UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

For

the quarterly period ended:

For the transition period from to

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State of other jurisdiction of incorporation) | (IRS Employer ID No.) |

(Address of principal executive offices)

(Issuer’s Telephone Number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

The

The

|

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days:

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller reporting company

| ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

The number of shares of the registrant’s common stock, par value $0.001, issued and outstanding as of May 10, 2023, was shares.

TABLE OF CONTENTS

| PART II. OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 19 |

| Item 1A. | Risk Factors | 19 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 19 |

| Item 3. | Defaults Upon Senior Securities | 19 |

| Item 4. | Mine Safety Disclosures | 19 |

| Item 5. | Other Information | 19 |

| Item 6. | Exhibits | 19 |

| Signatures | 20 | |

| 2 |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Sunshine Biopharma, Inc.

Consolidated Balance Sheets

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable | ||||||||

| Inventory | ||||||||

| Prepaid expenses | ||||||||

| Total Current Assets | ||||||||

| Property and equipment | ||||||||

| Intangible assets | ||||||||

| Right-of-use-asset | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | $ | ||||||

| Earnout payable | ||||||||

| Income tax payable | ||||||||

| Right-of-use-liability | ||||||||

| Total Current Liabilities | ||||||||

| Long-Term Liabilities: | ||||||||

| Deferred tax liability | ||||||||

| Right-of-use-liability | ||||||||

| Total Long-Term Liabilities | ||||||||

| TOTAL LIABILITIES | ||||||||

| SHAREHOLDERS' EQUITY | ||||||||

Preferred Stock, Series B $par value per share; shares authorized; shares issued and outstanding | ||||||||

Common Stock, $ par value per share; shares authorized; and issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | ||||||||

| Capital paid in excess of par value | ||||||||

| Accumulated comprehensive income | ||||||||

| Accumulated (Deficit) | ( | ) | ( | ) | ||||

| TOTAL SHAREHOLDERS' EQUITY | ||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited financial statements

| 3 |

Sunshine Biopharma, Inc.

Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

| March 31, | March 31, | |||||||

| 2023 | 2022 | |||||||

| Sales | $ | $ | ||||||

| Cost of sales | ||||||||

| Gross profit | ||||||||

| General and Administrative Expenses: | ||||||||

| Accounting | ||||||||

| Consulting | ||||||||

| Director fees | ||||||||

| Legal | ||||||||

| Marketing | ||||||||

| Office | ||||||||

| Patent fees | ||||||||

| R&D | ||||||||

| Salaries | ||||||||

| Taxes | ||||||||

| Depreciation and amortization | ||||||||

| Total General and Administrative Expenses | ||||||||

| (Loss) from operations | ( | ) | ( | ) | ||||

| Other Income (Expenses): | ||||||||

| Foreign exchange | ( | ) | ||||||

| Interest income | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Total Other Income (Expenses) | ( | ) | ||||||

| Net (loss) before income taxes | ( | ) | ( | ) | ||||

| Provision for income taxes | ||||||||

| Net (Loss) | ( | ) | ( | ) | ||||

| Gain from foreign exchange translation | ||||||||

| Comprehensive (Loss) | ( | ) | ( | ) | ||||

| Basic (loss) per common share | $ | ) | $ | ) | ||||

| Weighted average common shares outstanding (Basic & Diluted) | ||||||||

The accompanying notes are an integral part of these unaudited financial statements

| 4 |

Sunshine Biopharma, Inc.

Consolidated Statements of Cash Flows (Unaudited)

| March 31, | March 31, | |||||||

| 2023 | 2022 | |||||||

| Cash Flows From Operating Activities: | ||||||||

| Net (Loss) | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| Foreign exchange | ||||||||

| Accounts receivable | ||||||||

| Inventory | ( | ) | ( | ) | ||||

| Prepaid expenses | ( | ) | ||||||

| Accounts payable & accrued expenses | ( | ) | ||||||

| Income tax payable | ||||||||

| Interest payable | ( | ) | ||||||

| Net Cash Flows (Used) in Operations | ( | ) | ( | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Reduction in Right-of-use asset | ||||||||

| Cash from Nora Pharma Inc. acquisition | ( | ) | ||||||

| Purchase of intangible assets | ( | ) | ||||||

| Purchase of equipment | ||||||||

| Net Cash Flows (Used) in Investing Activities | ( | ) | ||||||

| Cash Flows From Financing Activities: | ||||||||

| Common stock issued for public offerings | ||||||||

| Purchase of treasury stock | ( | ) | ( | ) | ||||

| Lease liability | ( | ) | ||||||

| Payments of notes payable | ( | ) | ||||||

| Net Cash Flows (Used In) Provided by Financing Activities | ( | ) | ||||||

| Cash and cash equivalents at beginning of period | ||||||||

| Net Increase (Decrease) in cash and cash equivalents | ( | ) | ||||||

| Effect of exchange rate changes on cash | ( | ) | ||||||

| Cash and cash equivalents at end of period | $ | $ | ||||||

| Supplementary Disclosure of Cash Flow Information: | ||||||||

| Cash paid for interest | $ | $ | ||||||

| Cash paid for income taxes | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited financial statements

| 5 |

Sunshine Biopharma, Inc.

Consolidated Statement of Shareholders' Equity (Unaudited)

| Number of Common Shares Issued | Common Stock | Capital Paid in Excess of Par Value | Number of Preferred Shares Issued | Preferred Stock | Compre- hensive Income | Accumulated Deficit | Total | |||||||||||||||||||||||||

| Three Months Period Ended March 31, 2022 | ||||||||||||||||||||||||||||||||

| Balance December 31, 2021 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||||

| Common stock and pre-funded warrants issued in public offerings | – | |||||||||||||||||||||||||||||||

| Exercise of warrants | – | |||||||||||||||||||||||||||||||

| Preferred stock purchased from related party | – | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Net (loss) | – | – | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||

| Balance December 31, 2022 | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||||||

| Repurchased stock | ( | ) | ( | ) | ( | ) | – | ( | ) | |||||||||||||||||||||||

| Net (loss) | – | – | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balance at March 31, 2023 | $ | $ | $ | $ | ( | ) | ||||||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited financial statements

| 6 |

Sunshine Biopharma, Inc.

Notes to Consolidated Financial Statements (Unaudited)

For the three months ended March 31, 2023 and 2022

Note 1 – Description of Business

The Company was originally incorporated under the name Mountain West Business Solutions, Inc. on August 31, 2006, in the State of Colorado.

Effective October 15, 2009, the Company acquired Sunshine Biopharma, Inc. in a transaction classified as a reverse acquisition. Sunshine Biopharma, Inc. held an exclusive license to a new anticancer drug bearing the laboratory name, Adva-27a (the “License Agreement”). Upon completion of the reverse acquisition transaction, the Company changed its name to Sunshine Biopharma, Inc. and began operating as a pharmaceutical company focusing on the development of the licensed Adva-27a anticancer drug. In December 2015, the Company acquired all rights to Adva-27a by purchasing PCT/FR2007/000697 and PCT/CA2014/000029 and terminated the License Agreement.

On May 22, 2020, the Company filed a provisional patent application in the United States for a new treatment for Coronavirus infections. The Company’s patent application covers composition subject matter pertaining to small molecules for inhibition of the main Coronavirus protease, Mpro, an enzyme that is essential for viral replication. The patent application has a priority date of May 22, 2020. On April 30, 2021, the Company filed a PCT application containing new research results and extending coverage to include the Coronavirus Papain-Like protease, PLpro. The priority date of May 22, 2020 has been maintained in the newly filed PCT application. The Company’s lead Anti-Coronavirus compound arising from these patents bears the laboratory name SBFM-PL4.

On February 18, 2022, the Company entered into a research agreement (the “SRA”) with the University of Arizona for the purposes of conducting research focused on determining the in vivo safety, pharmacokinetics, and dose selection properties of three University of Arizona owned PLpro inhibitors, to be followed by efficacy testing in mice infected with SARS-CoV-2 (the “Research Project”). Under the SRA, the University of Arizona granted the Company a first option to negotiate a commercial, royalty-bearing license for all intellectual property developed by University of Arizona under the Research Project. In addition, the Company and the University of Arizona entered into an option agreement (the “Option Agreement”) whereby the Company was granted a first option to negotiate a royalty-bearing commercial license for the underlying technology of the Research Project. On September 13, 2022, the Company exercised its option under the Option Agreement and on February 24, 2023 entered into an exclusive worldwide license agreement with the University of Arizona for all of the technology related to the Research Project.

On April 20, 2022, the Company filed a provisional patent application in the United States covering mRNA molecules capable of destroying cancer cells in vitro. The patent application contains composition and utility subject matter pertaining to the structure and sequence of such mRNA molecules. The lead anticancer mRNA molecule arising from this technology is targeted for liver cancer and bears the laboratory name K1.1.

On October 20, 2022, the Company acquired Nora Pharma Inc. (“Nora Pharma”), a Canadian generic pharmaceuticals company based in the greater Montreal area. Nora Pharma has 37 employees and operates in a 15,000 square foot facility certified by Health Canada. Nora Pharma currently offers 50 generic prescription drugs and 11 OTC products. The consolidated financial statements contained in this Report include the results of operations of Nora Pharma from January 1, 2023 through March 31, 2023.

Note 2 – Basis of Presentation

The unaudited financial statements of the Company for the three months periods ended March 31, 2023 and 2022 have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and pursuant to the requirements for reporting on Form 10-Q and Regulation S-X. Accordingly, they do not include all the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. However, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for the fair presentation of the financial position and the results of operations. Results shown for interim periods are not necessarily indicative of the results to be obtained for a full fiscal year. The balance sheet information as of December 31, 2022 was derived from the audited financial statements included in the Company's financial statements as of and for the year ended December 31, 2022 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on April 4, 2023. These financial statements should be read in conjunction with that report.

| 7 |

Note 3 – Acquisition of Nora Pharma Inc.

On October 20, 2022 the Company acquired all of

the issued and outstanding shares of Nora Pharma Inc. The purchase price

for the shares was $

The following table summarizes the allocation of the purchase price as of October 20, 2022, the acquisition date using Nora Pharma’s balance sheet assets and liabilities:

Allocation of purchase price

| Accounts receivable | $ | |||

| Inventory | ||||

| Intangible assets | ||||

| Equipment & furniture | ||||

| Other assets | ||||

| Total assets | ||||

| Liabilities assumed | ( | ) | ||

| Net assets | ||||

| Goodwill | ||||

| Total Consideration | $ |

The value of the 3,700,000 common shares issued as part of the consideration paid for Nora Pharma was determined based on the closing market price of the Company’s common shares on the acquisition date, October 20, 2022 ($1.22 per share).

The Company impaired 100% of the goodwill amount in 2022 and is intending to depreciate the intangible assets over 5 years using the straight-line method.

As part of the consideration paid for Nora Pharma,

the Company agreed to a $

| 8 |

The unaudited financial information in the table below summarizes the combined results of operations of the Company (Sunshine Biopharma and Nora Pharma) for the years ended December 31, 2022 and 2021, on a pro forma basis, as though the companies had been combined as of January 1, 2021. The unaudited pro forma financial information does not purport to be indicative of the Company's combined results of operations which would have been obtained had the acquisition taken place on January 1, 2021, nor should it be taken as indicative of future consolidated results of operations:

| Pro Forma results from acquisition | December 31, 2022 | December 31, 2021 | ||||||

| Total revenues | $ | $ | ||||||

| Net (loss) from operations | $ | ( | ) | $ | ( | ) | ||

| Net (loss) | $ | ( | ) | $ | ( | ) | ||

| Basic and fully diluted (loss) per share | $ | ) | $ | ) | ||||

| Weighted average number of shares outstanding | ||||||||

Note 4 – Reverse Stock Splits

Effective

February 9, 2022, the Company completed a

Note 5 – Capital Stock

The Company’s authorized capital is comprised of shares of $ par value common stock and shares of $ par value preferred stock, to have such rights and preferences as the Directors of the Company have or may assign from time to time. Out of the authorized Preferred Stock, the Company had previously designated 850,000 shares as Series “A” Preferred Stock (“Series A”). At December 31, 2019, the Company had no issued and outstanding shares of Series A. On June 17, 2020, the Company filed an amendment to its Articles of Incorporation (the “Amendment”) eliminating the Series A shares and the designation thereof, which shares were returned to the status of undesignated shares of Preferred Stock. In addition, the Amendment increased the number of authorized Series B Preferred Shares from five hundred thousand (500,000) to one million (1,000,000) shares. The Series B Preferred Stock is non-convertible, non-redeemable and non-retractable. It has superior liquidation rights to the common stock at $0.10 per share and gives the holder the right to 1,000 votes per share. As of December 31, 2021, there were shares of the Series B Preferred Stock held by the CEO of the Company.

On

February 17, 2022, the Company completed a public offering and received net proceeds of $

On February 22, 2022, the Company redeemed shares of Series B Preferred Stock from the CEO of the Company at a redemption price equal to the stated value of $per share.

| 9 |

On

March 14, 2022, the Company completed a private placement and received net proceeds of $

On

April 28, 2022, the Company completed another private placement and received net proceeds of $

On

October 20, 2022, the Company issued

shares of common stock as part of the acquisition of Nora Pharma. These shares were valued at $

During

the fiscal year ended December 31, 2021, the Company issued an aggregate of

shares of its common stock valued at $

in connection with the conversion of $

On January 19, 2023, the Company announced a

stock repurchase program of up to $

Through March 31, 2023 and December 31, 2022, the Company has a total of shares of common stock issued and outstanding, respectively.

The

Company has declared

Note 6 – Warrants

The Company accounts for issued warrants either as a liability or equity in accordance with ASC 480-10 or ASC 815-40. Under ASC 480-10, warrants are considered a liability if they are mandatorily redeemable and they require settlement in cash, other assets, or a variable number of shares. If warrants do not meet liability classification under ASC 480-10, the Company considers the requirements of ASC 815-40 to determine whether the warrants should be classified as a liability or as equity. Under ASC 815-40, contracts that may require settlement for cash are liabilities, regardless of the probability of the occurrence of the triggering event. Liability-classified warrants are measured at fair value on the issuance date and at the end of each reporting period. Any change in the fair value of the warrants after the issuance date is recorded in the consolidated statements of operations as a gain or loss. If warrants do not require liability classification under ASC 815-40, in order to conclude warrants should be classified as equity, the Company assesses whether the warrants are indexed to its common stock and whether the warrants are classified as equity under ASC 815-40 or other applicable GAAP standard. Equity-classified warrants are accounted for at fair value on the issuance date with no changes in fair value recognized after the issuance date.

| 10 |

In 2022, the Company completed three financing events, and in connection therewith, it issued warrants as follows:

| Type | Number | Exercise Price | Expiry Date | |||

| Pre-Funded Warrants | $ |

|||||

| Tradeable Warrants | $ |

|||||

| Investor Warrants | $ |

|||||

| April Warrants | $ |

| * |

As

of March 31, 2023, all of the Pre-Funded Warrants and a total of Tradeable Warrants were exercised resulting in aggregate proceeds

of $

The Company’s outstanding warrants at March 31, 2023 consisted of the following:

| Type | Number | Exercise Price | Expiry Date | |||

| Pre-Funded Warrants | $ |

|||||

| Tradeable Warrants | $ |

|||||

| Investor Warrants | $ |

|||||

| April Warrants | $ |

Basic net loss per share is calculated by dividing the net loss by the weighted-average number of shares of common stock outstanding during the period, without consideration for common stock equivalents.

Diluted net loss per share is calculated by dividing the net loss by the weighted-average number of shares of common stock outstanding during the period, taking into consideration common stock equivalents.

In

February 2022, the Company issued Tradeable Warrants pursuant to the Company’s Public Offering.

In March and April 2022, the Company issued Investor Warrants and April Warrants pursuant to two private placements. As of March

31, 2023, Tradeable Warrants and Investor Warrants were exercised, leaving

In March and April 2022, the Company issued and sold Pre-Funded Warrants to purchase an aggregate of 3,692,276 shares of common stock at a nominal exercise price of $0.001 per share (see Note 3). During the three months ended March 31, 2023, all of these warrants were exercised and therefore had no remaining dilutive effect.

Note 8 – Lease

The Company has obligations as a lessee for office space with initial non-cancellable terms in excess of one year. The Company classified the lease as an operating lease. The lease contains a renewal option for a period of five years. Because the Company is certain to exercise the renewal option, the optional period is included in determining the lease term, and associated payments under the renewal option are included in the lease payments. The Company’s lease does not include termination options for either party to the lease or restrictive financial or other covenants. Payments due under the lease contract include fixed payments plus a variable Payment. The Company’s office space lease requires it to make variable payments for the Company’s proportionate share of building’s property taxes, insurance, and common area maintenance. These variable lease payments are not included in lease payments used to determine lease liability and are recognized as variable costs when incurred.

| 11 |

Amounts reported on the balance sheet as of March 31, 2023 were as follows:

| Operating lease ROU asset | $ |

| Operating Lease liability - Short-term | $ |

| Operating lease liability - Long-term | $ |

| Remaining lease term | |

| Discount rate |

Amounts disclosed for ROU assets obtained in exchange for lease obligations and reductions of ROU assets resulting from reductions of lease obligations include amounts reduced from the carrying amount of ROU assets resulting from deferred rent.

Maturities of lease liabilities under non-cancellable operating leases at March 31, 2023 are as follows:

| 2023 | $ |

| 2024 | $ |

| 2025 | $ |

| 2026 | $ |

| 2027 | $ |

| Thereafter | $ |

Note 9 – Management and Director Compensation

The

Company paid its officers cash compensation totaling $

The

Company paid its directors cash compensation totaling $

Note 10 – Subsequent Events

In accordance with ASC 855 – Subsequent Events, the Company has analyzed its operations after March 31, 2023 to the date these unaudited financial statements were available. No subsequent transactions were identified.

| 12 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included herein. This discussion includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The statements regarding Sunshine Biopharma, Inc. contained in this Report that are not historical in nature, particularly those that utilize terminology such as “may,” “will,” “should,” “likely,” “expects,” “anticipates,” “estimates,” “believes” or “plans,” or comparable terminology, are forward-looking statements based on current expectations and assumptions, and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements. Important factors known to us that could cause such material differences are identified in this report and in our annual report on Form 10-K for the year ended December 31, 2021. We undertake no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable law. You are advised, however, to consult any future disclosures we make on related subjects in future reports to the SEC.

About Sunshine Biopharma

Sunshine Biopharma Inc. is a pharmaceutical company offering and researching life-saving medicines in a wide variety of therapeutic areas, including oncology and antivirals. In addition to our own drug development operations, we operate three wholly owned subsidiaries, including (i) Nora Pharma Inc. (“Nora Pharma”), a Canadian corporation with a portfolio consisting of 50 prescription drugs on the market in Canada and 28 additional drugs scheduled to be launched in 2023 and 2024, (ii) Sunshine Biopharma Canada Inc. (“Sunshine Canada”), a Canadian corporation which develops and sells OTC supplements, and (iii) NOX Pharmaceuticals, Inc., a Colorado corporation which is inactive and is scheduled to be dissolved later this year.

History

We were incorporated in the State of Colorado on August 31, 2006 and on October 15, 2009 we acquired Sunshine Biopharma, Inc. in a transaction classified as a reverse acquisition. Sunshine Biopharma, Inc. was holding an exclusive license to a new anticancer drug bearing the laboratory name, Adva-27a (the “License Agreement”). Upon completion of the reverse acquisition transaction, we changed our name to Sunshine Biopharma, Inc. and began operating as a pharmaceutical company focusing on the development of the licensed Adva-27a anticancer drug. In December 2015, we acquired all worldwide issued (US Patent Number 8,236,935, and 10,272,065) and pending patents under PCT/FR2007/000697 and PCT/CA2014/000029 for the Adva-27a anticancer compound and terminated the License Agreement.

In early 2020, we initiated a new R&D project focused on the development of a treatment for COVID-19 and on May 22, 2020, we filed a provisional patent application in the United States for the new coronavirus treatment. The patent application covers composition subject matter pertaining to small molecules for inhibition of the main Coronavirus protease, Mpro. On April 30, 2021, we filed a PCT application containing new research results and extending coverage to include the Coronavirus Papain-Like protease, PLpro.

In June 2021, we initiated another R&D project in which we set out to determine if certain mRNA molecules can be used as anticancer agents. The data obtained for mRNA molecules bearing the laboratory name K1.1 became the subject of a new patent application filed in April 2022.

On October 20, 2022, we acquired Nora Pharma Inc. (“Nora Pharma”), a Canadian generic pharmaceuticals company based in the greater Montreal area. Nora Pharma has 37 employees and operates in a 15,000 square foot facility certified by Health Canada. Nora Pharma currently offers 50 generic prescription drugs and 11 nonprescription OTC products. Nora Pharma sales were $10.7 million USD during its fiscal year ended June 30, 2022. The consolidated financial statements contained in this report include the results of operations of Nora Pharma from October 20, 2022 through December 31, 2022.

| 13 |

Products on the Market

As a result of the acquisition of Nora Pharma we now have the following generic prescription drugs on the market in Canada:

| Drug | Action/Indication | Reference Brand | ||

| Alendronate | Osteoporosis | Fosamax® | ||

| Amlodipine | Cardiovascular | Norvasc® | ||

| Apixaban | Cardiovascular | Eliquis® | ||

| Atorvastatin | Cardiovascular | Lipitor® | ||

| Azithromycin | Antibacterial | Zithromax® | ||

| Candesartan | Hypertension | Atacand® | ||

| Candesartan HCTZ | Hypertension | Atacand® | ||

| Celecoxib | Anti-inflammatory | Celebrex® | ||

| Cetirizine | Allergy | Reactine® | ||

| Ciprofloxacin | Antibiotic | Cipro® | ||

| Citalopram | Central nervous system | Celexa® | ||

| Clindamycin | Antibiotic | Dalacin® | ||

| Clopidogrel | Cardiovascular | Plavix® | ||

| Donepezil | Central nervous system | Aricept® | ||

| Duloxetine | Central nervous system | Cymbalta® | ||

| Dutasteride | Urology | Avodart® | ||

| Escitalopram | Central nervous system | Cipralex® | ||

| Ezetimibe | Cardiovascular | Ezetrol® | ||

| Finasteride | Urology | Proscar® | ||

| Flecainide | Cardiovascular | Tambocor® | ||

| Fluconazole | Antifungal | Diflucan® | ||

| Fluoxetine | Central nervous system | Prozac® | ||

| Hydroxychloroquine | Antimalarial | Plaquenil® | ||

| Lacosamide | Central nervous system | Vimpat® | ||

| Letrozole | Oncology | Femara® | ||

| Levetiracetam | Central nervous system | Keppra® | ||

| Mirtazapine | Central nervous system | Remeron® | ||

| Metformin | Diabetes | Glucophage® | ||

| Montelukast | Allergy | Singulair® | ||

| Olanzapine ODT | Central nervous system | Zyprexa® | ||

| Olmesartan | Cardiovascular | Olmetec® | ||

| Olmesartan HCTZ | Cardiovascular | Olmetec Plus® | ||

| Pantoprazole | Acid Reflux | Pantoloc® | ||

| Paroxetine | Central nervous system | Paxil® | ||

| Perindopril | Cardiovascular | Coversyl® | ||

| Pravastatin | Cardiovascular | Pravachol® | ||

| Pregabalin | Central nervous system | Lyrica® | ||

| Quetiapine | Central nervous system | Seroquel® | ||

| Quetiapine XR | Central nervous system | Seroquel XR® | ||

| Ramipril | Cardiovascular | Altace® | ||

| Rizatriptan ODT | Central nervous system | Maxalt® ODT | ||

| Rosuvastatin | Cardiovascular | Crestor® | ||

| Sertraline | Central nervous system | Zoloft® | ||

| Sildenafil | Urology | Viagra® | ||

| Tadalafil | Urology | Cialis® | ||

| Telmisartan | Cardiovascular | Micardis® | ||

| Telmisartan HCTZ | Cardiovascular | Micardis Plus® | ||

| Tramadol Acetaminophen | Central nervous system | Tramacet® | ||

| Zolmitriptan | Central nervous system | Zomig® | ||

| Zopiclone | Central nervous system | Imovane® |

| 14 |

In addition, we have the following nonprescription OTC products on the market in Canada and partially in the U.S.:

| Product | Description | |

| Essential 9™ | Essential Amino Acids capsules (761 mg) | |

| L-Arginine | L-Arginine capsules (500 mg) | |

| L-Carnitine | L-Carnitine capsules (667 mg) | |

| Extreme-Mass™ | Weight Gain powder | |

| Iso-Whey™ | Whey Protein powder | |

| BCAA 2:1:1™ | Branched-Chain Amino Acids capsules (600 mg) | |

| L-Creatine | L-Creatine Monohydrate powder | |

| Nora B12-1000 | Vitamin B-12 tablets (Cyanocobalamine, 1,000 mcg) | |

| Nora Calcium | Calcium Carbonate tablets (500 mg) | |

| Nora Cal-D 400 | Calcium Carbonate (500 mg) + Vitamin D (400 IU) tablets | |

| Nora Cal-D 1000 | Calcium Carbonate (500 mg) + Vitamin D (1,000 IU) tablets | |

| Nora D-400 | Vitamin D tablets (Calciferol 400 IU) | |

| Nora D-1000 | Vitamin D tablets (Calciferol 1,000 IU) | |

| Nora Senna | Senna Alexandrina tablets (8.6 mg) | |

| Nora Sennosides | Senna Alexandrina tablets (8.6 mg) | |

| NRA-ASA | Acetylsalicylic Acid tablets (80 mg) | |

| NRA-Docusate Sodium | Docusate Sodium capsules (100 mg) | |

| NRA K-20 | Potassium Chloride tablets (1,500 mg) |

Products in Development

The following table summarizes our generic and proprietary drugs in development:

| Generic Drugs | Therapeutic Area(s) | Development Stage | Launch Date | |||

| Group A (4 Products) | Central Nervous System, Urology, Cardiovascular | Under Regulatory Review | 2023Q2 | |||

| Group B (3 Products) | Central Nervous System, Gastrointestinal | Under Regulatory Review | 2023Q3 | |||

| Group C (1 Product) | Oncology | Under Regulatory Review | 2023Q4 | |||

| Group D (8 Products) | Central Nervous System, Cardiovascular, Metabolism | Under Regulatory Review | 2024Q1 | |||

| Group E (5 Products) | Cardiovascular, Urology, Endocrinology | Under Regulatory Review | 2024Q2 | |||

| Group F (6 Products) | Urology, Cardiovascular, Oncology, Anti-infectives | Under Regulatory Review | 2024Q3 |

| Proprietary Drugs | Therapeutic Area | Development Stage | Launch Date | |||

| Adva-27a (Small Molecule) | Oncology (Pancreatic Cancer) | IND-Enabling Studies | TBD | |||

| K1.1 (mRNA LNP) | Oncology (Liver Cancer) | Animal Testing | TBD | |||

| SBFM-PL4 (Small Molecule) | Antiviral (COVID-19) | Animal Testing | TBD |

Proprietary Drugs in Development

Adva-27a Anticancer Drug

In the area of oncology, our proprietary drug development activities have been focused on the development of a small molecule called Adva-27a for the treatment of aggressive forms of cancer. A Topoisomerase II inhibitor, Adva-27a has been shown to be effective at destroying Multidrug Resistant Cancer cells including Pancreatic Cancer cells, Breast Cancer cells, Small-Cell Lung Cancer cells and Uterine Sarcoma cells (Published in ANTICANCER RESEARCH, Volume 32, Pages 4423-4432, October 2012). We are the direct owner of all patents pertaining to Adva-27a including U.S. Patents Number 8,236,935 and 10,272,065.

| 15 |

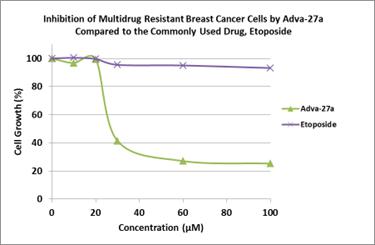

Adva-27a is a GEM-difluorinated C-glycoside derivative of Podophyllotoxin. Another derivative of Podophyllotoxin called Etoposide is currently on the market and is used to treat various types of cancer including leukemia, lymphoma, testicular cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. Etoposide is one of the most widely used anticancer drugs. Adva-27a and Etoposide are similar in that they both attack the same target in cancer cells, namely the DNA unwinding enzyme, Topoisomerase II. Unlike Etoposide however, Adva-27a is able to penetrate and destroy Multidrug Resistant Cancer cells. In addition, Adva-27a has been shown to have distinct and more desirable biological and pharmacological properties compared to Etoposide. In side-by-side studies using Multidrug Resistant Breast Cancer cells and Etoposide as a reference, Adva-27a showed markedly greater cell killing activity (see Figure 1).

Figure 1

In February 2023, we signed a research agreement with the Jewish General Hospital (“JGH”), to complete the IND-enabling studies. The JGH has also agreed to negotiate with us the terms for Phase I Clinical Trials. Adva-27a’s initial indication will be pancreatic cancer for which there are currently little or no treatment options available. All aspects of the clinical trials in Canada will employ FDA standards at all levels.

K1.1 Anticancer mRNA

In June 2021, we initiated a new research project in which we set out to determine if certain mRNA molecules can be used as anti-cancer agents. The data collected to date have shown that a selected group of mRNA molecules are capable of destroying cancer cells in vitro including multidrug resistant breast cancer cells (MCF-7/MDR), ovarian adenocarcinoma cells (OVCAR-3), and pancreatic cancer cells (SUIT-2). Studies using non-transformed (normal) human cells (HMEC cells) showed that these mRNA molecules had little cytotoxic effects. These new mRNA molecules, bearing the laboratory name K1.1, are readily adaptable for delivery into patients using the mRNA vaccine technology. In April 2022, we filed a provisional patent application in the United States covering the subject mRNA molecules. We recently concluded an agreement with a specialized partner for the purposes of formulating our K1.1 mRNA molecules into lipid nanoparticles, ready for use to conduct studies in xenograft mice. We anticipate commencing such studies later this year.

SBFM-PL4 COVID-19 Treatment

The initial genome expression products of Severe Acute Respiratory Syndrome Coronavirus 2 (SARS-CoV-2), the causative agent of COVID-19, are two large polyproteins, referred to as pp1a and pp1ab. These two polyproteins are cleaved at 15 specific sites by two virus encoded proteases (Mpro and PLpro) to generate 16 different non-structural proteins essential for viral replication. Mpro and PLpro represent attractive anti-viral drug development targets as they play a central role in the early stages of viral replication. PLpro is of particular interest as a therapeutic target in that, in addition to processing viral proteins, it is also responsible for suppression of the human immune system making the virus more life-threatening.

| 16 |

Our COVID-19 research effort has been focused on developing an inhibitor of PLpro, the viral enzyme that mediates suppression of the human immune system. On May 22, 2020, we filed a patent application in the United States for a new treatment for Coronavirus infections. Our patent application covers composition subject matter pertaining to small molecules for inhibition of the Coronavirus main protease (Mpro) and papain-like protease (PLpro).

In February 2022, we expanded our PLpro inhibitors research effort by entering into a research agreement with the University of Arizona for the purposes of conducting research focused on determining the in vivo safety, pharmacokinetics, and dose selection properties of three University of Arizona owned PLpro inhibitors, to be followed by efficacy testing in mice infected with SARS-CoV-2 (the “Research Project”). Under the agreement, the University of Arizona granted the Company a first option to negotiate a commercial, royalty-bearing license for all intellectual property developed by University of Arizona personnel under the Research Project. In addition, the Company and the University of Arizona entered into an option agreement (the “Option Agreement”) whereby the Company was granted a first option to negotiate a royalty-bearing commercial license for the underlying technology of the Research Project. On September 13, 2022, we exercised our option under the Option Agreement and on February 24, 2023, we entered into an exclusive worldwide license agreement with the University of Arizona for all of the technology related to the Research Project.

Intellectual Property

We are the sole owner of all worldwide rights pertaining to Adva-27a. These patent rights are covered by PCT/FR2007/000697 and PCT/CA2014/000029. The patent applications filed under these two PCT's have been issued in the United States (US Patent Number 8,236,935 and 10,272,065), Europe, and Canada.

On May 22, 2020, we filed a provisional patent application in the United States for a new treatment for Coronavirus infections. Our patent application covers composition subject matter pertaining to small molecules for inhibition of the main Coronavirus protease, Mpro, an enzyme that is essential for viral replication. The patent application has a priority date of May 22, 2020. On April 30, 2021, we filed a PCT application containing new research results and extending coverage to include the Coronavirus Papain-Like protease, PLpro. The priority date of May 22, 2020 has been maintained in the newly filed PCT application.

On April 20, 2022, we filed a provisional patent application in the United States covering mRNA molecules capable of destroying cancer cells in vitro. The patent application contains composition and utility subject matter pertaining to the structure and sequence of the relevant mRNA molecules.

Our recently acquired wholly owned subsidiary, Nora Pharma, owns 152 DIN’s issued by Health Canada for prescription drugs currently on the market in Canada. These DIN’s were secured through in-licenses or cross-licenses from international manufacturers of generic pharmaceutical products.

In addition, we are the owner of two NPN’s issued by Health Canada: NPN 80089663 authorizes us to manufacture and sell our in-house developed OTC product, Essential 9™, and NPN 80093432 authorizes us to manufacture and sell the OTC product, Calcium-Vitamin D under the brand name Essential Calcium-Vitamin D™.

Results of Operations

Comparison of results of operations for the three months ended March 31, 2023 and 2022

During the three months ended March 31, 2023, we generated $4,894,053 in sales, compared to $122,645 for the three months ended March 31, 2022, an increase of $4,771,408. The increase is attributable to sales generated by our recently acquired wholly owned subsidiary, Nora Pharma. The direct cost for generating these sales was $3,065,931 (62.6%) for the three months ended March 31, 2023, compared to $59,845 for the three months ended March 31, 2022 (48.8%). The increase in the cost of goods sold in 2023 is due to the cost of manufacturing of the generic prescription drugs sold by Nora Pharma. Our gross profit grew to $1,828,122 for the three months ended March 31, 2023, compared to $62,800 for the three months ended March 31, 2022.

| 17 |

General and administrative expenses during the three month period ended March 31, 2023 were $3,657,103, compared to $1,286,164 during the three month period ended March 31, 2022, an increase of $2,370,939. This increase was the result of increased overhead associated with being a Nasdaq listed company and expenses related to Nora Pharma operations. Specifically, we incurred increased costs in accounting ($95,951), consulting ($126,117), office costs ($199,953), research and development ($71,273), salaries ($1,739,257) and taxes ($63,718). Overall, we incurred a loss of $1,828,981 from our operations for the three months ended March 31, 2023, compared to a loss of $1,223,364 from our operations in the three month period ended March 31, 2022.

In addition, we had net interest income of approximately $172,821 during the three months ended March 31, 2023, compared to a net interest expense of approximately $12,870 during the three months ended March 31, 2022, as a result of interest earned on the cash on hand.

As a result, we incurred a net loss of $1,702,430 for the three months ended March 31, 2023, compared to a net loss of $1,236,234 for the three month period ended March 31, 2022.

Liquidity and Capital Resources

As of March 31, 2023, we had cash or cash equivalents of $19,294,218.

Net cash used in operating activities was $1,850,106 during the three months ended March 31, 2023, compared to $1,304,208 during the three month period ended March 31, 2022. The increase was a result of the addition of Nora Pharma’s operations.

Cash flows used in investing activities were $146,303 for the three months ended March 31, 2023, compared to $0 for the three months ended March 31, 2022. The increase was the result of cash invested in Nora Pharma.

Cash flows used in financing activities were $(538,299) for the three months ended March 31, 2023, compared to $12,437,673 provided by financing activities for the three months ended March 31, 2022. The decrease was primarily as a result of no offerings made during the three months ended March 31, 2023 compared to two offerings completed in February and March 2022, and due to our purchase of $506,822 in common stock under Rule 10B-14 in the first quarter of 2023 period compared to $0 during the same period in 2022.

We are not generating adequate revenues from our operations to fully implement our business plan as set forth herein. On February 17, 2022, we received net proceeds of approximately $6.8 million from the sale of common stock and warrants in an underwritten public offering. On March 14, 2022, we received net proceeds of approximately $6.8 million from the sale of common stock and warrants in a private placement. On April 28, 2022, we received net proceeds of approximately $16.8 million from the sale of common stock and warrants in a private placement. We believe our existing cash will be sufficient to fund our operations, including general and administrative expenses, expanded research and development activities, and OTC supplements business, for the next 24 months. There is no assurance our estimates will be accurate.

Management estimates that we will need additional capital in the amount of approximately $30 million to fully implement our business plan, including funding for further research and development activities and possibly clinical trials, as well as expansion of our generic pharmaceuticals operations arising from the Nora Pharma acquisition. Additional capital may not be available on terms acceptable to us, or at all. Currently, we do not have any firm committed arrangements for financing and can provide no assurance that we will be able to obtain financing when required. No assurance can be given that we will obtain access to capital markets in the future or that financing, adequate to satisfy the cash requirements of implementing our business will be available on acceptable terms. Our inability to obtain acceptable financing could have an adverse effect upon the results of our operations and financial condition.

Critical Accounting Estimates

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

For a detailed list of significant accounting policies, please see our annual report on Form 10-K for the fiscal year ended December 31, 2022, including our financial statements and notes thereto included therein as filed with the SEC on April 4, 2023.

| 18 |

Recently Adopted Accounting Standards

In February 2020, the FASB issued ASU 2020-02, Financial Instruments-Credit Losses (Topic 326) and Leases (Topic 842) - Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 119 and Update to SEC Section on Effective Date Related to Accounting Standards Update No. 2016-02, Leases (Topic 842) which amends the effective date of the original pronouncement for smaller reporting companies. ASU 2016-13 and its amendments will be effective for the Company for interim and annual periods in fiscal years beginning after December 15, 2022. The Company believes the adoption will modify the way the Company analyzes financial instruments, but it does not anticipate a material impact on results of operations. The Company is in the process of determining the effects adoption will have on its consolidated financial statements.

In August 2020, the FASB issued ASU 2020-06, Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815 – 40), (“ASU 2020-06”). ASU 2020-06 simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. The ASU2020-06 amendments are effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. The Company is evaluating the impact of this guidance on its unaudited consolidated financial statements.

Off Balance-Sheet Arrangements

None.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company and are not required to provide the information under this item.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this report.

These controls are designed to ensure that information required to be disclosed in the reports we file or submit pursuant to the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission, and that such information is accumulated and communicated to our management, including our CEO and CFO, to allow timely decisions regarding required disclosure.

Based on this evaluation, our management, including our CEO and CFO concluded that our disclosure controls and procedures were effective as of March 31, 2023, at reasonable assurance levels.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting during the quarter ended March 31, 2023, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 19 |

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We are not party to, and our property is not the subject of, any material legal proceedings.

ITEM 1A. RISK FACTORS

We are a smaller reporting company and are not required to provide the information under this item.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

| Exhibit No. | Description | |

| 31.1 | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* | |

| 31.2 | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2022* | |

| 32.1 | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002** | |

| 101 | Inline XBRL Document Set for the financial statements and accompanying notes in Part I, Item 1, of this Quarterly Report on Form 10-Q.* | |

| 104 | Inline XBRL for the cover page of this Quarterly Report on Form 10-Q, included in the Exhibit 101 Inline XBRL Document Set.* |

| * | Filed herewith. | |

| ** | Furnished herewith. |

| 20 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized, on May 10, 2023.

| SUNSHINE BIOPHARMA, INC. | |||

| By: | /s/ Dr. Steve N. Slilaty | ||

| Dr. Steve N. Slilaty | |||

| Chief Executive Officer (principal executive officer) | |||

| By: | /s/ Camille Sebaaly | ||

Camille Sebaaly Chief Financial Officer (principal financial and accounting officer) |

|||

| 21 |