010 through the acquisition date of November 3, 2010.

- •

- as a measurement used in comparing our operating performance on a consistent basis;

- •

- to calculate incentive compensation for our employees;

- •

- for planning purposes, including the preparation of our internal annual operating budget;

- •

- to evaluate the performance and effectiveness of our operational strategies; and

- •

- to assess compliance with various metrics associated with our debt agreements.

- •

- adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest

or principal payments, on our debt;

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may

have to be replaced in the future, and adjusted EBITDA does not reflect the cash requirements for such replacements;

- •

- adjusted EBITDA does not reflect our tax expense or the cash requirements to pay our taxes; and

Adjusted EBITDA eliminates the effects of items that we do not consider indicative of our core operating performance. Adjusted EBITDA is a supplemental measure of operating performance that does not represent and should not be considered as an alternative to net income, as determined by U.S. generally accepted accounting principles, or GAAP, and our calculation of adjusted EBITDA may not be comparable to that reported by other companies.

Management believes the inclusion of the adjustments to adjusted EBITDA are appropriate to provide additional information to investors about certain material non-cash items and about unusual items that we do not expect to continue at the same level in the future. By providing this non-GAAP financial measure, together with a reconciliation to GAAP results, we believe we are enhancing investors' understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing strategic initiatives. We believe adjusted EBITDA is used by investors as a supplemental measure to evaluate the overall operating performance of companies in our industry.

Management uses adjusted EBITDA or comparable metrics:

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of the limitations are:

14

- •

- adjusted EBITDA does not reflect the non-cash component of employee compensation.

To address these limitations, we reconcile adjusted EBITDA to the most directly comparable GAAP measure, net income. Further, we also review GAAP measures and evaluate individual measures that are not included in adjusted EBITDA.

In calculating adjusted EBITDA, we exclude costs associated with our transition to a stand-alone company and our debt refinancing as these are non-recurring in nature. We believe it is useful to exclude share-based compensation expense from adjusted EBITDA because non-cash equity grants made at a certain price and point in time do not necessarily reflect how our business is performing at any particular time and share-based compensation expense is not a key measure of our core operating performance. We exclude acquisition and integration costs as they are non-recurring in nature and not indicative of our core operations. Adjustments related to our put rights reflect non-operational expenses associated with the change in the fair value of a financial instrument. We also adjust for NPC's EBITDA so that adjusted EBITDA for 2010 is comparable to future periods in which NPC's results are consolidated with our results.

The following table reconciles net income to adjusted EBITDA:

| |

Successor | Non-GAAP Combined Year Ended December 31, 2009 |

Predecessor | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Six Months Ended June 30, 2011 |

Six Months Ended June 30, 2010 |

Year Ended December 31, 2010 |

Year Ended December 31, 2008 |

||||||||||||

| |

(in thousands) |

|||||||||||||||

Net income |

$ | 16,360 | $ | 13,769 | $ | 54,917 | $ | 89,468 | $ | 152,602 | ||||||

Interest expense—net(a) |

59,573 | 57,691 | 116,020 | 68,784 | 5,635 | |||||||||||

Income tax expense (benefit) |

2,551 | 3,269 | (956 | ) | 36,700 | 96,049 | ||||||||||

Depreciation and amortization |

75,701 | 50,825 | 110,964 | 52,241 | 2,250 | |||||||||||

EBITDA |

154,185 | 125,554 | 280,945 | 247,193 | 256,536 | |||||||||||

Transition costs(b) |

27,128 | 21,181 | 44,519 | 24,059 | 18,213 | |||||||||||

Debt refinancing costs(c) |

13,699 | — | — | — | — | |||||||||||

Share-based compensation(d) |

1,393 | 1,188 | 2,799 | 1,723 | 3,919 | |||||||||||

Acquisition and integration costs(e) |

502 | 1,091 | 4,489 | — | — | |||||||||||

Losses related to put rights(f) |

100 | 3,000 | 4,300 | 9,100 | — | |||||||||||

Transaction costs(g) |

— | — | — | 16,324 | — | |||||||||||

NPC(h) |

— | 36,269 | 63,451 | — | — | |||||||||||

Adjusted EBITDA |

$ | 197,007 | $ | 188,283 | $ | 400,503 | $ | 298,399 | $ | 278,668 | ||||||

- (a)

- The

amounts of interest expense for 2009 and 2008 include internal funding costs allocated to us by Fifth Third Bank prior to the separation transaction and

are included as non-operating expenses on our statements of income.

- (b)

- Transition costs include costs associated with our separation transaction from Fifth Third Bank, including costs incurred for our human resources, finance, marketing and legal functions and severance costs; consulting fees related to non-recurring transition projects; expenses related to various strategic and separation initiatives; depreciation and amortization charged to us by Fifth Third Bank under our transition services agreement; and compensation costs

15

related to payouts of a one-time signing bonus to former Fifth Third Bank employees transferred to us as part of our transition deferred compensation plan.

- (c)

- Includes

non-operating expenses incurred with the refinancing of our debt in May 2011.

- (d)

- Share-based

compensation includes non-cash compensation expense recorded related to phantom equity units of Vantiv Holding issued to our

employees. See Note 11 to our audited financial statements.

- (e)

- Acquisition

and integration costs include fees incurred in connection with our acquisitions in 2010, including legal, accounting and advisory fees as well

as consulting fees for integration services.

- (f)

- Represents

the non-cash expense related to fair value adjustments to the value of the put rights Vantiv, Inc. received from Fifth Third

Bank in connection with the separation transaction. The put rights will terminate in connection with this offering and, accordingly, we do not expect adjustments to fair value to be material in future

periods. For more information regarding the put rights, see Note 7 to our audited financial statements.

- (g)

- Consists

of transaction costs, principally professional and advisory fees, incurred by us on behalf of Advent in connection with the separation transaction.

- (h)

- Reflects NPC's EBITDA from January 2010 until our acquisition of NPC in November 2010.

- (4)

- Gives effect to the reorganization transactions described in "Organizational Structure" and the sale of our Class A common stock in this offering and the application of the net proceeds from this offering as described in "Use of Proceeds."

16

An investment in our Class A common stock involves a high degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, before making an investment in our Class A common stock. If any of the following risks actually occur, our business, financial condition and results of operations may be materially adversely affected. In such an event, the trading price of our Class A common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business

If we cannot keep pace with rapid developments and change in our industry and provide new services to our clients, the use of our services could decline, reducing our revenues.

The electronic payments market in which we compete is subject to rapid and significant changes. This market is characterized by rapid technological change, new product and service introductions, evolving industry standards, changing customer needs and the entrance of non-traditional competitors. In order to remain competitive, we are continually involved in a number of projects to develop new services or compete with these new market entrants, including the development of mobile phone payment applications, prepaid card offerings, ecommerce services and other new offerings emerging in the electronic payments industry. These projects carry risks, such as cost overruns, delays in delivery performance problems and lack of customer acceptance. In the electronic payments industry these risks are acute. Any delay in the delivery of new services or the failure to differentiate our services or to accurately predict and address market demand could render our services less desirable, or even obsolete, to our clients. Furthermore, even though the market for alternative payment processing services is evolving, it may not continue to develop rapidly enough for us to recover the costs we have incurred in developing new services targeted at this market.

In addition, the services we deliver are designed to process very complex transactions and provide reports and other information on those transactions, all at very high volumes and processing speeds. Any failure to deliver an effective and secure service or any performance issue that arises with a new service could result in significant processing or reporting errors or other losses. As a result of these factors, our development efforts could result in increased costs and/or we could also experience a loss in business that could reduce our earnings or could cause a loss of revenue if promised new services are not timely delivered to our clients or do not perform as anticipated. We also rely in part on third parties, including some of our competitors and potential competitors, for the development of, and access to new technologies. Our future success will depend in part on our ability to develop or adapt to technological changes and evolving industry standards. If we are unable to develop, adapt to or access technological changes or evolving industry standards on a timely and cost effective basis, our business, financial condition and results of operations would be materially adversely affected.

Furthermore, our competitors may have the ability to devote more financial and operational resources than we can to the development of new technologies and services, including ecommerce and mobile payment processing services, that provide improved operating functionality and features to their existing service offerings. If successful, their development efforts could render our services less desirable to clients, resulting in the loss of clients or a reduction in the fees we could generate from our offerings.

The payment processing industry is highly competitive, and we compete with certain firms that are larger and that have greater financial resources. Such competition could adversely affect the transaction and other fees we receive from merchants and financial institutions, and as a result, our margins, business, financial condition and results of operations.

The market for payment processing services is highly competitive. Other providers of payment processing services have established a sizable market share in the small and mid-sized merchant and financial institution processing and servicing sector, as well as servicing large merchants and financial

17

institutions, which are the markets in which we are principally focused. We also face competition from non-traditional payment processors that have significant financial resources. Our growth will depend on a combination of the continued growth of electronic payments and our ability to increase our market share. The weakness of the current economic recovery could cause future growth of electronic payments to slow compared to historical rates of growth.

Our competitors include financial institutions, subsidiaries of financial institutions and well-established payment processing companies, including Bank of America Merchant Services, Chase Paymentech Solutions, Elavon Inc. (a subsidiary of U.S. Bancorp), First Data Corporation, Global Payments, Inc., Heartland Payment Systems, Inc. and WorldPay Payment Services in our Merchant Services segment, and Fidelity National Information Services, Inc., First Data Corporation, Fiserv, Inc., Total System Services, Inc. and Visa Debit Processing Service in our Financial Institution Services segment. With respect to our Financial Institutions Services segment, in addition to competition with direct competitors, we also compete with the capabilities of many larger potential clients that have either historically developed their key payment processing applications in-house, or have recently moved such application in-house, and therefore weigh whether they should develop these capabilities in-house or acquire them from a third party.

Our competitors that are financial institutions or are affiliated with financial institutions may not incur the sponsorship costs we incur for registration with the payment networks. Many of these competitors have substantially greater financial, technological and marketing resources than we have. Accordingly, these competitors may be able to offer more attractive fees to our current and prospective clients, or especially with respect to our financial institution clients, other services that we do not offer. Competition may influence the fees we receive. If competition causes us to reduce the fees we charge, we will have to aggressively control our costs in order to maintain our profit margins. Competition could also result in a loss of existing clients, and greater difficulty attracting new clients, which we may not be able to do. One or more of these factors could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, we are facing new competition emerging from non-traditional competitors offering alternative payment methods, such as PayPal and Google. These non-traditional competitors have significant financial resources and robust networks and are highly regarded by consumers. If these non-traditional competitors gain a greater share of total electronic payments transactions, it could also have material adverse effect on our business, financial condition and results of operations.

Unauthorized disclosure of data, whether through cybersecurity breaches, computer viruses or otherwise, could expose us to liability, protracted and costly litigation and damage our reputation.

We are responsible for certain third parties under Visa, MasterCard and other payment network rules and regulations, including merchants, ISOs, third party service providers and other agents, which we refer to collectively as associated participants. We and certain of our associated participants process, store and/or transmit sensitive data, such as names, addresses, social security numbers, credit or debit card numbers, driver's license numbers and bank account numbers, and we have ultimate liability to the payment networks and member financial institutions that register us with Visa, MasterCard and other payment networks for our failure or the failure of our associated participants to protect this data in accordance with payment network requirements. The loss of merchant or cardholder data by us or our associated participants could result in significant fines and sanctions by the payment networks or governmental bodies, which could have a material adverse effect on our business, financial condition and results of operations.

These concerns about security are increased when we transmit information over the Internet. Computer viruses can be distributed and spread rapidly over the Internet and could infiltrate our systems, which might disrupt our delivery of services and make them unavailable. In addition, a significant cybersecurity breach could result in payment networks prohibiting us from processing

18

transactions on their networks or the loss of our financial institution sponsorship that facilitates our participation in the payment networks.

We and our associated participants have been in the past and could be in the future, subject to breaches of security by hackers. In such circumstances, our encryption of data may not prevent unauthorized access and we may be subject to liability, including payment network fines and assessments and claims for unauthorized purchases with misappropriated credit, debit or card information, impersonation or other similar fraud claims. A misuse of such data or a cybersecurity breach could harm our reputation and deter clients from using electronic payments generally and our services specifically, increase our operating expenses in order to correct the breaches or failures, expose us to uninsured liability, increase our risk of regulatory scrutiny, result in the imposition of penalties and fines under state and federal laws or by the payment networks, and adversely affect our continued payment network registration and financial institution sponsorship.

We cannot assure you that there are written agreements in place with every associated participant or that such written agreements will prevent the unauthorized use or disclosure of data or allow us to seek reimbursement from associated participants. Any such unauthorized use or disclosure of data could result in protracted and costly litigation, which could have a material adverse effect on our business, financial condition and results of operations.

Our systems and our third party providers' systems may fail due to factors beyond our control, which could interrupt our service, cause us to lose business and increase our costs.

We depend on the efficient and uninterrupted operation of numerous systems, including our computer systems, software, data centers and telecommunications networks, as well as the systems of third parties. Our systems and operations or those of our third party providers, could be exposed to damage or interruption from, among other things, fire, natural disaster, power loss, telecommunications failure, unauthorized entry and computer viruses. Our property and business interruption insurance may not be adequate to compensate us for all losses or failures that may occur. Defects in our systems or those of third parties, errors or delays in the processing of payment transactions, telecommunications failures or other difficulties could result in:

- •

- loss of revenues;

- •

- loss of clients;

- •

- loss of merchant and cardholder data;

- •

- fines imposed by payment network associations;

- •

- harm to our business or reputation resulting from negative publicity;

- •

- exposure to fraud losses or other liabilities;

- •

- additional operating and development costs; and/or

- •

- diversion of technical and other resources.

We may not be able to continue to expand our share of the existing payment processing markets or expand into new markets which would inhibit our ability to grow and increase our profitability.

Our future growth and profitability depend, in part, upon our continued expansion within the markets in which we currently operate, the further expansion of these markets, the emergence of other markets for payment processing, and our ability to penetrate these markets. Future growth and profitability of our business will depend upon our ability to penetrate other markets for payment processing. We may not be able to successfully identify suitable acquisition, investment and partnership or joint venture candidates in the future, and if we do, they may not provide us with the benefits we

19

anticipated. Once completed, investments, partnerships and joint ventures may not realize the value that we expect.

Our expansion into new markets is also dependent upon our ability to apply our existing technology or to develop new applications to meet the particular service needs of each new market. We may not have adequate financial or technological resources to develop effective and secure services or distribution channels that will satisfy the demands of these new markets. If we fail to expand into new and existing payment processing markets, we may not be able to continue to grow our revenues and earnings.

Furthermore, in response to market developments, we may expand into new geographical markets and foreign countries in which we do not currently have any operating experience. We cannot assure you that we will be able to successfully expand in such markets or internationally due to our lack of experience and the multitude of risks associated with global operations.

Any acquisitions, partnerships or joint ventures that we make could disrupt our business and harm our financial condition.

Acquisitions, partnerships and joint ventures are part of our growth strategy. We evaluate, and expect in the future to evaluate potential strategic acquisitions of and partnerships or joint ventures with complementary businesses, services or technologies. We may not be successful in identifying acquisition, partnership and joint venture candidates. In addition, we may not be able to successfully finance or integrate any businesses, services or technologies that we acquire or with which we form a partnership or joint venture. For instance, we may not be able to successfully integrate the recently acquired NPC platforms into our existing platforms. Furthermore, the integration of any acquisition may divert management's time and resources from our core business and disrupt our operations. Certain partnerships and joint ventures we make with merchants may prevent us from competing for certain clients or in certain lines of business. We may spend time and money on projects that do not increase our revenue. As a subsidiary of a bank holding company, Fifth Third Bancorp, for purposes of the Bank Holding Company Act of 1956, as amended, or the BHC Act, we may conduct only activities authorized under the BHC Act for a bank holding company or a financial holding company, and as a subsidiary of a bank, Fifth Third Bank, for purposes of relevant federal and state banking laws, we may conduct only activities authorized under such laws. These activities and restrictions may limit our ability to acquire other businesses or enter into other strategic transactions. In addition, in connection with any acquisitions, we must comply with state and federal antitrust requirements. It is possible that perceived or actual violations of these requirements could give rise to regulatory enforcement action or result in us not receiving all necessary approvals in order to complete a desired acquisition. To the extent we pay the purchase price of any acquisition in cash, it would reduce our cash reserves, and to the extent the purchase price is paid with our stock, it could be dilutive to our stockholders. To the extent we pay the purchase price with proceeds from the incurrence of debt, it would increase our already high level of indebtedness and could negatively affect our liquidity and restrict our operations. Our competitors may be willing or able to pay more than us for acquisitions, which may cause us to lose certain acquisitions that we would otherwise desire to complete. In addition, pursuant to the supermajority provisions in the Amended and Restated Vantiv Holding Limited Liability Company Agreement and consent rights in the Vantiv, Inc. Stockholders' Agreement, Advent and Fifth Third Bank's approval is required for acquisitions and incurrences of indebtedness above certain thresholds. We cannot ensure that any acquisition, partnership or joint venture we make will not have a material adverse effect on our business, financial condition and results of operations.

20

If we fail to comply with the applicable requirements of the Visa, MasterCard or other payment networks, those payment networks could seek to fine us, suspend us or terminate our registrations through our financial institution sponsors. Fines could have a material adverse effect on our business, financial condition or results of operations, and if these registrations are terminated, we may not be able to conduct our business.

A significant source of our revenue comes from processing transactions through the Visa, MasterCard and other payment networks. The payment networks routinely update and modify their requirements. Changes in the requirements may impact our ongoing cost of doing business and we may not, in every circumstance, be able to pass through such costs to our clients or associated participants. Furthermore, if we do not comply with the payment network requirements, the payment networks could seek to fine us, suspend us or terminate our registrations which allow us to process transactions on their networks. On occasion, we have received notices of non-compliance and fines, which have typically related to excessive chargebacks by a merchant or data security failures on the part of a merchant. If we are unable to recover fines from or pass through costs to our merchants or other associated participants, we would experience a financial loss. The termination of our registration, or any changes in the payment network rules that would impair our registration, could require us to stop providing payment network services to the Visa, MasterCard or other payment networks, which would have a material adverse effect on our business, financial condition and results of operations.

Changes in payment network rules or standards could adversely affect our business, financial condition and results of operations.

In order to provide our transaction processing services, we are registered through our bank partnerships with the Visa, MasterCard and other payment networks as service providers for member institutions. As such, we and many of our clients are subject to card association and payment network rules that could subject us or our clients to a variety of fines or penalties that may be levied by the card associations or payment networks for certain acts or omissions by us or our associated participants. On occasion, we have received notices of non-compliance and fines, which have typically related to excessive chargebacks by a merchant or data security failures on the part of a merchant. If we are unable to recover fines from our merchants, we would experience a financial loss. The Visa, MasterCard and other payment networks, some of which are our competitors, set the standards with which we must comply. The termination of our member registration or our status as a certified service provider, or any changes in card association or other payment network rules or standards, including interpretation and implementation of the rules or standards, that increase our cost of doing business or limit our ability to provide transaction processing services to or through our clients, could have a material adverse effect on our business, financial condition and results of operations.

If we cannot pass increases from payment networks including interchange, assessment, transaction and other fees along to our merchants, our operating margins will be reduced.

We pay interchange and other fees set by the payment networks to the card issuing financial institution and the payment networks for each transaction we process. From time to time, the payment networks increase the interchange fees and other fees that they charge payment processors and the financial institution sponsors. At their sole discretion, our financial institution sponsors have the right to pass any increases in interchange and other fees on to us and they have consistently done so in the past. We are generally permitted under the contracts into which we enter, and in the past we have been able to, pass these fee increases along to our merchants through corresponding increases in our processing fees. However, if we are unable to pass through these and other fees in the future, it could have a material adverse effect on our business, financial condition and results of operations.

21

We rely on financial institution sponsors, which have substantial discretion with respect to certain elements of our business practices, and financial institution clearing service providers, in order to process electronic payment transactions. If these sponsorships or clearing services are terminated and we are unable to secure new bank sponsors or financial institutions, we will not be able to conduct our business.