UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the fiscal year ended |

| or | |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the transition period from to |

Commission File Number:

iShares® Gold Trust

(Exact name of registrant as specified in its charter)

| | |

| (State or other jurisdiction of | (I.R.S. Employer |

c/o iShares Delaware Trust Sponsor LLC

Attn: Product Management Team

iShares Product Research & Development

(Address of principal executive offices)(Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | Accelerated filer ☐ |

|

| Non-accelerated filer ☐ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

As of June 30, 2020, the aggregate market value of the shares held by non-affiliates was approximately $

As of January 29, 2021, the Registrant had

DOCUMENTS INCORPORATED BY REFERENCE:

None

Cautionary Note Regarding Forward Looking Statements

This Annual Report on Form 10-K includes statements which relate to future events or future performance. In some cases, you can identify such forward‑looking statements by terminology such as “may,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this report that address activities, events or developments that may occur in the future, including such matters as changes in commodity prices and market conditions (for gold and the shares), the operations of iShares Gold Trust (the “Trust”), the plans of iShares Delaware Trust Sponsor LLC (the “Sponsor”), the sponsor of the Trust, and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses made by the Sponsor on the basis of its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this report, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies and other world economic and political developments. See Item 1A. “Risk Factors.” Consequently, all the forward-looking statements made in this report are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of the shares issued by the Trust. Although the Sponsor does not make forward-looking statements unless it believes it has a reasonable basis for doing so, the Sponsor cannot guarantee their accuracy. Neither the Trust nor the Sponsor is under any duty to update any of the forward-looking statements to conform such statements to actual results or to a change in the expectations or predictions.

Page

| PART I |

|

|

| Item 1. | 1 |

|

| Item 1A. | 8 |

|

| Item 1B. | 15 |

|

| Item 2. | 15 |

|

| Item 3. | 15 |

|

| Item 4. | 15 |

|

| PART II |

|

|

| Item 5. | 16 |

|

| Item 6. | 16 |

|

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 |

| Item 7A. | 19 |

|

| Item 8. | 20 |

|

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

20 |

| Item 9A. | 21 |

|

| Item 9B. | 21 |

|

| PART III |

|

|

| Item 10. | 22 |

|

| Item 11. | 22 |

|

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

22 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

23 |

| Item 14. | 23 |

|

| PART IV |

|

|

| Item 15. | 24 |

|

| Item 16. | 24 |

Summary

The purpose of the iShares Gold Trust (the “Trust”) is to own gold transferred to the Trust in exchange for shares issued by the Trust (“Shares”). Each Share represents a fractional undivided beneficial interest in the net assets of the Trust. The assets of the Trust consist primarily of gold held by the Trust’s custodian on behalf of the Trust. However, there may be situations where the Trust will unexpectedly hold cash. For example, a claim may arise against a third party, which is settled in cash. In situations where the Trust unexpectedly receives cash or other assets, no new Shares will be issued until after the record date for the distribution of such cash or other property has passed.

The Trust was formed on January 21, 2005 when an initial deposit of gold was made in exchange for the issuance of three Baskets (a “Basket” consists of 50,000 Shares). The Trust is a grantor trust formed under the laws of the State of New York.

The sponsor of the Trust is iShares Delaware Trust Sponsor LLC (the “Sponsor”), a Delaware limited liability company and an indirect subsidiary of BlackRock, Inc. (“BlackRock”). The trustee of the Trust is The Bank of New York Mellon (the “Trustee”) and the custodian of the Trust is JPMorgan Chase Bank N.A., London branch (the “Custodian”). The agreement between the Trust and the Custodian is governed by English law. The Trust does not have any officers, directors or employees.

The Trust’s net asset value grew from $17,628,525,082 at December 31, 2019 to $31,918,269,136 at December 31, 2020, the Trust’s fiscal year end. Outstanding Shares of the Trust grew from 1,211,150,000 Shares outstanding at December 31, 2019 to 1,770,450,000 Shares outstanding at December 31, 2020.

The activities of the Trust are limited to (1) issuing Baskets in exchange for the gold deposited with the Custodian as consideration, (2) selling gold as necessary to cover the Sponsor’s fee, Trust expenses not assumed by the Sponsor and other liabilities, and (3) delivering gold in exchange for Baskets surrendered for redemption. The Trust is not actively managed. It does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of gold.

The Sponsor of the Trust maintains a website at www.ishares.com, through which the Trust’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), are made available free of charge after they have been filed or furnished to the Securities and Exchange Commission (the “SEC”). Additional information regarding the Trust may also be found on the SEC’s EDGAR database at www.sec.gov.

Trust Objective

The Trust seeks to reflect generally the performance of the price of gold. The Trust seeks to reflect such performance before payment of the Trust’s expenses and liabilities. The Shares are intended to constitute a simple and cost-effective means of making an investment similar to an investment in gold. An investment in physical gold requires expensive and sometimes complicated arrangements in connection with the assay, transportation, warehousing and insurance of the metal. Traditionally, such expense and complications have resulted in investments in physical gold being efficient only in amounts beyond the reach of many investors. The Shares have been designed to remove the obstacles represented by the expense and complications involved in an investment in physical gold, while at the same time having an intrinsic value that reflects, at any given time, the price of the gold owned by the Trust at such time, less the Trust’s expenses and liabilities. Although the Shares are not the exact equivalent of an investment in gold, they provide investors with an alternative that allows a level of participation in the gold market through the securities market.

An investment in Shares is:

Backed by gold held by the Custodian on behalf of the Trust.

The Shares are backed by the assets of the Trust. The Trustee’s arrangements with the Custodian contemplate that at the end of each business day there can be in the Trust account maintained by the Custodian no gold in an unallocated form. The Trust’s gold holdings are represented by physical gold, are identified on the Custodian’s or, if applicable, sub-custodian’s, books as the property of the Trust, and are held by the Custodian in New York, London and other locations that may be authorized in the future.

As accessible and easy to handle as any other investment in shares.

Retail investors may purchase and sell Shares through traditional brokerage accounts. Because the intrinsic value of each Share is a function of the price of only a fraction of an ounce of gold held by the Trust, the cash outlay necessary for an investment in Shares should be less than the amount required for currently existing means of investing in physical gold. Shares are eligible for margin accounts.

Listed.

The Shares are listed and trade on NYSE Arca, Inc. (“NYSE Arca”) under the ticker symbol IAU.

Relatively cost-efficient.

Because the expenses involved in an investment in physical gold are dispersed among all holders of Shares, an investment in Shares may represent a cost-efficient alternative to investments in physical gold for investors not otherwise in a position to participate directly in the market for physical gold.

Secondary Market Trading

While the Trust seeks to reflect generally the performance of the price of gold less the Trust’s expenses and liabilities, Shares may trade at, above or below their net asset value per Share (the “NAV”). The NAV of the Shares will fluctuate with changes in the market value of the Trust’s assets. The trading prices of Shares will fluctuate in accordance with changes in their NAV, as well as market supply and demand. The amount of the discount or premium in the trading price relative to the NAV may be influenced by non-concurrent trading hours between the major gold markets and NYSE Arca. While the Shares trade on NYSE Arca until 4:00 p.m. (New York time), liquidity in the market for gold may be reduced after the close of the major world gold markets, including London, Zurich and the Commodity Exchange, Inc. (“COMEX”) in Chicago. As a result, during this time, trading spreads, and the resulting premium or discount, on Shares may widen. However, given that Baskets can be created and redeemed in exchange for the underlying amount of gold, the Sponsor believes that the arbitrage opportunities may provide a mechanism to mitigate the effect of such premium or discount.

The Trust is not registered as an investment company for purposes of U.S. federal securities laws, and is not subject to regulation by the SEC as an investment company. Consequently, the owners of Shares do not have the regulatory protections provided to investors in registered investment companies. For example, the provisions of the Investment Company Act of 1940, as amended (the “Investment Company Act”), that limit transactions with affiliates, prohibit the suspension of redemptions (except under certain limited circumstances) or limit sales loads, among others, do not apply to the Trust.

The Trust does not hold or trade in commodity futures contracts or any other instruments regulated by the U.S. Commodity Exchange Act (the “CEA”), as administered by the U.S. Commodity Futures Trading Commission (the “CFTC”). Furthermore, the Trust is not a commodity pool for purposes of the CEA. Consequently, the Trustee and the Sponsor are not subject to registration as commodity pool operators with respect to the Trust. The owners of Shares do not receive the CEA disclosure document and certified annual report required to be delivered by the registered commodity pool operator with respect to a commodity pool, and the owners of Shares do not have the regulatory protections provided to investors in commodity pools operated by registered commodity pool operators.

Custody of the Trust’s Gold

The Custodian is responsible for safekeeping the Trust’s gold. The Custodian may keep the Trust’s gold at locations in New York, Toronto or London, or with the consent of the Trustee and the Sponsor, in other places. The Custodian may, at its own expense and risk, use sub-custodians to discharge its obligations to the Trust. The Custodian will remain responsible to the Trust for any gold held by any sub-custodian appointed by the Custodian to the same extent as if such gold were held by the Custodian itself.

The Custodian has agreed to use reasonable care in the performance of its duties to the Trust, and will only be responsible for any loss or damage suffered by the Trust as a direct result of the Custodian’s negligence, fraud or willful default in the performance of its duties. The Custodian’s liability is limited to the value of any gold lost, or the amount of any balance held on an unallocated basis, at the time of the Custodian’s negligence, fraud or willful default.

None of the Custodian, or its directors, employees, agents or affiliates will incur any liability to the Trust if, by reason of any law or regulation, or of an act of God, terrorism or other circumstance beyond the Custodian’s control, the Custodian is prevented or forbidden from, or delayed in, performing its obligations to the Trust. The Custodian has agreed to indemnify the Trustee for any loss or liability directly resulting from a breach of the Custodian’s representations and warranties in the custodian agreement between the Trustee and the Custodian (the “Custodian Agreement”), a failure of the Custodian to act in accordance with the Trustee’s instructions or any physical loss, destruction or damage to the gold held for the Trust’s account, except for losses due to nuclear fission or fusion, radioactivity, war, terrorist event, invasion, insurrection, civil commotion, riot, strike, act of government or public authority, act of God, or a similar cause that is beyond the control of the Custodian for which the Custodian will not be responsible to the Trust.

The Custodian has agreed to maintain insurance in support of its custodial obligations under the Custodian Agreement, including covering any loss of gold. The Custodian has the right to reduce, cancel or allow to expire without replacement such insurance coverage, provided that it gives prior written notice to the Trustee. In the case of a cancellation or expiration without replacement, the required notice must be at least 30 days prior to the last day of coverage. The Trustee has not received from the Custodian any notice of reduction, cancellation or expiration of its insurance coverage. The insurance is held for the benefit of the Custodian, not for the benefit of the Trust or the Trustee, and the Trustee may not submit a claim under the insurance maintained by the Custodian.

The Custodian has agreed to grant to the officers and properly designated representatives of the Trustee and to the independent public accountants for the Trust access to the Custodian’s records for the purpose of confirming the content of those records. Upon at least ten days’ prior notice, any such officer or properly designated representative, any independent public accountants for the Trust and any person designated by any regulatory authority having jurisdiction over the Trustee or the Trust is entitled to examine on the Custodian’s premises the gold held by the Custodian and the records regarding the gold held for the account of the Custodian at a sub-custodian. The Custodian has agreed that it will only retain sub-custodians if they agree to grant to the Trustee and the independent registered public accounting firm of the Trust access to records and inspection rights similar to those set forth above. During the period covered by this report, Inspectorate America Corporation and Inspectorate International Ltd., acting as authorized representatives of the Trustee pursuant to the foregoing provisions, inspected on two separate occasions the premises where the Trust’s gold is warehoused and on September 3, 2020 and December 1, 2020 issued their reports summarizing their findings. Such reports are posted by the Sponsor on the Trust’s website.

Valuation of Gold; Computation of Net Asset Value

On each business day, as soon as practicable after 4:00 p.m. (New York time), the Trustee evaluates the gold held by the Trust and determines the net asset value of the Trust and the NAV. For purposes of making these calculations, a business day means any day other than a day when NYSE Arca is closed for regular trading.

The Trustee values the gold held by the Trust using that day’s London Bullion Market Association (“LBMA”) Gold Price PM.

LBMA Gold Price is the price per troy ounce, in U.S. dollars, of unallocated gold delivered in London determined by ICE Benchmark Administration (“IBA”) following an electronic auction consisting of one or more 30-second rounds starting at 10:30 a.m. (London time) (in the case of LBMA Gold Price AM) or 3:00 p.m. (London time) (in the case of LBMA Gold Price PM) on each day that the London gold market is open for business, and published shortly thereafter. At the start of each round of auction, IBA publishes a price for that round. Participants then have 30 seconds to enter, change or cancel their orders (i.e., how much gold they want to buy or sell at that price). At the end of each round, order entry is frozen, and the system checks to see if the imbalance (i.e., the difference between buying and selling) is within the threshold (normally 10,000 troy ounces for gold). If the imbalance is outside the threshold at the end of a round, then the auction is not balanced, the price is adjusted and a new round starts. If the imbalance is within the threshold then the auction is finished, and the price is set as the LBMA Gold Price AM or LBMA Gold Price PM, as appropriate, for that day. Any imbalance is shared equally between all direct participants (even if they did not place orders or did not log in), and the net volume for each participant trades at the final price. The prices during the auction are determined by an algorithm that takes into account current market conditions and activity in the auction. Each auction is actively supervised by IBA staff. As of the date of this report, information publicly available on IBA’s website indicates that the direct participants currently qualified to submit orders during the electronic auctions used for the daily determination of the LBMA Gold Price are Bank of China, Bank of Communications, Citibank, N.A. London Branch, Coins ‘N’ Things Inc., Goldman Sachs International plc, HSBC Bank USA NA, Industrial and Commercial Bank of China (ICBC), StoneX Financial Ltd, Jane Street Global Trading, LLC, JP Morgan Chase Bank, N.A. London Branch, Koch Supply and Trading LP, Marex Financial Limited, Morgan Stanley, Standard Chartered Bank, and Toronto- Dominion Bank.

If there is no LBMA Gold Price PM on any day, the Trustee is authorized to use the most recently announced LBMA Gold Price AM unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate as a basis for evaluation. Once the value of the Trust’s gold has been determined, the Trustee subtracts all accrued fees, expenses and other liabilities of the Trust from the total value of the gold and all other assets of the Trust. The resulting figure is the net asset value of the Trust. The Trustee determines the NAV by dividing the net asset value of the Trust by the number of Shares outstanding on the day the computation is made.

Trust Expenses

The Trust’s only ordinary recurring expense is expected to be the Sponsor’s fee. In exchange for the Sponsor’s fee, the Sponsor has agreed to assume the following administrative and marketing expenses incurred by the Trust: the Trustee’s fee, the Custodian’s fee, NYSE Arca listing fees, SEC registration fees, printing and mailing costs, audit fees and expenses, and up to $100,000 per annum in legal fees and expenses.

The Sponsor’s fee is accrued daily at an annualized rate equal to 0.25% of the net asset value of the Trust and is payable monthly in arrears. The Trustee will, when directed by the Sponsor, and, in the absence of such direction, may, in its discretion, sell gold in such quantity and at such times, as may be necessary to permit payment of the Sponsor’s fee and of Trust expenses or liabilities not assumed by the Sponsor. The Trustee is authorized to sell gold at such times and in the smallest amounts required to permit such payments as they become due, it being the intention to avoid or minimize the Trust’s holdings of assets other than gold. Accordingly, the amount of gold to be sold will vary from time to time depending on the level of the Trust’s expenses and the market price of gold. The Custodian has agreed to purchase from the Trust, at the request of the Trustee, gold needed to cover Trust expenses at a price equal to the price used by the Trustee to determine the value of the gold held by the Trust on the date of the sale. Cash held by the Trustee pending payment of the Trust’s expenses will not bear any interest.

The Sponsor earned $65,443,749 for the year ended December 31, 2020. Each sale of gold by the Trust will be a taxable event to Shareholders. See “United States Federal Income Tax Consequences --Taxation of U.S. Shareholders.”

Deposit of Gold; Issuance of Baskets

The Trust issues and redeems Shares on a continuous basis but only in Baskets of 50,000 Shares. Only registered broker-dealers who have entered into written agreements with the Sponsor and the Trustee (each, an “Authorized Participant”) can deposit gold and receive Baskets in exchange. Upon the deposit of the corresponding amount of gold with the Custodian, and the payment of the Trustee’s applicable fee and of any expenses, taxes or charges (such as stamp taxes or stock transfer taxes or fees), the Trustee will deliver the appropriate number of Baskets to the Depository Trust Company account of the depositing Authorized Participant. As of the date of this report, ABN AMRO Clearing Chicago LLC, Barclays Capital Inc., Citigroup Global Markets, Inc., Credit Suisse Securities (USA), LLC, Deutsche Bank Securities Inc., Goldman Sachs & Co., HSBC Securities (USA) LLC, J.P. Morgan Securities, Inc., Merrill Lynch Professional Clearing Corp., Morgan Stanley & Co. LLC, Scotia Capital (USA) Inc., UBS Securities LLC, Virtu Americas LLC and Virtu Financial BD LLC are the only Authorized Participants. The Sponsor and the Trustee maintain a current list of Authorized Participants. Gold deposited with the Custodian must meet the specifications for weight, dimensions, fineness (or purity), identifying marks and appearance of gold bars and as of January 1, 2020, must be produced by refiners that meet certain throughput and tangible net worth requirements as set forth in “Good Delivery List Rules - Conditions for Listing for Good Delivery Refiners” published by the LBMA.

Before making a deposit, the Authorized Participant must deliver to the Trustee a written purchase order, or submit a purchase order through the Trustee’s electronic order entry system, indicating the number of Baskets it intends to acquire and the location or locations where it expects to make the corresponding deposit of gold with the Custodian. The Trustee will acknowledge the purchase order unless it or the Sponsor decides to refuse the deposit. The date the Trustee receives that order determines the amount of gold the Authorized Participant needs to deposit (such amount, the “Basket Gold Amount”). However, orders received by the Trustee after 3:59 p.m. (New York time) on a business day will not be accepted and should be resubmitted on the next following business day. The Trustee has entered into an agreement with the Custodian which contains arrangements so that gold can be delivered to the Custodian in New York, Toronto, London or at other locations that may be authorized in the future.

If the Trustee accepts the purchase order, it transmits to the Authorized Participant, via facsimile or electronic mail message, no later than 5:00 p.m. (New York time) on the date such purchase order is received, or deemed received, a copy of the purchase order endorsed “Accepted” by the Trustee and indicating the Basket Gold Amount that the Authorized Participant must deliver to the Custodian in exchange for each Basket. In the case of purchase orders submitted via the Trustee’s electronic order system, the Authorized Participant will receive an automated email indicating the acceptance of the purchase order and the purchase order will be marked “Accepted” in the Trustee’s electronic order system. Prior to the Trustee’s acceptance as specified above, a purchase order only represents the Authorized Participant’s unilateral offer to deposit gold in exchange for Baskets and has no binding effect upon the Trust, the Trustee, the Custodian or any other party.

The Basket Gold Amount necessary for the creation of a Basket changes from day to day. At the creation of the Trust, the initial Basket Gold Amount was 5,000 ounces of gold. On each day that NYSE Arca is open for regular trading, the Trustee adjusts the quantity of gold constituting the Basket Gold Amount as appropriate to reflect sales of gold, any loss of gold that may occur, and accrued expenses. The computation is made by the Trustee as promptly as practicable after 4:00 p.m. (New York time). See “Valuation of Gold; Computation of Net Asset Value” for a description of how the LBMA Gold Price PM is determined, and description of how the Trustee determines the NAV. The Trustee determines the Basket Gold Amount for a given day by multiplying the NAV by the number of Shares in each Basket (50,000) and dividing the resulting product by that day’s LBMA Gold Price PM. Fractions of a fine ounce of gold smaller than 0.001 fine ounce are disregarded for purposes of the computation of the Basket Gold Amount. The Basket Gold Amount so determined is communicated via facsimile or electronic mail message to all Authorized Participants, and made available on the Sponsor’s website for the Shares. NYSE Arca also publishes the Basket Gold Amount determined by the Trustee as indicated above.

Because the Sponsor has assumed what are expected to be most of the Trust’s expenses and the Sponsor’s fee accrues daily at the same rate, in the absence of any extraordinary expenses or liabilities, the amount of gold by which the Basket Gold Amount decreases each day is predictable. The Trustee intends to make available on each business day through the same channels used to disseminate the actual Basket Gold Amount determined by the Trustee as indicated above an indicative Basket Gold Amount for the next business day. Authorized Participants may use that indicative Basket Gold Amount as guidance regarding the amount of gold that they may expect to have to deposit with the Custodian in respect of purchase orders placed by them on such next business day and accepted by the Trustee. The agreement entered into with each Authorized Participant provides, however, that once a purchase order has been accepted by the Trustee, the Authorized Participant will be required to deposit with the Custodian the Basket Gold Amount determined by the Trustee on the effective date of the purchase order.

No Shares are issued unless and until the Custodian has informed the Trustee that it has allocated to the Trust’s account the corresponding amount of gold.

Redemption of Baskets; Withdrawal of Gold

Authorized Participants, acting on authority of the registered holder of Shares, may surrender Baskets in exchange for the corresponding Basket Gold Amount announced by the Trustee. Upon the surrender of such Shares and the payment of the Trustee’s applicable fee and of any expenses, taxes or charges (such as stamp taxes or stock transfer taxes or fees), the Trustee will deliver to the order of the redeeming Authorized Participant the amount of gold corresponding to the redeemed Baskets. Shares can only be surrendered for redemption in Baskets of 50,000 Shares each.

Before surrendering Baskets for redemption, an Authorized Participant must deliver to the Trustee a written request, or submit a redemption order through the Trustee’s electronic order entry system, indicating the number of Baskets it intends to redeem and the location where it would like to take delivery of the gold represented by such Baskets. The date the Trustee receives that order determines the Basket Gold Amount to be received in exchange. However, orders received by the Trustee after 3:59 p.m. (New York time) on a business day will not be accepted and should be resubmitted on the next following business day.

The Custodian may make the gold available for collection at its office or at the office of a sub-custodian if the gold is being held by a sub-custodian. Gold is delivered at the locations designated by the Trustee, in consultation with the Custodian. Redeeming Authorized Participants are entitled to express a preference as to where they would like to have gold delivered, but have no right to receive delivery at a specified location. All taxes incurred in connection with the delivery of gold to the Custodian in exchange for Baskets (including any applicable value added tax) will be the sole responsibility of the Authorized Participant making such delivery.

Unless otherwise agreed to by the Custodian, gold is delivered to the redeeming Authorized Participants in the form of physical bars only (except that any amount of less than 430 ounces may be transferred to an unallocated account of or as ordered by, the redeeming Authorized Participant).

Redemptions of Baskets may be suspended only (1) during any period in which regular trading on NYSE Arca is suspended or restricted or the exchange is closed (other than scheduled holiday or weekend closings), or (2) during an emergency as a result of which delivery, disposal or evaluation of gold is not reasonably practicable.

Fees and Expenses of the Trustee

Each deposit of gold for the creation of Baskets and each surrender of Baskets for the purpose of withdrawing Trust property (including if the trust agreement between the Trustee and the Sponsor (the “Trust Agreement”) terminates) must be accompanied by a payment to the Trustee of a fee of $500 (or such other fee as the Trustee, with the prior written consent of the Sponsor, may from time to time announce).

The Trustee is entitled to reimburse itself from the assets of the Trust for all expenses and disbursements incurred by it for extraordinary services it may provide to the Trust or in connection with any discretionary action the Trustee may take to protect the Trust or the interests of the holders.

Trust Expenses and Gold Sales

In addition to the fee payable to the Sponsor, the following expenses are paid out of the assets of the Trust:

| ● |

any expenses or liabilities of the Trust that are not assumed by the Sponsor; |

| ● |

any taxes and other governmental charges that may fall on the Trust or its property; |

| ● |

expenses and costs of any action taken by the Trustee or the Sponsor to protect the Trust and the rights and interests of holders of Shares; and |

| ● |

any indemnification of the Sponsor as described below. |

The Trustee will, when directed by the Sponsor, and, in the absence of such direction, may, in its discretion, sell the Trust’s gold from time to time as necessary to permit payment of the fees and expenses that the Trust is required to pay. See “Trust Expenses.”

The Trustee is not responsible for any depreciation or loss incurred by reason of sales of gold made in compliance with the Trust Agreement.

Payment of Taxes

The Trustee may deduct the amount of any taxes owed from any distributions it makes. It may also sell Trust assets, by public or private sale, to pay any taxes owed. Registered holders of Shares will remain liable if the proceeds of the sale are not enough to pay the taxes.

UNITED STATES FEDERAL INCOME TAX CONSEQUENCES

The following discussion of the material United States federal income tax consequences that generally will apply to the purchase, ownership and disposition of Shares by a U.S. Shareholder (as defined below), and certain United States federal income consequences that may apply to an investment in Shares by a Non-U.S. Shareholder (as defined below), represents, insofar as it describes conclusions as to United States federal income tax law and subject to the limitations and qualifications described therein, the opinion of Clifford Chance US LLP, special United States federal income tax counsel to the Sponsor. This is based on the United States Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations promulgated thereunder and judicial and administrative interpretations of the Code, all as in effect on the date of this report and all of which are subject to change either prospectively or retroactively. The tax treatment of owners of beneficial interests in the Shares (“Shareholders”) may vary depending upon their own particular circumstances. Certain Shareholders (including banks, financial institutions, insurance companies, tax-exempt organizations, broker-dealers, traders, Shareholders that are partnerships for United States federal income tax purposes, persons holding Shares as a position in a “hedging,” “straddle,” “conversion,” or “constructive sale” transaction for United States federal income tax purposes, persons whose “functional currency” is not the U.S. dollar, or other investors with special circumstances) may be subject to special rules not discussed below. In addition, the following discussion applies only to investors who will hold Shares as “capital assets” within the meaning of Section 1221 of the Code. Moreover, the discussion below does not address the effect of any state, local or foreign tax law on an owner of Shares. Purchasers of Shares are urged to consult their own tax advisers with respect to all federal, state, local and foreign tax law considerations potentially applicable to their investment in Shares.

For purposes of this discussion, a “U.S. Shareholder” is a Shareholder that is:

| ● |

an individual who is treated as a citizen or resident of the United States for United States federal income tax purposes; |

| ● |

a corporation (or entity treated as a corporation for United States federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia; |

| ● |

an estate, the income of which is includible in gross income for United States federal income tax purposes regardless of its source; or |

| ● |

a trust, if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more United States persons have the authority to control all substantial decisions of the trust, or a trust that has made a valid election under applicable Treasury Regulations to be treated as a domestic trust. |

A Shareholder that is not (1) a U.S. Shareholder as defined above or (2) a partnership for United States federal income tax purposes, is considered a “Non‑U.S. Shareholder” for purposes of this discussion.

Taxation of the Trust

The Sponsor and the Trustee will treat the Trust as a grantor trust for United States federal income tax purposes. In the opinion of Clifford Chance US LLP, special United States federal income tax counsel to the Sponsor, the Trust will be classified as a grantor trust for United States federal income tax purposes. As a result, the Trust itself will not be subject to United States federal income tax. Instead, the Trust’s income and expenses will flow through to the Shareholders, and the Trustee will report the Trust’s income, gains, losses and deductions to the Internal Revenue Service (“IRS”) on that basis. The opinion of Clifford Chance US LLP represents only its best legal judgment and is not binding on the IRS or any court. Accordingly, there can be no assurance that the IRS will agree with the conclusions of counsel’s opinion and it is possible that the IRS or another tax authority could assert a position contrary to one or all of those conclusions and that a court could sustain that contrary position. Neither the Sponsor nor the Trustee will request a ruling from the IRS with respect to the classification of the Trust for United States federal income tax purposes. If the IRS were to assert successfully that the Trust is not classified as a grantor trust, the Trust would be classified as a partnership for United States federal income tax purposes, which may affect timing and other tax consequences to the Shareholders.

The following discussion assumes that the Trust will be classified as a grantor trust for United States federal income tax purposes.

Taxation of U.S. Shareholders

Shareholders will be treated, for United States federal income tax purposes, as if they directly owned a pro rata share of the underlying assets held in the Trust. Shareholders also will be treated as if they directly received their respective pro rata shares of the Trust’s income, if any, and as if they directly incurred their respective pro rata shares of the Trust’s expenses. In the case of a Shareholder that purchases Shares for cash, its initial tax basis in its pro rata share of the assets held in the Trust at the time it acquires its Shares will be equal to its cost of acquiring the Shares. In the case of a Shareholder that acquires its Shares as part of a creation of a Basket, the delivery of gold to the Trust in exchange for the underlying gold represented by the Shares will not be a taxable event to the Shareholder, and the Shareholder’s tax basis and holding period for the Shareholder’s pro rata share of the gold held in the Trust will be the same as its tax basis and holding period for the gold delivered in exchange therefor. For purposes of this discussion, and unless stated otherwise, it is assumed that all of a Shareholder’s Shares are acquired on the same date and at the same price per Share. Shareholders that hold multiple lots of Shares, or that are contemplating acquiring multiple lots of Shares, should consult their own tax advisers as to the determination of the tax basis and holding period for the underlying gold related to such Shares.

When the Trust sells gold, for example to pay expenses, a Shareholder will recognize gain or loss in an amount equal to the difference between (1) the Shareholder’s pro rata share of the amount realized by the Trust upon the sale and (2) the Shareholder’s tax basis for its pro rata share of the gold that was sold. A Shareholder’s tax basis for its share of any gold sold by the Trust generally will be determined by multiplying the Shareholder’s total basis for its share of all of the gold held in the Trust immediately prior to the sale, by a fraction the numerator of which is the amount of gold sold, and the denominator of which is the total amount of the gold held in the Trust immediately prior to the sale. After any such sale, a Shareholder’s tax basis for its pro rata share of the gold remaining in the Trust will be equal to its tax basis for its share of the total amount of the gold held in the Trust immediately prior to the sale, less the portion of such basis allocable to its share of the gold that was sold. The delivery to the Trust of gold in specified denominations (e.g., COMEX gold in denominations of 100 ounces) and the subsequent delivery by the Trust of gold in different denominations (e.g., LBMA gold in denominations of 400 ounces) will not constitute a taxable event.

Upon a Shareholder’s sale of some or all of its Shares, the Shareholder will be treated as having sold the portion of its pro rata share of the gold held in the Trust at the time of the sale that is attributable to the Shares sold. Accordingly, the Shareholder generally will recognize gain or loss on the sale in an amount equal to the difference between (1) the amount realized pursuant to the sale of the Shares and (2) the Shareholder’s tax basis for the portion of its pro rata share of the gold held in the Trust at the time of sale that is attributable to the Shares sold, as determined in the manner described in the preceding paragraph.

A redemption of some or all of a Shareholder’s Shares in exchange for the underlying gold represented by the Shares redeemed generally will not be a taxable event to the Shareholder. In addition, a Shareholder that acquires its Shares as part of a creation of a Basket by the delivery to the Trust of gold in specified denominations (e.g., COMEX gold in denominations of 100 ounces), the subsequent redemption of its Shares for gold delivered by the Trust in different denominations (e.g., LBMA gold in denominations of 400 ounces) will not constitute a taxable event, provided that the amount of gold received upon redemption contains the equivalent metallic content of the gold delivered upon creation, less amounts accrued or sold to pay the Trust’s expenses and other charges. The Shareholder’s tax basis for the gold received in the redemption generally will be the same as the Shareholder’s tax basis for the portion of its pro rata share of the gold held in the Trust immediately prior to the redemption that is attributable to the Shares redeemed. The Shareholder’s holding period with respect to the gold received should include the period during which the Shareholder held the Shares redeemed. A subsequent sale of the gold received by the Shareholder will be a taxable event.

After any sale or redemption of less than all of a Shareholder’s Shares, the Shareholder’s tax basis for its pro rata share of the gold held in the Trust immediately after such sale or redemption generally will be equal to its tax basis for its share of the total amount of the gold held in the Trust immediately prior to the sale or redemption, less the portion of such basis which is taken into account in determining the amount of gain or loss recognized by the Shareholder upon such sale or, in the case of a redemption, is treated as the basis of the gold received by the Shareholder in the redemption.

Maximum 28% Long-Term Capital Gains Tax Rate for U.S. Shareholders Who Are Individuals

Under current law, gains recognized by individuals from the sale of “collectibles”, including gold, held for more than one year are taxed at a maximum rate of 28%, rather than the current maximum 20% rate applicable to most other long-term capital gains. For these purposes, gain recognized by an individual upon the sale of an interest in a trust that holds collectibles is treated as gain recognized on the sale of collectibles, to the extent that the gain is attributable to unrealized appreciation in value of the collectibles held by the Trust. Therefore, any gain recognized by an individual U.S. Shareholder attributable to a sale of Shares held for more than one year, or attributable to the Trust’s sale of any gold which the Shareholder is treated (through its ownership of Shares) as having held for more than one year, generally will be taxed at a maximum rate of 28%. The tax rates for capital gains recognized upon the sale of assets held by an individual U.S. Shareholder for one year or less or by a taxpayer other than an individual United States taxpayer are generally the same as those at which ordinary income is taxed.

3.8% Tax on Net Investment Income

Certain U.S. Shareholders who are individuals are required to pay a 3.8% tax on the lesser of the excess of their modified adjusted gross income over a threshold amount ($250,000 for married persons filing jointly and $200,000 for single taxpayers) or their “net investment income”, which generally includes capital gains from the disposition of property. This tax is in addition to any capital gains taxes due on such investment income. A similar tax will apply to estates and trusts. U.S. Shareholders should consult their own tax advisers regarding the effect, if any, this law may have on their investment in the Shares.

Brokerage Fees and Trust Expenses

Any brokerage or other transaction fee incurred by a Shareholder in purchasing Shares will be treated as part of the Shareholder’s tax basis in the underlying assets of the Trust. Similarly, any brokerage fee incurred by a Shareholder in selling Shares will reduce the amount realized by the Shareholder with respect to the sale.

Shareholders will be required to recognize the full amount of gain or loss upon a sale of gold by the Trust (as discussed above), even though some or all of the proceeds of such sale are used by the Trustee to pay Trust expenses. Shareholders may deduct their respective pro rata shares of each expense incurred by the Trust to the same extent as if they directly incurred the expense. Shareholders who are individuals, estates or trusts, or certain closely held corporations, however, may be subject to various limitations on their ability to use their allocable share of the Trust’s deductions and losses. Prospective Shareholders should consult their own tax advisers regarding the United States federal income tax consequences of holding Shares in light of their particular circumstance.

Investment by U.S. Tax-Exempt Shareholders

Certain U.S. Shareholders (“U.S. Tax-Exempt Shareholders”) are subject to United States federal income tax only on their unrelated business taxable income (“UBTI”). Unless they incur debt in order to purchase Shares, it is expected that U.S. Tax-Exempt Shareholders should not realize UBTI in respect of income or gains from the Shares. U.S. Tax-Exempt Shareholders should consult their own independent tax advisers regarding the United States federal income tax consequences of holding Shares in light of their particular circumstances.

Investment by Regulated Investment Companies

Mutual funds and other investment vehicles which are “regulated investment companies” within the meaning of Code Section 851 should consult with their tax advisers concerning (1) the likelihood that an investment in Shares, although they are a “security” within the meaning of the Investment Company Act, may be considered an investment in the underlying gold for purposes of Code Section 851(b) and (2) the extent to which an investment in Shares might nevertheless be consistent with preservation of their qualification under Code Section 851.

Investment by Certain Retirement Plans

Section 408(m) of the Code provides that the purchase of a “collectible” as an investment for an individual retirement account (“IRA”), or for a participant‑directed account maintained under any plan that is tax-qualified under Section 401(a) of the Code, is treated as a taxable distribution from the account to the owner of the IRA, or to the participant for whom the plan account is maintained, of an amount equal to the cost to the account of acquiring the collectible. The Trust has received a private letter ruling from the IRS which provides that the purchase of Shares by an IRA or a participant-directed account maintained under a plan that is tax-qualified under Section 401(a) of the Code, will not constitute the acquisition of a collectible or be treated as resulting in a taxable distribution to the IRA owner or plan participant under Code Section 408(m). However, in the event any redemption of Shares results in the distribution of gold bullion to an IRA or a participant-directed account maintained under a plan that is tax-qualified under Section 401(a) of the Code, such distribution would constitute the acquisition of a collectible to the extent provided under Section 408(m) of the Code. See “ERISA and Related Considerations.”

Taxation of Non-U.S. Shareholders

A Non-U.S. Shareholder generally will not be subject to United States federal income tax with respect to gain recognized upon the sale or other disposition of Shares, or upon the sale of gold by the Trust, unless (1) the Non-U.S. Shareholder is an individual and is present in the United States for 183 days or more during the taxable year of the sale or other disposition, and the gain is treated as being from United States sources or (2) the gain is effectively connected with the conduct by the Non-U.S. Shareholder of a trade or business in the United States and certain other conditions are met.

United States Information Reporting and Backup Withholding

The Trustee will file certain information returns with the IRS, and provide certain tax-related information to Shareholders, in connection with the Trust. Each Shareholder will be provided with information regarding its allocable portion of the Trust’s annual income (if any) and expenses. A U.S. Shareholder may be subject to United States backup withholding tax in certain circumstances unless it provides its taxpayer identification number and complies with certain certification procedures. Non-U.S. Shareholders may have to comply with certification procedures to establish that they are not a United States person in order to avoid the information reporting and backup withholding tax requirements.

The amount of any backup withholding will be allowed as a credit against a Shareholder’s United States federal income tax liability and may entitle such a Shareholder to a refund, provided that the required information is furnished to the IRS in a timely manner.

Taxation in Jurisdictions Other Than the United States

Prospective purchasers of Shares that are based in or acting out of a jurisdiction other than the United States are advised to consult their own tax advisers as to the tax consequences, under the laws of such jurisdiction (or any other jurisdiction other than the United States to which they are subject), of their purchase, holding, sale and redemption of or any other dealing in Shares and, in particular, as to whether any value added tax, other consumption tax or transfer tax is payable in relation to such purchase, holding, sale, redemption or other dealing.

ERISA AND RELATED CONSIDERATIONS

The Employee Retirement Income Security Act of 1974 (“ERISA”) and/or Section 4975 of the Code impose certain requirements on: (i) employee benefit plans and certain other plans and arrangements, including individual retirement accounts and annuities, Keogh plans and certain collective investment funds or insurance company general or separate accounts in which such plans or arrangements are invested, that are subject to Title I of ERISA and/or Section 4975 of the Code (collectively, “Plans”); and (ii) persons who are fiduciaries with respect to the investment of assets treated as “plan assets” within the meaning of U.S. Department of Labor (“DOL”) regulation 29 C.F.R. § 2510.3-101, as modified by Section 3(42) of ERISA (the “Plan Assets Regulation”), of a Plan. Investments by Plans are subject to the fiduciary requirements and the applicability of prohibited transaction restrictions under ERISA and the Code.

“Governmental plans” within the meaning of Section 3(32) of ERISA, certain “church plans” within the meaning of Section 3(33) of ERISA and “non-U.S. plans” described in Section 4(b)(4) of ERISA, while not subject to the fiduciary responsibility and prohibited transaction provisions of Title I of ERISA or Section 4975 of the Code, may be subject to any federal, state, local, non-U.S. or other law or regulation that is substantially similar to the foregoing provisions of ERISA and the Code. Fiduciaries of any such plans are advised to consult with their counsel prior to an investment in the Shares.

In contemplating an investment of a portion of Plan assets in the Shares, the Plan fiduciary responsible for making such investment should carefully consider, taking into account the facts and circumstances of the Plan, the “Risk Factors” discussed below and whether such investment is consistent with its fiduciary responsibilities. The Plan fiduciary should consider, among other issues, whether: (1) the fiduciary has the authority to make the investment under the appropriate governing plan instrument; (2) the investment would constitute a direct or indirect non-exempt prohibited transaction with a “party in interest” or a “disqualified person” within the meaning of ERISA and Section 4975 of the Code respectively; (3) the investment is in accordance with the Plan’s funding objectives; and (4) such investment is appropriate for the Plan under the general fiduciary standards of investment prudence and diversification, taking into account the overall investment policy of the Plan, the composition of the Plan’s investment portfolio and the Plan’s need for sufficient liquidity to pay benefits when due. When evaluating the prudence of an investment in the Shares, the Plan fiduciary should consider the DOL’s regulation on investment duties, which can be found at 29 C.F.R. § 2550.404a-1.

It is intended that: (a) none of the Sponsor, the Trustee, the Custodian or any of their respective affiliates (the “Transaction Parties”) has through this report and related materials provided any investment advice within the meaning of Section 3(21) of ERISA to the Plan in connection with the decision to purchase or acquire such Shares; and (b) the information provided in this report and related materials will not make a Transaction Party a fiduciary to the Plan.

Risks Related to Gold

Actual or perceived disruptions in the processes used to determine the LBMA Gold Price PM, or lack of confidence in that benchmark, may adversely affect the return on your investment in the Shares (if any).

Because the objective of the Trust is to reflect the performance of the price of gold, any disruptions affecting the processes related to how the market determines the price of gold will have an effect on the value of the Shares.

The LBMA Gold Price AM and LBMA Gold Price PM are gold price benchmark mechanisms administered by IBA, an independent specialist benchmark administrator appointed by the LBMA. Twice daily during London business hours, IBA hosts an electronic auction consisting of one or more 30-second rounds.

Investors should keep in mind that electronic markets are not exempt from failures, as the experiences of the initial public offerings of Facebook and BATS Global Markets illustrate. In addition, electronic trading platforms may be subject to influence by high-frequency traders with results that are highly contested by the industry, regulators and market observers.

As of the date of this filing, the LBMA Gold Price AM and LBMA Gold Price PM have been subjected to the test of actual trading markets for approximately five years. As with any innovation, it is possible that electronic failures or other unanticipated events may occur that could result in delays in the announcement of, or the inability of the system to produce, an LBMA Gold Price AM or LBMA Gold Price PM on any given day. In addition, if a perception were to develop that the LBMA Gold Price AM or LBMA Gold Price PM are vulnerable to manipulation attempts, or if the administration proceedings surrounding the determination and publication of the LBMA Gold Price AM or LBMA Gold Price PM were seen as unfair, biased or otherwise compromised by the markets, the behavior of investors and traders in gold may change, and those changes may have an effect on the price of gold (and, consequently, the value of the Shares). In any of these circumstances, the intervention of extraneous events disruptive of the normal interaction of supply and demand of gold at any given time may result in distorted prices and losses on an investment in the Shares that, but for such extraneous events, might not have occurred.

Other effects of disruptions in the determination of the LBMA Gold Price AM or LBMA Gold Price PM or any inaccuracies in setting of the auction prices on the operations of the Trust include the potential for an incorrect valuation of the Trust’s gold, an inaccurate computation of the Sponsor’s fee, and the sales of gold to cover Trust expenses at prices that do not accurately reflect the fundamentals of the gold market. Each of these events could have an adverse effect on the value of the Shares. The operation of the auction process which determines the LBMA Gold Price is also dependent on the continued operation of the LBMA and the IBA and their applicable systems.

The LBMA Gold Price AM and LBMA Gold Price PM are regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”).

As of the date of this filing, the Sponsor has no reason to believe that the LBMA Gold Price PM will not fairly represent the price of the gold held by the Trust. Should this situation change, the Sponsor expects to use the powers granted by the Trust’s governing documents to seek to replace the LBMA Gold Price PM with a more reliable indicator of the value of the Trust’s gold. There is no assurance that such alternative value indicator will be identified, or that the process of changing from the LBMA Gold Price PM to a new benchmark price will not adversely affect the price of the Shares.

Future governmental decisions may have significant impact on the price of gold, which may result in a significant decrease or increase in the value of the net assets and the net asset value of the Trust.

Generally, gold prices reflect the supply and demand of available gold. Governmental decisions, such as the executive order issued by the President of the United States in 1933 requiring all persons in the United States to deliver gold to the Federal Reserve or the abandonment of the gold standard by the United States in 1971, have been viewed as having significant impact on the supply and demand of gold and the price of gold. Future governmental decisions may have an impact on the price of gold and may result in a significant decrease or increase in the value of the net assets and the net asset value of the Trust. Further regulations applicable to U.S. banks and non-U.S. bank entities operating in the United States with respect to their trading in physical commodities, such as precious metals, may further impact the price of gold in the United States.

Because the Trust holds only gold, an investment in the Trust may be more volatile than an investment in a more broadly diversified portfolio.

The Trust holds only gold. As a result, the Trust’s holdings are not diversified. Accordingly, the Trust’s net asset value may be more volatile than another investment vehicle with a more broadly diversified portfolio and may fluctuate substantially over short or long periods of time. Fluctuations in the price of gold are expected to have a direct impact on the value of the Shares.

An investment in the Trust may be deemed speculative and is not intended as a complete investment program. An investment in Shares should be considered only by persons financially able to maintain their investment and who can bear the risk of loss associated with an investment in the Trust. Investors should review closely the objective and strategy and redemption provisions of the Trust, as discussed herein, and familiarize themselves with the risks associated with an investment in the Trust.

Risks Related to the Shares

Because the Shares are created to reflect the price of the gold held by the Trust, the market price of the Shares will be as unpredictable as the price of gold has historically been. This creates the potential for losses, regardless of whether you hold Shares for a short-, mid- or long-term period.

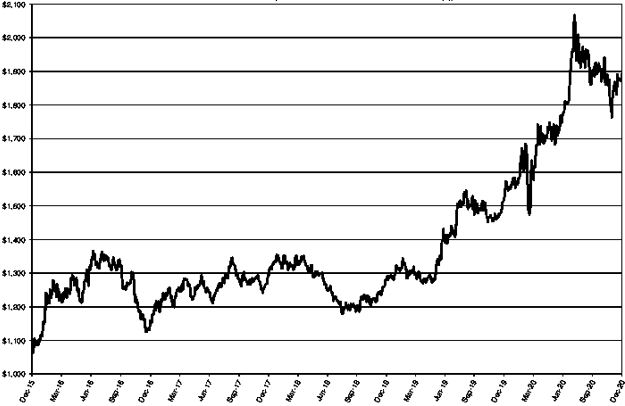

Shares are created to reflect, at any given time, the market price of gold owned by the Trust at that time less the Trust’s expenses and liabilities. Because the value of Shares depends on the price of gold, it is subject to fluctuations similar to those affecting gold prices. The price of gold has fluctuated widely over the past several years. If gold markets continue to be characterized by the wide fluctuations that they have shown in the past several years, the price of the Shares will change widely and in an unpredictable manner. This exposes your investment in Shares to potential losses if you need to sell your Shares at a time when the price of gold is lower than it was when you made your investment in Shares. Even if you are able to hold Shares for the mid- or long-term, you may never realize a profit, because gold markets have historically experienced extended periods of flat or declining prices.

Following an investment in Shares, several factors may have the effect of causing a decline in the prices of gold and a corresponding decline in the price of Shares. Among them:

| ● |

large sales, including those by the official sector (government, central banks and related institutions), which own a significant portion of the aggregate world holdings. If one or more of these institutions decide to sell in amounts large enough to cause a decline in world gold prices, the price of the Shares will be adversely affected; |

| ● |

a significant increase in gold hedging activity by gold producers. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the Shares; |

| ● |

a significant change in the attitude of speculators and investors towards gold. Should the speculative community take a negative view towards gold, a decline in world gold prices could occur, negatively impacting the price of the Shares; |

| ● |

global gold supply and demand, which is influenced by such factors as gold’s uses in jewelry, technology and industrial applications, purchases made by investors in the form of bars, coins and other gold products, forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries such as China, South Africa, the United States and Australia; |

| ● |

global or regional political, economic or financial events and situations, especially those unexpected in nature; |

| ● |

investors’ expectations with respect to the rate of inflation; |

| ● |

interest rates; |

| ● |

investment and trading activities of hedge funds and commodity funds; |

| ● |

other economic variables such as income growth, economic output and monetary policies; and |

| ● |

investor confidence. |

Conversely, several factors may trigger a temporary increase in the price of gold prior to your investment in the Shares. If that is the case, you will be buying Shares at prices affected by the temporarily high prices of gold, and you may incur losses when the causes for the temporary increase disappear.

Investors should be aware that while gold is used to preserve wealth by investors around the world, there is no assurance that gold will maintain its long‑term value in terms of future purchasing power. In the event the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately.

Furthermore, although gold has been used as a portfolio diversifier due to its historically low-to-negative correlation with stocks and bonds, diversification does not ensure against, nor can it prevent against, risk of loss.

The amount of gold represented by each Share will decrease over the life of the Trust due to the sales of gold necessary to pay the Sponsor’s fee and other Trust expenses. Without increases in the price of gold sufficient to compensate for that decrease, the price of the Shares will also decline and you will lose money on your investment in Shares.

Although the Sponsor has agreed to assume all organizational and certain ordinary administrative and marketing expenses incurred by the Trust, not all Trust expenses have been assumed by the Sponsor. For example, any taxes and other governmental charges that may be imposed on the Trust’s property will not be paid by the Sponsor. As part of its agreement to assume some of the Trust’s ordinary administrative expenses, the Sponsor has agreed to pay legal fees and expenses of the Trust not in excess of $100,000 per annum. Any legal fees and expenses in excess of that amount will be the responsibility of the Trust.

Because the Trust does not have any income, it needs to sell gold to cover the Sponsor’s fee and expenses not assumed by the Sponsor. The Trust may also be subject to other liabilities (for example, as a result of litigation) that have also not been assumed by the Sponsor. The only source of funds to cover those liabilities will be sales of gold held by the Trust. Even if there are no expenses other than those assumed by the Sponsor, and there are no other liabilities of the Trust, the Trustee will still need to sell gold to pay the Sponsor’s fee. The result of these sales is a decrease in the amount of gold represented by each Share. New deposits of gold, received in exchange for new Shares issued by the Trust, do not reverse this trend.

A decrease in the amount of gold represented by each Share results in a decrease in its price even if the price of gold has not changed. To retain the Share’s original price, the price of gold has to increase. Without that increase, the lesser amount of gold represented by the Share will have a correspondingly lower price. If these increases do not occur, or are not sufficient to counter the lesser amount of gold represented by each Share, you will sustain losses on your investment in Shares.

An increase in the Trust expenses not assumed by the Sponsor, or the existence of unexpected liabilities affecting the Trust, will force the Trustee to sell larger amounts of gold, and will result in a more rapid decrease of the amount of gold represented by each Share and a corresponding decrease in its value.

The Trust is a passive investment vehicle. This means that the value of your Shares may be adversely affected by Trust losses that, if the Trust had been actively managed, it might have been possible to avoid.

The Trustee does not actively manage the gold held by the Trust. This means that the Trustee does not sell gold at times when its price is high, or acquire gold at low prices in the expectation of future price increases. It also means that the Trustee does not make use of any of the hedging techniques available to professional gold investors to attempt to reduce the risks of losses resulting from price decreases. Any losses sustained by the Trust will adversely affect the value of your Shares.

The price received upon the sale of Shares may be less than the value of the gold represented by them.

The result obtained by subtracting the Trust’s expenses and liabilities on any day from the price of the gold owned by the Trust on that day is the net asset value of the Trust which, when divided by the number of Shares outstanding on that day, results in the NAV.

Shares may trade at, above or below their NAV. The NAV will fluctuate with changes in the market value of the Trust’s assets. The trading prices of Shares will fluctuate in accordance with changes in their NAVs as well as market supply and demand. The amount of the discount or premium in the trading price relative to the NAV may be influenced by non-concurrent trading hours between the major gold markets and NYSE Arca. While the Shares will trade on NYSE Arca until 4:00 p.m. (New York time), liquidity in the market for gold will be reduced after the close of the major world gold markets, including London, Zurich and the COMEX in Chicago. As a result, during this time, trading spreads, and the resulting premium or discount on Shares, may widen.

The costs inherent in buying or selling the Shares may detract significantly from investment results.

Buying or selling the Shares on an exchange involves two types of costs that apply to all securities transactions effectuated on an exchange. When buying or selling Shares through a broker or other intermediary, you will likely incur a brokerage commission or other charges imposed by that broker or intermediary. In addition, you may incur the cost of the “spread,” that is, the difference between what investors or market makers are willing to pay for the Shares (the “bid” price) and the price at which they are willing to sell the Shares (the “ask” price). Because of the costs inherent in buying or selling the Shares, frequent trading may detract significantly from investment results and an investment in the Shares may not be advisable for investors who anticipate regularly making small investments.

An investment in the Shares may be adversely affected by competition from other methods of investing in gold.

The Trust competes with other financial vehicles, including traditional debt and equity securities issued by companies in the gold industry and other securities backed by or linked to gold (including exchange-traded products), direct investments in gold and investment vehicles similar to the Trust. Market and financial conditions, and other conditions beyond the Sponsor’s control, may make it more attractive to invest in other financial vehicles or to invest in gold directly, which could limit the market for the Shares and reduce the liquidity of the Shares.

The liquidation of the Trust may occur at a time when the disposition of the Trust’s gold will result in losses to investors in Shares.

The Trust will have a limited duration. If certain events occur, at any time, the Trustee will have to terminate the Trust. Otherwise, the Trust will terminate automatically on January 19, 2045.

Upon termination of the Trust, the Trustee will sell gold in the amount necessary to cover all expenses of liquidation, and to pay any outstanding liabilities of the Trust. The remaining gold will be distributed among investors surrendering Shares. Any gold remaining in the possession of the Trustee after 90 days may be sold by the Trustee and the proceeds of the sale will be held by the Trustee until claimed by any remaining holders of Shares. Sales of gold in connection with the liquidation of the Trust at a time of low prices will likely result in losses, or adversely affect your gains, on your investment in Shares.

The liquidity of the Shares may also be affected by the withdrawal from participation of Authorized Participants.

In the event that one or more Authorized Participants that have substantial interests in Shares withdraw from participation, the liquidity of the Shares will likely decrease, which could adversely affect the market price of the Shares and result in your incurring a loss on your investment in Shares.

There may be situations where an Authorized Participant is unable to redeem a Basket of Shares. To the extent the value of gold decreases, these delays may result in a decrease in the value of the gold the Authorized Participant will receive when the redemption occurs, as well as a reduction in liquidity for all Shareholders in the secondary market.

Although Shares surrendered by Authorized Participants in Basket-size aggregations are redeemable in exchange for the underlying amount of gold, redemptions may be suspended during any period while regular trading on NYSE Arca is suspended or restricted, or in which an emergency exists that makes it reasonably impracticable to deliver, dispose of, or evaluate gold. If any of these events occurs at a time when an Authorized Participant intends to redeem Shares, and the price of gold decreases before such Authorized Participant is able again to surrender for redemption Baskets, such Authorized Participant will sustain a loss with respect to the amount that it would have been able to obtain in exchange for the gold received from the Trust upon the redemption of its Shares, had the redemption taken place when such Authorized Participant originally intended it to occur. As a consequence, Authorized Participants may reduce their trading in Shares during periods of suspension, decreasing the number of potential buyers of Shares in the secondary market and, therefore, decreasing the price a Shareholder may receive upon sale.

Authorized Participants with large holdings may choose to terminate the Trust.

Holders of 75% of the Shares have the power to terminate the Trust. This power may be exercised by a relatively small number of holders. If it is so exercised, investors who wished to continue to invest in gold through the vehicle of the Trust will have to find another vehicle, and may not be able to find another vehicle that offers the same features as the Trust.

The lack of an active trading market for the Shares may result in losses on your investment at the time of disposition of your Shares.

Although Shares are listed for trading on NYSE Arca, you should not assume that an active trading market for the Shares will be maintained. If you need to sell your Shares at a time when no active market for them exists, such lack of an active market will most likely adversely affect the price you receive for your Shares (assuming you are able to sell them).

If the process of creation and redemption of Baskets encounters any unanticipated difficulties, the possibility for arbitrage transactions by Authorized Participants intended to keep the price of the Shares closely linked to the price of gold may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV.

If the processes of creation and redemption of Shares (which depend on timely transfers of gold to and by the Custodian) encounter any unanticipated difficulties, potential market participants, such as the Authorized Participants and their customers, who would otherwise be willing to purchase or redeem Baskets to take advantage of any arbitrage opportunity arising from discrepancies between the price of the Shares and the price of the underlying gold may not take the risk that, as a result of those difficulties, they may not be able to realize the profit they expect. If this is the case, the liquidity of the Shares may decline and the price of the Shares may fluctuate independently of the price of gold and may fall or otherwise diverge from NAV. Furthermore, in the event that the London market for physical gold should become relatively illiquid and thereby materially restrict opportunities for arbitraging by delivering gold in return for Baskets, the price of Shares may diverge from the value of physical gold.

As an owner of Shares, you will not have the rights normally associated with ownership of other types of shares.

Shares are not entitled to the same rights as shares issued by a corporation. By acquiring Shares, you are not acquiring the right to elect directors, to receive dividends, to vote on certain matters regarding the issuer of your Shares or to take other actions normally associated with the ownership of shares.

As an owner of Shares, you will not have the protections normally associated with ownership of shares in an investment company registered under the Investment Company Act, or the protections afforded by the CEA.

The Trust is not registered as an investment company and is not required to be registered under the Investment Company Act. Consequently, the owners of Shares do not have the protections under the Investment Company Act provided to investors in registered investment companies. For example, the provisions of the Investment Company Act that limit transactions with affiliates, prohibit the suspension of redemptions (except under certain limited circumstances) or limit sales loads, among others, do not apply to the Trust.