UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________

FORM 10-K

__________________________________

|

(Mark One) |

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended September 1, 2018 |

|

|

OR |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

|

Commission file number 1-14130

__________________________________

MSC INDUSTRIAL DIRECT CO., INC.

(Exact Name of Registrant as Specified in Its Charter)

__________________________________

|

New York |

11-3289165 |

|

75 Maxess Road, Melville, New York |

11747 |

(516) 812-2000

(Registrant’s telephone number, including area code)

__________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Each Exchange on Which Registered |

|

Class A Common Stock, par value $.001 |

The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

__________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non‑accelerated filer ☐ |

Smaller reporting company ☐ |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of Class A common stock held by non-affiliates of the registrant as of March 3, 2018 was approximately $3,957,389,283. As of October 1, 2018, 45,406,118 shares of Class A common stock and 10,369,547 shares of Class B common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant’s Proxy Statement for its 2019 annual meeting of shareholders is hereby incorporated by reference into Part III of this Annual Report on Form 10-K.

MSC INDUSTRIAL DIRECT CO., INC.

i

Except for historical information contained herein, certain matters included in this Annual Report on Form 10-K are, or may be deemed to be, forward‑looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. The words “will,” “may,” “designed to,” “believe,” “should,” “anticipate,” “plan,” “expect,” “intend,” “estimate” and similar expressions identify forward‑looking statements, which speak only as of the date of this annual report. These forward‑looking statements are contained principally under Item 1, “Business,” and under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Because these forward-looking statements are subject to risks and uncertainties, actual results could differ materially from the expectations expressed in the forward‑looking statements. Important factors that could cause actual results to differ materially from the expectations reflected in the forward‑looking statements include those described in Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In addition, new risks emerge from time to time and it is not possible for management to predict all such risk factors or to assess the impact of such risk factors on our business. Given these risks and uncertainties, the reader should not place undue reliance on these forward‑looking statements. We undertake no obligation to update or revise these forward‑looking statements to reflect subsequent events or circumstances.

General

MSC Industrial Direct Co., Inc. (together with its subsidiaries, “MSC,” the “Company,” “we,” “our,” or “us”) is a leading North American distributor of metalworking and maintenance, repair and operations (“MRO”) products and services. With a history of driving innovation in industrial product distribution for more than 75 years, we help solve our manufacturing customers’ metalworking, MRO and operational challenges. Through our technical metalworking expertise and inventory management and other supply chain solutions, our team of more than 6,500 associates keeps our customers’ manufacturing operations up and running and improves their efficiency, productivity and profitability.

We serve a broad range of customers throughout the United States, Canada and the United Kingdom, from individual machine shops to Fortune 100 manufacturing companies to government agencies such as the United States General Services Administration and the United States Department of Defense. We operate a sophisticated network of 12 customer fulfillment centers (eight in the United States, three in Canada and one in the U.K.) and 100 branch offices (99 in the United States and one in the U.K.). Our primary customer fulfillment centers are located in or near Harrisburg, Pennsylvania; Atlanta, Georgia; Elkhart, Indiana; Reno, Nevada; and Columbus, Ohio in the United States. In addition, we operate seven smaller customer fulfillment centers in or near Hanover Park, Illinois; Dallas, Texas; Shelbyville, Kentucky (repackaging and replenishment center); Wednesbury, England; Edmonton, Canada; Beamsville, Canada; and Moncton, Canada.

We offer approximately 1,645,000 active, saleable stock-keeping units (“SKUs”) through our catalogs; brochures; eCommerce channels, including our website, mscdirect.com (“MSC website”); our inventory management solutions; and call-centers and branches. We carry many of the products we sell in our inventory, so that orders for these in-stock products are processed and fulfilled the day the order is received. We offer next-day delivery nationwide for qualifying orders placed by 8 p.m. Eastern Standard Time (excluding Class C (“Consumables”) category products). Our customers can choose among many convenient ways to place orders: mscdirect.com, eProcurement platforms, call-centers or direct communication with our outside sales associates.

We believe that our value-added solutions approach to driving our customers’ success serves to differentiate MSC from traditional transaction-focused distributors. We endeavor to save our customers money when they partner with us for their MRO and metalworking product needs. We focus on building strong partnerships with our customers to help them improve their productivity and growth. We do this several ways:

|

· |

our experienced team includes customer care team members, metalworking specialists, safety specialists, inventory management specialists, technical support teams, and experienced sales associates focused on driving our customers’ success by reducing their operational costs; |

|

· |

our robust systems and transactional data enable us to provide insights to our customers to help them take cost out of their supply chains and operations; |

1

|

· |

our extensive product inventory enables customers to deal with fewer suppliers, streamlining their purchasing work and reducing their administrative costs; |

|

· |

our timely shipping enables our customers to reduce their inventory investment and carrying costs; |

|

· |

our purchasing process consolidates multiple purchases into a single order, providing a single invoice for multiple purchases over time, and offering direct shipments to specific departments and personnel at one or more facilities. This reduces our customers’ administrative costs; |

|

· |

our extensive eCommerce capabilities provide sophisticated search and transaction capabilities, access to real-time inventory, customer-specific pricing, workflow management tools, customized reporting and other features. We can also interface directly with many purchasing portals; |

|

· |

our inventory management solutions enable our customers to carry less inventory and still dramatically reduce situations when a critical item is out of stock; and |

|

· |

our proprietary software solution, called Ap Op (Application Optimization), enables our metalworking specialists to document productivity savings for customers for a range of applications, including grinding, milling, turning, threading, sawing, hole-making, metalworking fluids and other manufacturing process improvements. |

Industry Overview

MSC operates in a large, fragmented industry. National, regional and local distributors, retail outlets, small distributorships, online distributors, direct mail suppliers, large warehouse stores and manufacturers’ own sales forces all serve MRO customers.

Nearly every industrial and service business has an ongoing need for MRO supplies. These businesses, with the exception of the largest industrial plants, often do not have the resources to manage and monitor their MRO inventories effectively. They spend more than necessary to purchase and track their supplies, providing an opportunity for MSC to serve as their one-stop MRO product supplier. Even the larger facilities often store their supplies in multiple locations, so they often carry excess inventories and duplicate purchase orders. In many organizations, multiple people often acquire the same item in small quantities via expensive, one-off purchases, resulting in higher purchasing costs and administrative efforts to keep track of supplies.

With limited capital availability, and limited eCommerce capabilities and operating leverage, smaller industrial distributors are under increasing pressure to consolidate and/or curtail services and product lines to remain competitive. Their challenge represents MSC’s opportunity. We improve purchasing efficiency and reduce costs for our customers because our offerings enable our customers to consolidate suppliers, purchase orders and invoices, and reduce inventory tracking, stocking decisions, purchases and out-of-stock situations. In addition, through Vendor Managed Inventory (“VMI”), Customer Managed Inventory (“CMI”) and vending solutions, we empower our customers to utilize sophisticated inventory management solutions.

Business Strategy

MSC’s business strategy is based on helping our customers become more productive and profitable by reducing their total cost for purchasing, using and maintaining MRO supplies. Our customer-focused culture and high-touch engagement model drives value for our customers and results in deep customer relationships. Our strategy includes the following key elements:

Inventory Management Solutions. Our approach starts with a thorough customer assessment. Our expert associates develop and recommend solutions that provide exceptional value to the customer. Depending on the customer’s size and needs, we customize options to address complexity and processes, as well as specific products, technical issues and cost targets. The options include eProcurement, CMI, VMI, vending, tool crib control, or part-time or full-time on-site resources. Our world-class sourcing, logistics and business systems provide predictable, reliable and scalable service.

Broad Selection of Products. Customers want a full range of product options, even as they look to reduce the number of suppliers they partner with. We provide “good-better-best” alternatives, comprising a spectrum of brand name, MSC exclusive brand and generic MRO products. MSC’s broad selection of products enables customers to choose the right combination of price and quality on every purchase to meet their needs.

Same-Day Shipping and Next-Day Delivery. We guarantee same-day shipping of our core metalworking and MRO products, enabling customers to reduce supply inventories. We fulfill our same-day shipment guarantee about 99% of the time. We offer next-day delivery nationwide for qualifying orders placed by 8 p.m. Eastern Standard Time (excluding Class

2

C category products). We know that our customers value this service, and areas accessible by next-day delivery generate significantly greater sales for MSC than areas where next-day delivery is not available.

Superior Customer Service. Our commitment to customer service starts with our more than 6,500 associates who share their deep expertise and knowledge of metalworking and MRO products to help our customers achieve greater success. We invest in sophisticated information systems and provide extensive training to empower our associates to better support our customers. Using our proprietary customer support software, our in-bound sales representatives: can inform customers on a real-time basis of product availability; recommend substitute products; verify credit information; receive special, custom or manufacturer direct orders; cross‑check inventory items using previously entered customer product codes; and arrange or provide technical assistance. We offer: customized billing; customer savings reports; electronic data interchange ordering; eCommerce capabilities; bulk discounts; and stocking of specialty items requested by customers.

Technical Support. We provide technical support and one-on-one service through our field and customer care center representatives. We have a dedicated team of nearly 100 metalworking specialists who work with customers to improve their manufacturing processes and efficiency, as well as a technical support team that provides assistance to our sales teams and customers via phone and email. Our customers recognize the value of a distributor that can provide technical support to improve their operations and productivity.

Commitment to Technological Innovation. We embrace technological innovations to support our growth, improve customer service and reduce our operating costs. The innovations make our buying practices more effective, improve our automated inventory replenishment and streamline order fulfillment. MSC’s proprietary software helps our customers and sales representatives determine the availability of products in real time and evaluate alternative products and pricing. The MSC website contains a searchable online catalog with electronic ordering capabilities. The MSC website also offers an array of services, workflow management tools and related information.

We also continually upgrade our distribution methods and systems and provide comprehensive electronic ordering capabilities (“EDI” and “XML”) to support our customers’ purchase order processing. We continue to invest in our VMI, CMI and vending solutions that streamline customer replenishment and trim our customers’ inventories. Our vending solutions include different kinds of machines, such as storage lockers or carousels, which can stand alone or be combined with other machines. MSC vending machines use network or web-based software to enable customers to gain inventory visibility, save time and drive profitability.

Advanced Technologies and www.mscdirect.com. The MSC website (www.mscdirect.com) is available 24 hours a day, seven days a week, providing personalized real-time inventory availability, superior search capabilities, online bill payment, delivery tracking status and other enhancements, including work-flow management tools. The user-friendly search engine allows customers to find SKUs by keyword, part description, competitive part number, vendor number or brand. The MSC website is a key component of our strategy to reduce our customers’ transaction costs and delivery time.

Competitive Pricing. Customers increasingly evaluate their total cost of purchasing, using and maintaining industrial supplies and recognize that price is an important aspect of their procurement costs. We make sure our pricing is competitive while reflecting the value that we bring through our comprehensive services.

Growth Strategy

Our growth strategy includes a number of tactics to continue to gain market share. These include the following:

Expanding and enhancing our metalworking capabilities to aggressively penetrate customers in heavy and light manufacturing. MSC is a leading distributor of metalworking products in the United States. We have continued to expand our metalworking sales team, increase technical support and enhance supplier relationships. We are developing high-performance metalworking products marketed under MSC exclusive brands, providing high-value product alternatives for our customers. Our metalworking field specialists and centralized technical support team members have diverse backgrounds in machining, programming, management and engineering. They help our customers select the right tool for the job from our deep supplier base and exclusive brands.

Expanding programs for government and national account customers. Although MSC has been providing MRO and metalworking supplies to the commercial sector for more than 75 years, we have more recently focused on government customers and have a large, growing contract business with numerous federal, state, and local education agencies. We have developed customized government and national account programs. Even with our recent success, we see plenty of opportunity for additional growth in this area.

3

We provide customized national account programs for larger customers, often as enterprise-wide engagements. These national account customers value our ability to support their procurement needs electronically to reduce their transactional costs. Our dedicated national account managers and operations experts provide supply chain solutions that reduce these customers’ total costs of procurement and ownership through increased visibility into their MRO purchases and improved management. We demonstrate these savings by providing these customers with detailed reporting at both the enterprise and site level.

Increasing the size and improving the productivity of our direct sales force. We have invested resources to give our sales representatives more time with our customers and provide increased support during the MRO purchasing process. At September 1, 2018, our field sales and service associate headcount was 2,383 and our in-bound sales representative headcount was 933. Beginning in our fiscal fourth quarter of 2018, field sales and service personnel includes all customer-facing associates in an external sales or service role. We believe that our sales force investment has played a critical role in boosting our market share.

Increasing sales from existing customers and generating new customers with various value‑added programs. Our value‑added programs include business needs analysis, inventory management solutions and workflow management tools. Our customers particularly value our industrial vending solutions that can accommodate a range of products from precision cutting tools to MRO supplies.

Increasing the number of product lines and productive SKUs. We offer approximately 1,645,000 active, saleable SKUs through our catalogs; brochures; eCommerce channels, including our MSC website; our inventory management solutions; and call-centers and branches. We are increasing the breadth and depth of our product offerings and pruning non-value-added SKUs. In fiscal year 2018, we added approximately 80,000 SKUs, net of SKU removals, to our active, saleable SKU count. We plan to continue adding SKUs in fiscal 2019.

The most recent MSC catalog issued in September 2018 merchandises approximately 500,000 core metalworking and MRO products, which are included in the SKU totals above. Approximately 29% of these SKUs are MSC exclusive brands. We also leverage the depth and breadth of MSC’s product portfolio within our Class C category sales channel.

Improving our marketing programs. MSC has built an extensive buyer database, which we use to prospect for new customers. We deliver our master catalogs to the best prospects. We supplement our master catalogs with direct mail, digital and search engine marketing, and email. Our industry-specific expertise allows us to focus our outreach on the most promising growth areas.

Enhancing eCommerce capabilities. The MSC website is a proprietary, business-to-business, horizontal marketplace serving the metalworking and MRO market. The MSC website allows customers to enjoy added convenience without sacrificing customized service. The MSC website is a key component of our strategy to reduce customers’ transaction costs and internal requisition time. Most orders move directly from the customer’s desktop to our customer fulfillment center floor, removing human error, reducing handling costs and speeding up the transaction flow. MSC continues to evaluate the MSC website and solicit customer feedback, making on-going improvements to ensure that it remains a premier website in our marketplace. The MSC website provides advanced features, such as order approval (workflow) and purchase order control, that our customers interact with in order to derive business value beyond merely placing an order. Many large customer accounts transact business with MSC using eProcurement solution providers that sell a suite of eCommerce products. We have associations with many of these providers and continue to evaluate and expand our eProcurement capabilities.

Improving our excellent customer support service. MSC consistently receives high customer satisfaction ratings, according to customer surveys. We don’t just strive to meet our customers’ service needs, we work to anticipate them. This focus on our customers’ needs makes us stand apart in the market. We use customer comment cards, surveys and other customer outreach tools, using their feedback to drive the next generation of improvements to the customer experience.

Selectively pursuing strategic acquisitions. MSC is a leader in the highly fragmented industrial distribution market with significant opportunities for organic and acquisitive growth. We actively pursue strategic acquisitions that deepen our metalworking expertise, extend our capabilities into strategic adjacencies, and expand our markets in North America. In April 2018, MSC completed the acquisition of All Integrated Solutions (“AIS”). AIS is a leading value-added distributor of industrial fasteners and components, MRO supplies and assembly tools based in Franksville, Wisconsin. AIS delivers production fasteners and custom tool and fastener solutions for use in the assembly of manufactured commercial and consumer products. The company’s more than 135 associates serve customers in a region that includes Wisconsin, Minnesota, Michigan, Iowa, Indiana and North Dakota. MSC plans to provide AIS’s customer base with its 1.6 million product portfolio to support their full metalworking and MRO needs. Similarly, MSC will extend AIS’s production fastener

4

and VMI solutions to its manufacturing customers that share a common footprint. AIS provides a solid growth platform for expansion in the production fasteners market, complementing our robust Class C fastener and VMI solutions. AIS’s revenue in calendar 2017 was approximately $66 million. In July 2017, MSC completed the acquisition of DECO Tool Supply Co. (“DECO”), an industrial supply distributor based in Davenport, Iowa. DECO associates work across 10 branch offices located primarily in the Midwest. DECO’s sales force and branch footprint complement MSC’s coverage in the region. MSC will be able to provide DECO customers access to MSC's product portfolio to support their full metalworking and MRO needs. The acquisition enhances our metalworking business, because DECO associates bring considerable experience and expertise in metalworking solutions.

Products

Our broad range of MRO products includes cutting tools, measuring instruments, tooling components, metalworking products, fasteners, flat stock, raw materials, abrasives, machinery hand and power tools, safety and janitorial supplies, plumbing supplies, materials handling products, power transmission components, and electrical supplies. Our large and growing number of SKUs makes us an increasingly valuable partner to our customers as they look to trim their supplier base. Our assortment from multiple product suppliers and MSC exclusive brands, prices and quality levels enables our customers to select from “good-better-best” options on nearly all their purchases. We stand apart from our competitors by offering name brand, exclusive brand, and generic products; depth in our core product lines; and competitive pricing.

We purchase substantially all our products directly from approximately 3,000 suppliers. No single supplier accounted for more than 6% of our total purchases in fiscal 2018, fiscal 2017, or fiscal 2016.

Customer Fulfillment Centers

We have been enhancing our distribution efficiency and capabilities for decades. When our customers order an in- stock product online or via phone, we ship it the day the order is placed 99% of the time. We do that through our 12 customer fulfillment centers and 100 branch offices. Some specialty or custom items and very large orders are shipped directly from the manufacturer. We manage our primary customer fulfillment centers via computer‑based SKU tracking systems and radio frequency devices that locate specific stock items to make the selection process more efficient.

Sales and Marketing

We serve individual machine shops, Fortune 100 companies, government agencies and manufacturers of all sizes. We focus on relatively higher-margin, lower-volume products. With our acquisitions of AIS in fiscal 2018 and Barnes Distribution North America in fiscal 2013, we have increased our presence in the fastener and Class C product categories and significantly increased our presence in the VMI space. VMI involves not only the selling of the maintenance consumables by our associates, but also the management of appropriate stock levels for the customer, writing the necessary replenishment orders, putting away the stock, and maintaining a clean and organized inventory area.

Federal government customers include the U.S. Postal Service, the Department of Defense, large and small military bases, Veterans Affairs hospitals, and federal correctional facilities. We have individual state contracts but also are engaged in several state cooperatives.

Our national account program also includes Fortune 100 companies, large privately held companies, and international companies doing business in the United States. We have identified hundreds of additional national account prospects and have given our sales team tools to ensure we are targeting prospective customers that best fit the MSC model.

We have implemented advanced analytics and significantly increased the return on our direct marketing investments designed to acquire new customers and increase our share of business with current customers. While master catalogs, promotional catalogs and brochures continue to play an important role in our efforts, we accelerated a shift to search engine marketing, email marketing and online advertising to address changes in our customers’ buying behavior. We use our own database of over three million contacts together with external mailing lists to target buyers with the highest likelihood to buy.

Our sales representatives are highly trained and experienced individuals who build relationships with customers, assist customers in reducing costs, provide and coordinate technical support, coordinate special orders and shipments with vendors, and update customer account profiles in our information systems databases. Our marketing approach centers on the ability of our sales representatives, armed with our comprehensive databases as a resource, to respond effectively to the customer’s needs. When a customer places a call to MSC, the sales representative on the other end of the line has immediate access to that customer’s company and specific buyer profile, which includes billing and purchasing track records, and plant and industry information. Meanwhile, the sales representative has access to inventory levels on every SKU we carry.

5

Our in-bound sales representatives at our customer care centers undergo an intensive seven-week training course, followed up by regular on-site training seminars and workshops. We monitor and evaluate our sales associates at regular intervals, and provide our sales associates with technical training by our in-house specialists and product vendors. We maintain a separate technical support group dedicated to answering customer inquiries and assisting our customers with product operation information and finding the most efficient solutions to manufacturing problems.

Branch Offices

We operate 100 branch offices. There are 99 branch offices within the United States located in 42 states, and one located in the U.K. We have experienced higher sales growth and market penetration in areas around our branch offices and believe they play an integral role in obtaining new accounts and penetrating existing ones. This includes seven branch offices added with the acquisition of AIS in April 2018.

Publications

Our primary reference publications are our master catalogs, which are supported by specialty and promotional catalogs and brochures. MSC produces two annual catalogs: the MSC Big Book, which contains a comprehensive offering across all product lines; and the MSC Metalworking catalog. We use specialty and promotional publications to target customers in specific areas, such as metal fabrication, facilities management, safety and janitorial. Specialty and promotional catalogs, targeted to our best prospects, offer a more focused selection of products at a lower catalog production cost and more efficient use of advertising space.

We periodically balance ongoing strategies to improve direct marketing productivity and increase return on advertising dollars spent against programs to increase revenue and lifetime value. While master catalogs, promotional catalogs and brochures continue to play an important role in our efforts, we continue to experience a shift to search engine marketing, email marketing and online advertising to address changes in our customers’ buying behavior. As such, our mailing volume has trended down as shown below:

|

|

||||||

|

|

Fiscal Years Ended (1) |

|||||

|

|

September 1, 2018 (52 weeks) |

September 2, 2017 (52 weeks) |

September 3, 2016 (53 weeks) |

|||

|

Number of publication titles |

73 | 73 | 94 | |||

|

Number of publications mailed |

15,350,760 | 15,602,818 | 16,851,194 | |||

__________________________

|

(1) |

Excludes U.K. operations. |

Customer Service

One of our goals is to make purchasing our products as convenient as possible. Customers submit more than 60% of their orders digitally through our technology platforms (website, vending machines, and eProcurement). The remaining orders are primarily placed via telephone, fax and mail. The efficient handling of orders is a critical aspect of our business. Order entry and fulfillment occurs at each of our branches and our main customer care centers, mostly located at our customer fulfillment centers. Customer care phone representatives enter non-digital orders into computerized order processing systems. In the event of a local or regional breakdown, a call can usually be re-routed to an alternative location. When an order enters the system, a credit check is performed; if the credit is approved, the order is usually transmitted to the customer fulfillment center closest to the customer. Customers are invoiced for merchandise, shipping and handling promptly after shipment.

Information Systems

Our information systems enable us to centralize management of key functions, including communication links between customer fulfillment centers; inventory and accounts receivable; purchasing; pricing; sales and distribution; and the preparation of daily operating control reports. These systems help us ship on a same-day basis, respond quickly to order changes, provide a high level of customer service, and reduce costs. Our eCommerce environment is built upon a combined platform of our own intellectual property, state-of-the-art software from the world’s leading internet technology providers and world-class product data. This powerful combination of resources helps us deliver a superior online shopping experience with extremely high levels of reliability.

6

Most of our information systems operate in real time over a wide area network, letting each customer fulfillment center and branch office share information and monitor daily progress on sales activity, credit approval, inventory levels, stock balancing, vendor returns, order fulfillment and other performance measures. We maintain a sophisticated buying and inventory management system that monitors all our SKUs and automatically purchases inventory from vendors for replenishment based on projected customer ordering models. We also maintain an Electronic Data Interchange (“EDI”) purchasing program with our vendors to boost order placement efficiency, reduce order cycle processing time, and increase order accuracy.

In addition to developing the proprietary computer software programs for use in the customer service and distribution operations, we also provide a comprehensive EDI and Extensible Markup Language (“XML”) ordering system to support our customer-based purchase order processing. We also maintain a proprietary hardware and software platform to support our VMI program, which allows customers to integrate scanner‑accumulated orders directly into our Sales Order Entry system and website. Our CMI program enables customers to simply and effectively replenish inventory by submitting orders directly to our website. Our customized vending systems are used by customers in manufacturing plants across the United States to help them achieve supply chain and shop floor optimization, through inventory management and reduced tooling and labor costs. Our VMI, CMI and vending capabilities function directly as front-end ordering systems for our e-Portal-based customers. These solutions take advantage of advanced technologies built upon the latest innovations in wireless and cloud-based computing.

Our core business systems run in a highly distributed computing environment and utilize world-class software and hardware platforms from key partners. We utilize disaster recovery techniques and procedures, which are consistent with best practices in enterprise information technology (“IT”). Given such a distributed IT environment, we regularly review and upgrade our systems. We believe that our current systems and practice of implementing regular updates are adequate to support our current needs. In fiscal 2017, we went live on our upgraded core financial systems and in fiscal 2018 we went live on a new Human Resources platform. We are continuing to upgrade our systems and plan to make investments as necessary to enhance our operational effectiveness.

With the advent of advanced mobile technologies such as smart phones and tablets, access to information and decision-making can now be made anytime, anywhere. Recognizing this need, we have deployed technology to securely manage and maintain access to enterprise information from mobile devices that meet our security standards. Our sales representatives are equipped with proprietary mobile technology that allows them to tap into MSC’s supply chain directly from our customers’ manufacturing plants and make sure that critical inventory is always on site and available. In addition, we are enhancing our customer websites and portals to reflect this new mobile reality at a pace in line with customer adoption of mobile technology.

Our customer care centers and branch offices implemented a state-of-the-art phone system and workforce optimization platform in fiscal 2017. The features within the platform create a seamless environment equipped with advanced applications that assist our associates in optimizing our customers’ experience. The architecture has established a dynamic infrastructure that is scalable both in terms of operations and future capabilities. We are continuing to implement additional functionality aimed at enhancing the engagement and personalization of the customer experience regardless of the contact method chosen.

Competition

The MRO supply industry is a large, fragmented industry that is highly competitive. We face competition from: traditional channels of distribution, such as retail outlets; small dealerships; regional and national distributors utilizing direct sales forces; manufacturers of MRO supplies; large warehouse stores; and larger direct mail distributors. We also face substantial competition in the online distribution space that competes with price transparency. In addition, new entrants in the MRO supply industry could increase competition. We believe that sales of MRO supplies will become more concentrated over the next few years, which may make MRO supply distribution more competitive. Some of our competitors challenge us with a large variety of product offerings, greater financial resources, additional services, or a combination of these factors. In the industrial products market, customer purchasing decisions are based primarily on one or more of the following criteria: price, product selection, product availability, technical support relationship, level of service and convenience. We believe we compete effectively on all such criteria.

Seasonality

During any given time, we may be impacted by our industrial customers’ plant shutdowns, particularly during the summer months (our fourth fiscal quarter), as well as the winter months for the Christmas and New Year holiday period (our fiscal second quarter). In addition, we may be impacted by weather-related disruptions.

7

Compliance with Health and Safety and Environmental Protection Laws

Our operations are subject to and affected by a variety of federal, state, local and non-U.S. health and safety and environmental laws and regulations relating to the discharge, treatment, storage, disposal, investigation and remediation of certain materials, substances and wastes. We continually assess our compliance status and management of environmental matters to ensure that our operations are compliant with all applicable environmental laws and regulations.

Operating and maintenance costs associated with environmental compliance and management of sites are a normal and recurring part of our operations. With respect to all other matters that may currently be pending, in the opinion of management, based on our analysis of relevant facts and circumstances, compliance with applicable environmental laws is not likely to have a material adverse effect upon our capital expenditures, earnings or competitive position.

Associates

As of September 1, 2018, we employed 6,657 associates, which includes our U.K. and Canada operations. No associate is represented by a labor union. We consider our relationships with associates to be good and have experienced no work stoppages.

Available Information

We file annual, quarterly and current reports, and other reports and documents with the Securities and Exchange Commission (the “SEC”). The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at Station Place, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov.

The Company’s internet address is www.mscdirect.com. We make available on or through our investor relations page on our website, free of charge, our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and beneficial ownership reports on Forms 3, 4, and 5 and amendments to those reports as soon as reasonably practicable after this material is electronically filed with or furnished to the SEC. We also make available, on our website, the charters of the committees of our Board of Directors and Management’s Code of Ethics, the Code of Business Conduct and Corporate Governance Guidelines pursuant to SEC requirements and New York Stock Exchange (“NYSE”) listing standards. Information on our website does not constitute a part of this Annual Report on Form 10-K.

In addition to the other information in this Annual Report on Form 10-K, the following factors should be considered in evaluating the Company and its business. Our future operating results depend upon many factors and are subject to various risks and uncertainties. The known material risks and uncertainties which may cause our operating results to vary from anticipated results or which may negatively affect our operating results and profitability are as follows:

Our business depends heavily on the operating levels of our customers and the economic factors that affect them, including general economic conditions.

Many of the primary markets for the products and services we sell are subject to cyclical fluctuations that affect demand for goods and materials that our customers produce. Consequently, demand for our products and services has been and will continue to be influenced by most of the same economic factors that affect demand for and production of our customers’ products.

When, as occurs in economic downturns, current or prospective customers reduce production levels because of lower demand or tight credit conditions, their need for our products and services diminishes. Selling prices and terms of sale come under pressure, adversely affecting the profitability and the durability of customer relationships. Credit losses increase as well. Volatile economic and credit conditions also make it more difficult for distributors, as well as customers and suppliers, to forecast and plan future business activities.

In addition, as various sectors of our industrial customer base face increased foreign competition, and in fact lose business to foreign competitors or shift their operations overseas in an effort to reduce expenses, we may face increased difficulty in growing and maintaining our market share and growth prospects.

8

Changes in our customer and product mix, or adverse changes to the cost of goods we sell, could cause our gross margin percentage to fluctuate, or decrease.

From time to time, we have experienced changes in our customer mix and in our product mix. Changes in our customer mix have resulted from geographic expansion, daily selling activities within current geographic markets, and targeted selling activities to new customers. Changes in our product mix have resulted from marketing activities to existing customers and needs communicated to us from existing and prospective customers as well as from business acquisitions. As our large account customer program sales grow, we will face continued pressures on maintaining gross margin because these customers receive lower pricing due to their higher level of purchases from us. In addition, our continued expansion of our vending program and other eCommerce platforms has placed pressure on our gross margin. There can be no assurance that we will be able to maintain our historical gross margins. In addition, we may also be subject to price increases from vendors that we may not be able to pass along to our customers.

We operate in a highly competitive industry.

The MRO supply industry, although consolidating, still remains a large, fragmented industry that is highly competitive. We face competition from traditional channels of distribution such as retail outlets, small dealerships, regional and national distributors utilizing direct sales forces, manufacturers of MRO supplies, large warehouse stores and larger direct mail distributors. We believe that sales of MRO supplies will become more concentrated over the next few years, which may make the industry more competitive. Our competitors challenge us with a greater variety of product offerings, greater financial resources, additional services, or a combination of these factors. In addition, we also face the risk of companies which operate primarily outside of our industry entering our marketplace.

Our industry is evolving at an accelerated pace. If we do not have the agility and flexibility to effectively respond to this accelerated pace of industry changes, our strategy could be put at risk resulting in a loss of market share. We also face substantial competition in the online distribution space that competes with price transparency. Increased competition from online retailers (particularly those major internet providers who can offer a wide range of products and rapid delivery), and the adoption by competitors of aggressive pricing strategies and sales methods, could cause us to lose market share or reduce our prices, adversely affecting our sales, margins and profitability.

Our industry is evolving and consolidating, which could adversely affect our business and financial results.

The business of selling MRO supplies in North America is currently evolving and undergoing consolidation. This consolidation is being driven by customer needs. Customers are increasingly aware of the total costs of fulfillment, and of their need to have consistent sources of supply at multiple locations. Consistent sources of supply provide not just reliable product quantities, but also consistent pricing, quality and service capabilities. We believe these customer needs could result in fewer suppliers as the industry consolidates, and as the remaining suppliers become larger and capable of being a consistent source of supply.

Traditional MRO suppliers are attempting to consolidate the market through internal expansion, through acquisitions or mergers with other industrial suppliers, or through a combination of both. This consolidation allows suppliers to improve efficiency and spread fixed costs over a greater number of sales, and to achieve other benefits derived from economies of scale.

The trend of our industry toward consolidation could cause the industry to become more competitive as greater economies of scale are achieved by competitors, or as competitors with new lower-cost business models are able to operate with lower prices and gross profit on products. These trends may adversely affect our sales, margins and profitability.

Volatility in commodity and energy prices may adversely affect operating margins.

In times of commodity and energy price increases, we may be subject to price increases from our vendors and freight carriers that we may be unable to pass along to our customers. Raw material costs used in our vendors’ products (steel, tungsten, etc.) and energy costs may increase, which may result in increased production costs for our vendors. The fuel costs of our independent freight companies have been volatile. Our vendors and independent freight carriers typically look to pass increased costs along to us through price increases. When we are forced to accept these price increases, we may not be able to pass them along to our customers, resulting in lower margins.

In addition to increases in commodity and energy prices, decreases in those costs, particularly if severe, could also adversely impact us by creating deflation in selling prices, which could cause our gross profit margin to deteriorate, or by negatively impacting customers in certain industries, which could cause our sales to those customers to decline.

9

Inflation impacts the costs at which we can procure products and our ability to increase prices at which we sell to customers over time. Prolonged periods of low inflation or deflation could adversely affect our ability to increase the prices at which we sell to customers.

As a United States government contractor, we are subject to certain laws and regulations which may increase our costs of doing business and which subject us to certain compliance requirements and potential liabilities.

As a supplier to the United States government, we must comply with certain laws and regulations, including the Trade Agreements Act, the Buy American Act and the Federal Acquisition Regulation, relating to the formation, administration and performance of United States government contracts. These laws and regulations affect how we do business with government customers and, in some instances, impose added compliance and other costs on our business. From time to time, we are subject to governmental or regulatory inquiries or audits relating to our compliance with these laws and regulations. A violation of specific laws and regulations could result in the imposition of fines and penalties or the termination of our United States government contracts and could harm our reputation and cause our business to suffer.

Our business is exposed to the credit risk of our customers which could adversely affect our operating results.

We perform periodic credit evaluations of our customers’ financial condition, and collateral is generally not required. We evaluate the collectability of accounts receivable based on numerous factors, including past transaction history with customers and their creditworthiness and we provide a reserve for accounts that we believe to be uncollectible. A significant deterioration in the economy could have an adverse effect on the servicing of these accounts receivable, which could result in longer payment cycles, increased collection costs and defaults.

The risk of cancellation or rescheduling of orders may cause our operating results to fluctuate.

The cancellation or rescheduling of orders may cause our operating results to fluctuate. Although we strive to maintain ongoing relationships with our customers, there is an ongoing risk that orders may be cancelled or rescheduled due to fluctuations in our customers’ business needs or purchasing budgets, including changes in national and local government budgets. Additionally, although our customer base is diverse, ranging from individual machine shops to Fortune 100 companies and large governmental agencies, the cancellation or rescheduling of significant orders by larger customers may still have a material adverse effect on our operating results from time to time.

Work stoppages and other disruptions, including those due to extreme weather conditions, at transportation centers or shipping ports may adversely affect our ability to obtain inventory and make deliveries to our customers.

Our ability to provide same-day shipping and next-day delivery of our core metalworking and MRO products is an integral component of our overall business strategy. Disruptions at transportation centers or shipping ports due to labor stoppages or severe weather conditions affect both our ability to maintain core products in inventory and deliver products to our customers on a timely basis, which may in turn adversely affect our customer relationships and results of operations. In addition, severe weather conditions, including winter storms, could adversely affect demand for our products in particularly hard-hit regions and impact our sales.

Disruptions or breaches of our information systems, or violations of data privacy laws, could adversely affect us.

We believe that our IT systems are an integral part of our business and growth strategies. We depend upon our IT systems to help process orders, to manage inventory and accounts receivable collections, to manage financial reporting, to purchase, sell and ship products efficiently and on a timely basis, to maintain cost-effective operations, to operate our websites and to help provide superior service to our customers. Our IT systems may be vulnerable to damage or disruption caused by circumstances beyond our control or anticipation, such as catastrophic events, power outages, natural disasters, computer system or network failures, computer viruses, and physical or electronic break-ins. In addition, our IT systems may be vulnerable to cyber-attacks, which are rapidly evolving and becoming increasingly sophisticated. Despite our efforts to ensure the integrity of our IT systems, as cyber-attacks evolve and become more difficult to detect and successfully defend against, one or more cyber-attacks might defeat the measures that we take to anticipate, detect, avoid or mitigate these threats. These cyber-attacks and any unauthorized access or disclosure of our information could compromise and expose sensitive information and damage our reputation. Cyber-attacks could also cause us to incur significant remediation costs, disrupt our operations and divert management attention and key IT resources.

Any material cyber-attack or failure of our IT systems to perform as we anticipate could disrupt our business and operations, result in transaction errors, loss of data, processing inefficiencies, downtime, litigation, substantial remediation

10

costs (including potential liability for stolen assets or information and the costs of repairing system damage), the loss of sales and customers, and damage our reputation. In addition, changes to our information systems could disrupt our business operations. Any one or more of these consequences could have a material adverse effect on our business, financial condition and results of operations. Additionally, our suppliers and customers also rely upon IT systems to operate their respective businesses. If any of them experience a cyber-attack or other cyber incident, this could adversely impact their operations, which may in turn impact or adversely affect our operations.

In addition, regulatory authorities have increased their focus on how companies collect, process, use, store, share and transmit personal data. New privacy security laws and regulations, including the United Kingdom’s Data Protection Act 2018 (DPA) and the European Union General Data Protection Regulation 2016 (GDPR) that became effective May 2018, pose increasingly complex compliance challenges, which may increase compliance costs, and any failure to comply with data privacy laws and regulations could result in significant penalties.

Recent U.S. tax legislation could affect our effective tax rate and future profitability.

On December 22, 2017, the Tax Cuts and Jobs Act (the “TCJA”) was enacted. The TCJA made significant changes to U.S. federal income tax laws, including by reducing the U.S. corporate income tax rate, reducing the potential interest deduction limitations, permitting immediate expensing of certain qualifying capital expenditures, revising the rules governing net operating losses and repealing the deduction of certain performance-based compensation paid to an expanded group of executive officers. Our future results could be adversely affected by increased volatility in the effective tax rate as a result of the TCJA. Further, the TCJA may result in other adverse effects that we have not yet identified. The TCJA is unclear in many respects and could be subject to potential amendments and technical corrections, as well as interpretations and implementing regulations by the Treasury Department and the Internal Revenue Service, any of which could lessen or increase certain adverse impacts of the legislation.

Our success is dependent on certain key personnel.

Our success depends largely on the efforts and abilities of certain key senior management. The loss of the services of one or more of such key personnel could have a material adverse effect on our business and financial results. We do not maintain any key-man insurance policies with respect to any of our executive officers.

Our business depends on our ability to retain and to attract qualified sales and customer service personnel and metalworking specialists.

Our business depends on our ability to attract, train, and retain sales and customer service professionals and metalworking specialists. We greatly benefit from having associates who are familiar with the products we sell and their applications, as well as associates, and in particular metalworking specialists, who can provide technical support to our customers. Qualified individuals of the requisite caliber and number needed to fill these positions may be difficult to hire and retain in sufficient numbers. If we are unable to hire and retain associates capable of providing a high level of customer service and technical support, our operational capabilities and ability to provide differentiated services may be adversely affected.

The loss of key suppliers or contractors or supply chain disruptions could adversely affect our operating results.

We believe that our ability to offer a combination of well-known brand-name products and competitively priced exclusive brand products is an important factor in attracting and retaining customers. Our ability to offer a wide range of products and services is dependent on obtaining adequate product supply and services from our key suppliers and contractors. The loss of or a substantial decrease in the availability of products or services from key suppliers or contractors at competitive prices, or the loss of a key brand, could cause our revenues and profitability to decrease. In addition, supply interruptions could arise due to transportation disruptions, labor disputes or other factors beyond our control. Disruptions in our supply chain could result in a decrease in revenues and profitability.

Trade policies could make sourcing products from overseas more difficult and/or costlier.

Any changes to trade policies, including the imposition of significant restrictions or tariffs, whether because of amendments to or elimination of existing trade agreements, could adversely affect our ability to secure sufficient products to service our customers and/or result in increased product costs that we may not be able to pass on to our customers, resulting in lower margins.

11

Opening or expanding our customer fulfillment centers exposes us to risks of delays and may affect our operating results.

In the future, as part of our long-term strategic planning, we may open new customer fulfillment centers to improve our efficiency, geographic distribution and market penetration. In addition, we intend to make, as we have in the past, capital improvements and operational enhancements to certain of our existing customer fulfillment centers. Moving or opening customer fulfillment centers and effecting such improvements requires a substantial capital investment, including expenditures for real estate and construction, and opening new customer fulfillment centers requires a substantial investment in inventory. In addition, the opening of new customer fulfillment centers or the expansion of existing customer fulfillment centers would have an adverse impact on operating expenses as a percentage of sales, inventory turnover and return on investment in the periods prior to and for some time following the commencement of operations of each new customer fulfillment center or the completion of such expansions.

An interruption of operations at our headquarters or customer fulfillment centers could adversely impact our business.

Our business depends on maintaining operations at our co-located headquarters and customer fulfillment centers. A serious, prolonged interruption due to power outage, telecommunications outage, terrorist attack, earthquake, hurricane, fire, flood or other natural disaster or other interruption could have a material adverse effect on our business and financial results.

We are subject to litigation risk due to the nature of our business, which may have a material adverse effect on our business.

From time to time, we are involved in lawsuits or other legal proceedings that arise from business transactions. These may, for example, relate to product liability claims, commercial disputes, or employment matters. In addition, we could face claims over other matters, such as claims arising from our status as a government contractor, intellectual property matters, or corporate or securities law matters. The defense and ultimate outcome of lawsuits or other legal proceedings may result in higher operating expenses, which could have a material adverse effect on our business, financial condition, or results of operations.

We may encounter difficulties with acquisitions and other strategic transactions which could harm our business.

We have completed several acquisitions and we expect to continue to pursue acquisitions and other strategic transactions, such as joint ventures, that we believe will either expand or complement our business in new or existing markets or further enhance the value and offerings we are able to provide to our existing or future potential customers.

Acquisitions and other strategic transactions involve numerous risks and challenges, including the following:

•diversion of management’s attention from the normal operation of our business;

•potential loss of key associates and customers of the acquired companies;

•difficulties managing and integrating operations in geographically dispersed locations;

•the potential for deficiencies in internal controls at acquired companies;

•increases in our expenses and working capital requirements, which reduce our return on invested capital;

•lack of experience operating in the geographic market or industry sector of the acquired business; and

•exposure to unanticipated liabilities of acquired companies.

To integrate acquired businesses, we must implement our management information systems, operating systems and internal controls, and assimilate and manage the personnel of the acquired operations. The difficulties of this integration may be further complicated by geographic distances. The integration of acquired businesses may not be successful and could result in disruption to other parts of our business.

The terms of our credit facility and senior notes impose operating and financial restrictions on us, which may limit our ability to respond to changing business and economic conditions.

We currently have a $600.0 million unsecured revolving loan facility. The facility matures on April 14, 2022. The facility permits us, subject to approval of the administrative agent and the lenders providing the financing, to request incremental term loans and revolving commitment increases up to an aggregate amount of $300.0 million, in increments not less than $50.0 million or the remaining availability. In addition, we have outstanding $285.0 million aggregate principal amount of senior notes. The senior notes mature in June 2020 ($20.0 million), June 2021 ($20.0 million), January 2023 ($50.0 million), July 2023 ($75.0 million), June 2025 ($20.0 million), and July 2026 ($100.0 million). We also have a Note Purchase and Private Shelf Agreement with each of Met Life and Prudential, which provide for uncommitted facilities that allow for the issuance and sale of additional senior notes with aggregate availabilities of $210.0 million and $200.0 million, respectively.

12

We are subject to various operating and financial covenants under the credit facility and senior notes which restrict our ability to, among other things, incur additional indebtedness, make particular types of investments, incur certain types of liens, engage in fundamental corporate changes, enter into transactions with affiliates or make substantial asset sales. Any failure to comply with these covenants may constitute a breach under the credit facility and senior notes, which could result in the acceleration of all or a substantial portion of any outstanding indebtedness and termination of revolving credit commitments under the facility. Our inability to maintain our credit facility could materially adversely affect our liquidity and our business. At September 1, 2018, we were in compliance with the operating and financial covenants under the credit facility and senior notes.

We are subject to environmental, health and safety laws and regulations.

We are subject to federal, state, local, foreign and provincial environmental, health and safety laws and regulations. Fines and penalties may be imposed for non-compliance with applicable environmental, health and safety requirements and the failure to have or to comply with the terms and conditions of required permits. The failure by us to comply with applicable environmental, health and safety requirements could result in fines, penalties, enforcement actions, third-party claims for property damage and personal injury, requirements to clean up property or to pay for the costs of cleanup, or regulatory or judicial orders requiring corrective measures, which could have a material adverse effect on our business, financial condition, or results of operations.

Goodwill and indefinite-lived intangible assets recorded as a result of our acquisitions could become impaired.

As of September 1, 2018, our combined goodwill and indefinite-lived intangible assets amounted to $689.1 million. To the extent we do not generate sufficient cash flows to recover the net amount of any investments in goodwill and other indefinite-lived intangible assets recorded, the investment could be considered impaired and subject to write-off. We expect to record further goodwill and other indefinite-lived intangible assets as a result of future acquisitions we may complete. Future amortization of such assets or impairments, if any, of goodwill or indefinite-lived intangible assets would adversely affect our results of operations in any given period.

Our common stock price may be volatile.

We believe factors such as fluctuations in our operating results or the operating results of our competitors, changes in economic conditions in the market sectors in which our customers operate, notably the durable and non-durable goods manufacturing industry, which accounted for a substantial portion of our revenue for fiscal year 2018, fiscal year 2017 and fiscal year 2016, and changes in general market conditions, could cause the market price of our Class A common stock to fluctuate substantially.

Our principal shareholders exercise significant control over us.

We have two classes of common stock. Our Class A common stock has one vote per share and our Class B common stock has 10 votes per share. As of October 1, 2018, the Chairman of our Board of Directors, his sister, certain of their family members including our President and Chief Executive Officer, and related trusts collectively owned 100% of the outstanding shares of our Class B common stock and approximately 1.9% of the outstanding shares of our Class A common stock, giving them control over approximately 70.1% of the combined voting power of our Class A common stock and our Class B common stock. Consequently, such shareholders will be able to elect all the directors of the Company and to determine the outcome of any matter submitted to a vote of the Company’s shareholders for approval, including amendments to our certificate of incorporation and our amended and restated by-laws, any proposed merger, consolidation or sale of all or substantially all our assets and other corporate transactions. Because this concentrated control could discourage others from initiating any potential merger, takeover or other change of control transaction that may otherwise be beneficial to our shareholders, the market price of our Class A common stock could be adversely affected.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

13

We have customer fulfillment centers in or near the following locations:

|

|

|||||||

|

|

Approx. |

Operational |

Leased/ |

||||

|

Location |

Sq. Ft. |

Date |

Owned |

||||

|

Harrisburg, Pennsylvania |

821,000 |

1997 |

Owned |

||||

|

Atlanta, Georgia |

721,000 |

1990 |

Owned |

||||

|

Elkhart, Indiana |

545,000 |

1996 |

Owned |

||||

|

Columbus, Ohio |

468,000 |

2014 |

Owned |

||||

|

Reno, Nevada |

419,000 |

1999 |

Owned |

||||

|

Hanover Park, Illinois |

182,000 |

2003 |

Leased |

||||

|

Dallas, Texas |

135,000 |

2003 |

Leased |

||||

|

Shelbyville, Kentucky(1) |

110,000 |

1973 |

Owned |

||||

|

Beamsville, Canada |

85,000 |

2004 |

Owned |

||||

|

Wednesbury, United Kingdom |

75,000 |

1998 |

Leased |

||||

|

Edmonton, Canada |

40,500 |

2007 |

Leased |

||||

|

Moncton, Canada |

16,000 |

1981 |

Owned |

||||

|

|

|||||||

__________________________

|

(1) |

Repackaging and replenishment center. |

We maintain 99 branch offices within the United States located in 42 states and one branch office located in the U.K. The branches range in size from 1,800 to 72,000 square feet. Most of these branch offices are leased. These leases will expire at various periods, the longest extending to fiscal 2028. We added seven branch offices as a result of the AIS acquisition that was completed during April 2018. The aggregate annual lease payments on leased branch offices and the leased customer fulfillment centers in fiscal 2018 were approximately $11.6 million.

We maintain our co-located headquarters at a 170,000 square foot facility that we own in Melville, New York and a 162,000 square foot facility that we own in Davidson, North Carolina. In addition, we maintain office space in a 50,000 square foot facility that we lease in Southfield, Michigan. We believe that our existing facilities are adequate for our current needs and will be adequate for the foreseeable future; we also expect that suitable additional space will be available as needed.

There are various claims, lawsuits, and pending actions against the Company incidental to the operation of its business. Although the outcome of these matters is currently not determinable, management does not expect that the ultimate costs to resolve these matters will have a material adverse effect on the Company’s consolidated financial position, results of operations, or liquidity.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

14

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

MSC’s Class A common stock is traded on the NYSE under the symbol “MSM”. MSC’s Class B common stock is not traded in any public market.

The following table sets forth the range of the high and low sales prices as reported by the NYSE and cash dividends per share for the period from September 4, 2016 to September 1, 2018:

|

|

|||||||||

|

|

Dividend Per Share |

||||||||

|

|

Price of Class A Common Stock |

Common Stock |

|||||||

|

Fiscal Year Ended September 1, 2018 |

High |

Low |

Class A & Class B |

||||||

|

First Quarter – December 2, 2017 |

$ |

90.63 |

$ |

67.93 |

$ |

0.48 | |||

|

Second Quarter – March 3, 2018 |

99.94 | 84.84 | 0.58 | ||||||

|

Third Quarter – June 2, 2018 |

96.58 | 85.36 | 0.58 | ||||||

|

Fourth Quarter – September 1, 2018 |

94.73 | 77.00 | 0.58 | ||||||

|

|

|||||||||

|

|

|||||||||

|

|

Dividend Per Share |

||||||||

|

|

Price of Class A Common Stock |

Common Stock |

|||||||

|

Fiscal Year Ended September 2, 2017 |

High |

Low |

Class A & Class B |

||||||

|

First Quarter – December 3, 2016 |

$ |

91.02 |

$ |

69.96 |

$ |

0.45 | |||

|

Second Quarter – March 4, 2017 |

105.70 | 90.20 | 0.45 | ||||||

|

Third Quarter – June 3, 2017 |

105.29 | 81.58 | 0.45 | ||||||

|

Fourth Quarter – September 2, 2017 |

89.57 | 65.42 | 0.45 | ||||||

In 2003, our Board of Directors instituted a policy of paying regular quarterly cash dividends to our shareholders. The Company paid total annual cash dividends of $2.22 and $1.80 per share for fiscal 2018 and fiscal 2017, respectively. This policy is reviewed periodically by the Board of Directors.

On October 18, 2018, the Board of Directors declared a quarterly cash dividend of $0.63 per share, payable on November 27, 2018 to shareholders of record at the close of business on November 13, 2018. The dividend will result in a payout of approximately $35.4 million, based on the number of shares outstanding at October 1, 2018.

On October 1, 2018, the last reported sales price for MSC’s Class A common stock on the NYSE was $86.68 per share. The approximate number of holders of record of MSC’s Class A common stock as of October 1, 2018 was 569. The number of holders of record of MSC’s Class B common stock as of October 1, 2018 was 28.

Purchases of Equity Securities

The following table sets forth repurchases by the Company of its outstanding shares of Class A common stock during the quarter ended September 1, 2018:

|

|

|||||||||

|

Period |

Total Number of Shares Purchased(1),(2) |

Average Price Paid Per Share(3) |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(4) |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs |

|||||

|

06/03/18-07/02/18 |

5 |

$ |

92.79 |

— |

2,564,734 | ||||

|

07/03/18-08/02/18 |

332,826 | 82.89 | 287,029 | 2,277,705 | |||||

|

08/03/18-09/01/18 |

347,524 | 84.58 | 347,420 | 1,930,285 | |||||

|

Total |

680,355 |

$ |

83.76 | 634,449 | |||||

|

|

|||||||||

__________________________

(1)During the three months ended September 1, 2018, 507 shares of our Class A common stock were purchased by the Company as payment to satisfy our associates’ tax withholding liability for vested restricted stock awards associated with our share-based compensation program and are included in the total number of shares purchased.

(2) In July 2018, the Company announced that in connection with its existing share repurchase authorization, the Company entered into a stock purchase agreement with the holders of the Company’s Class B common stock to purchase a pro rata

15

number of shares, such that their aggregate percentage ownership in the Company would remain substantially the same. In August 2018, the Company purchased 45,314 shares of its Class A common stock from certain of its Class B shareholders at a purchase price of $82.64 per share. The figures for total shares purchased include shares purchased under the stock purchase agreement. See Note 9 “Shareholders’ Equity” in the Notes to the Consolidated Financial Statements for more information about the stock purchase.

(3)Activity is reported on a trade date basis.

(4)During fiscal 1999, our Board of Directors established the MSC Stock Repurchase Plan, which we refer to as the Repurchase Plan. The total number of shares of our Class A common stock initially authorized for future repurchase was set at 5,000,000 shares. On January 8, 2008, our Board of Directors reaffirmed and replenished the Repurchase Plan and set the total number of shares of Class A common stock authorized for future repurchase at 7,000,000 shares. On October 21, 2011, the Board of Directors reaffirmed and replenished the Repurchase Plan and set the total number of shares of Class A common stock authorized for future repurchase at 5,000,000 shares. As of September 1, 2018, the maximum number of shares that may yet be repurchased under the Repurchase Plan was 1,930,285 shares. There is no expiration date for the Repurchase Plan.

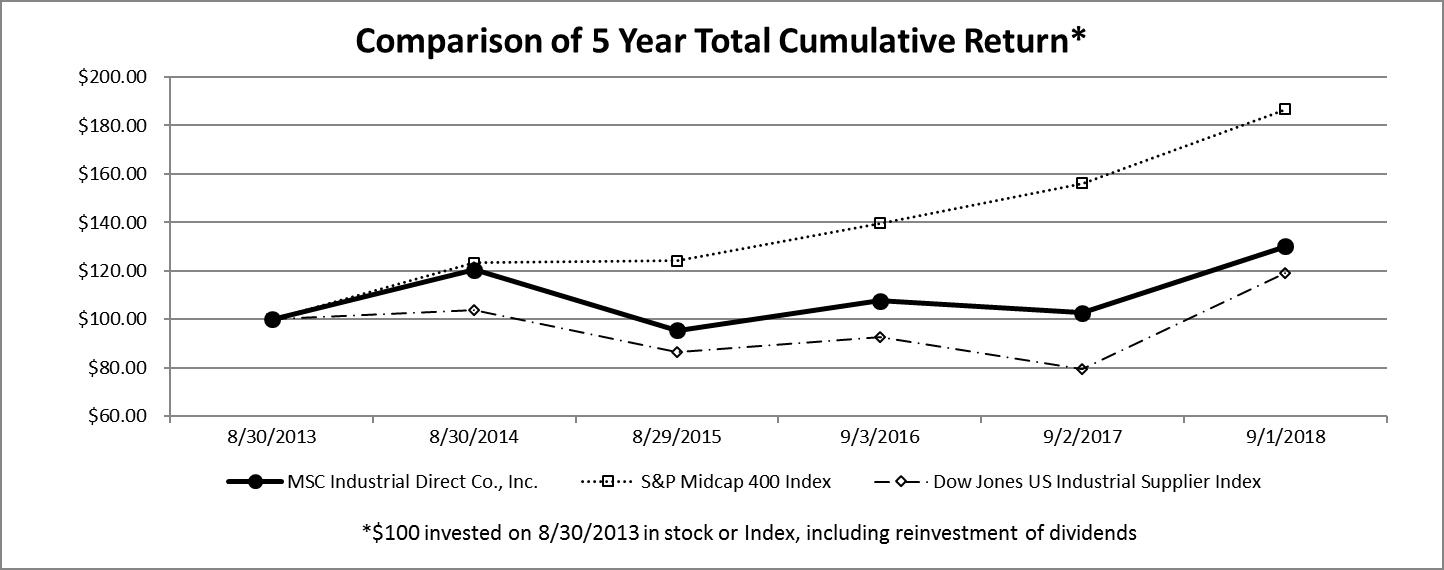

Performance Graph

The following stock price performance graph and accompanying information is not deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any filings under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, or be subject to the liabilities of Section 18 of the Exchange Act, regardless of any general incorporation language in any such filing.